Assessing Corning (GLW) Valuation After CES Awards And AI Data Center Enthusiasm

Corning (GLW) is back in the spotlight after its Gorilla Matte Pro and SurfaceIQ glass treatments received CES 2026 Innovation Awards, coinciding with renewed analyst and media focus on its role in AI data center infrastructure.

See our latest analysis for Corning.

Those CES awards land after a period where AI data center enthusiasm and media attention on Corning’s optical products helped fuel very strong longer term total shareholder returns, including a 1 year total shareholder return of 87.9%, even though the latest 1 day share price return was a 1.4% decline and the year to date share price return is a 3.0% decline from the current US$87.99 level. This suggests momentum has cooled recently compared with the stronger 3 year and 5 year total shareholder returns.

If Corning’s role in AI infrastructure has caught your attention, it could be a good moment to see what else is shaping the sector through high growth tech and AI stocks.

After an 87.9% 1 year total shareholder return and a recent pullback from the highs, the key question is simple: is Corning still priced below what its AI and glass businesses could justify, or is the market already baking in years of future growth?

Most Popular Narrative: 5.7% Undervalued

Compared with Corning’s last close at US$87.99, the most followed narrative points to a slightly higher fair value, anchored in data center and solar expectations.

Corning's Springboard plan aims to add more than $4 billion in annualized sales by 2026, driven by strong demand in Optical Communications and Solar sectors due to powerful secular trends, positively impacting revenue growth. The company sees substantial growth in Optical Communications, particularly in innovations for Gen AI data centers, which are expected to drive incremental revenue and accelerate operating margin improvements toward 20% by the end of 2026.

Curious what kind of revenue ramp and margin profile could justify that higher fair value estimate, and how long the data center cycle needs to run? The full narrative lays out a detailed earnings path, a specific profit margin destination, and the valuation multiple it thinks the market will ultimately pay for those numbers.

Result: Fair Value of $93.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on AI and solar demand staying strong, as well as on tariffs and competition not squeezing the margins that analysts are currently banking on.

Find out about the key risks to this Corning narrative.

Another View: Rich Multiples Against an “Undervalued” Narrative

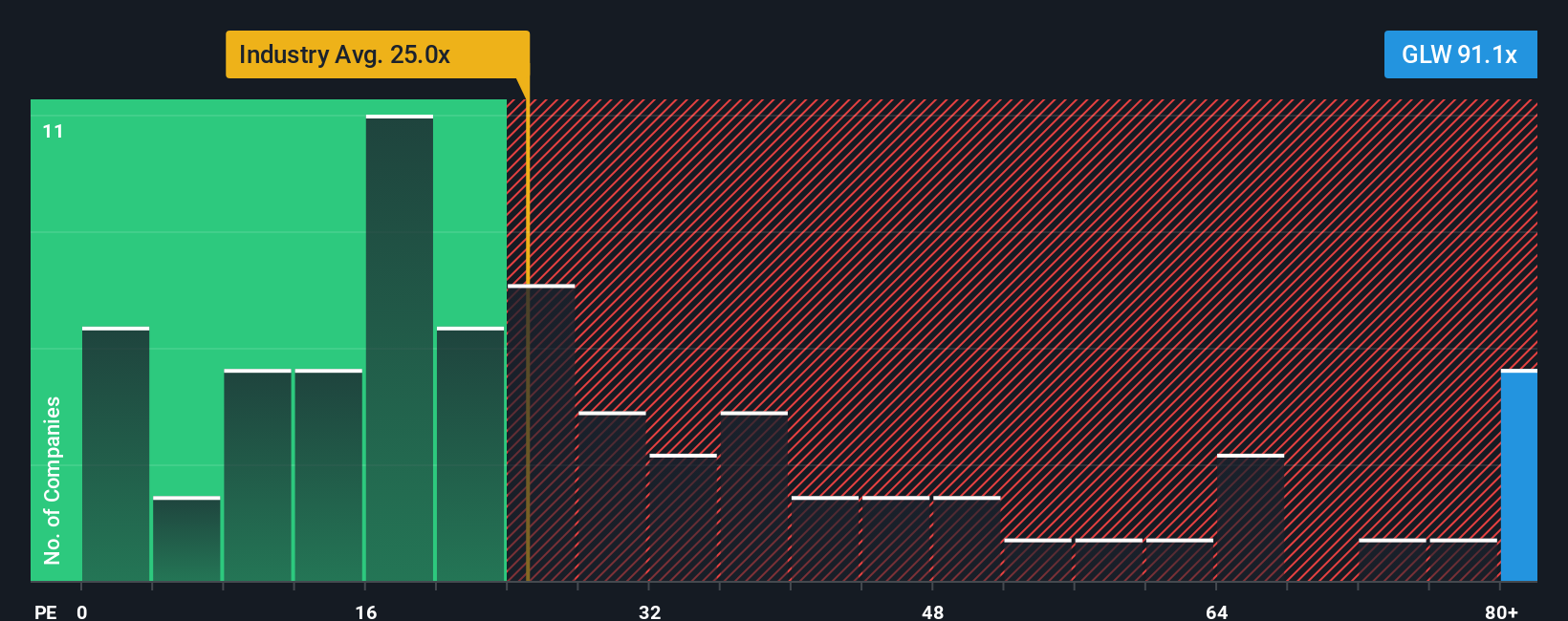

The 5.7% undervalued fair value story sits alongside a very different signal from Corning’s current P/E of 55.2x. This is far higher than the US electronic industry at 25.7x, the peer average at 38.1x, and the 35.8x fair ratio that our models suggest the market could move toward over time.

If the share price were to move closer to that fair ratio or industry range, today’s optimism could appear stretched. The key question is whether you think Corning can keep justifying this kind of premium.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Corning Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a custom thesis in minutes with Do it your way.

A great starting point for your Corning research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready For Your Next Investing Angle?

If Corning has sharpened your focus, do not stop here. Use the same toolkit to hunt for fresh ideas that fit your own risk and return preferences.

- Target potential mispricing by checking out these 884 undervalued stocks based on cash flows that line up strong cash flows with prices that may not fully reflect them yet.

- Explore the AI build out theme by scanning these 26 AI penny stocks positioned around chips, data infrastructure and software tied to this long term shift.

- Expand your income watchlist with these 12 dividend stocks with yields > 3% that already offer yields above 3% and established payout histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal