European Undiscovered Gems to Explore in January 2026

As the pan-European STOXX Europe 600 Index reaches new heights, buoyed by an improving economic backdrop and a strong annual performance in 2025, investors are increasingly turning their attention to smaller, less prominent companies that may offer unique growth opportunities. In this environment of optimism and robust market sentiment, identifying stocks with solid fundamentals and potential for expansion can be key to uncovering hidden gems within Europe's diverse markets.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Arendals Fossekompani | 26.72% | 2.84% | 7.78% | ★★★★★★ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Mangold Fondkommission | NA | -6.00% | -42.55% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Darwin | 3.03% | 50.55% | 46377.71% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Pharmanutra (BIT:PHN)

Simply Wall St Value Rating: ★★★★★☆

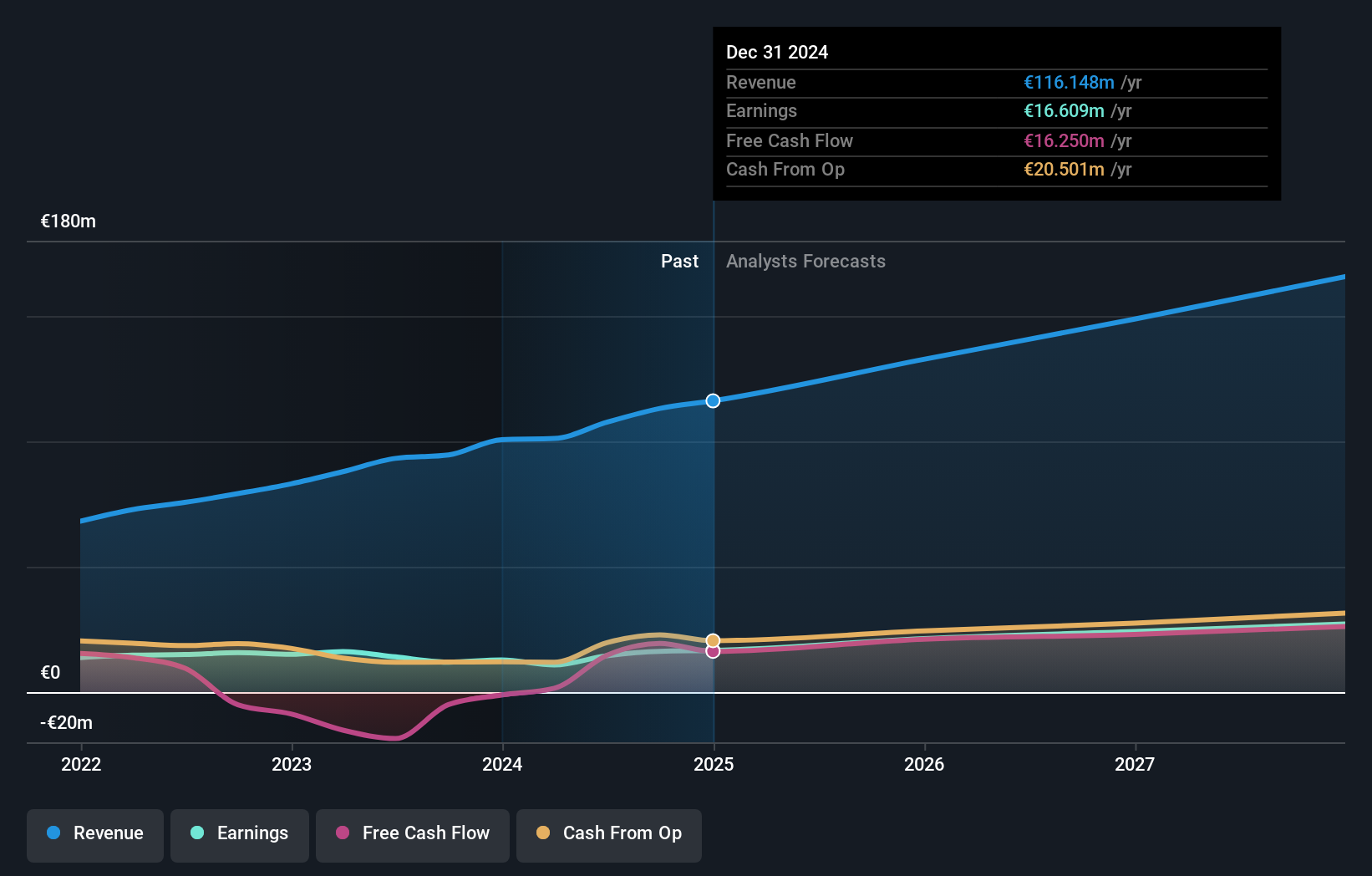

Overview: Pharmanutra S.p.A. is a pharmaceutical and nutraceutical company that focuses on researching, designing, developing, and marketing nutritional supplements and medical devices across Italy, Europe, the Middle East, South America, the Far East, and other international markets with a market cap of €544.50 million.

Operations: Pharmanutra generates revenue primarily from Italy (€75.15 million) and international markets (€44.66 million), with a smaller contribution from medical instruments (€6.82 million).

Pharmanutra, a smaller player in the personal products industry, has shown robust financial health with net income reaching €14.01 million for the first nine months of 2025, up from €13.17 million the previous year. The company's earnings have grown by 7.2% over the past year, outpacing its industry peers at 4.8%. Despite a debt to equity ratio increase from 5.5% to 29.5% over five years, interest payments are comfortably covered by EBIT at an impressive multiple of 880.6x, suggesting strong operational efficiency and potential for continued growth amidst market volatility.

- Unlock comprehensive insights into our analysis of Pharmanutra stock in this health report.

Understand Pharmanutra's track record by examining our Past report.

Bourrelier Group (ENXTPA:ALBOU)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bourrelier Group SA operates do-it-yourself (DIY) stores in France, Belgium, and the Netherlands with a market capitalization of €269.36 million.

Operations: Revenue primarily comes from the distribution segment, contributing €246.94 million, followed by industry and investments at €39.47 million and €5.72 million respectively. The hotel business adds another €8.01 million to the total revenue stream.

Bourrelier Group, a nimble player in the market, recently showcased notable earnings growth of €6.85M for the half year ended June 2025, up from €1M a year ago. Despite a hefty one-off loss of €5.9M impacting its recent annual results, the company's profitability remains intact with free cash flow in positive territory. However, interest coverage is tight at 1.4x EBIT against debt repayments, indicating potential financial strain if not managed carefully. Trading at nearly half its estimated fair value suggests room for upside if operational challenges are addressed effectively and market conditions remain favorable.

- Click here and access our complete health analysis report to understand the dynamics of Bourrelier Group.

Examine Bourrelier Group's past performance report to understand how it has performed in the past.

Solstad Offshore (OB:SOFF)

Simply Wall St Value Rating: ★★★★☆☆

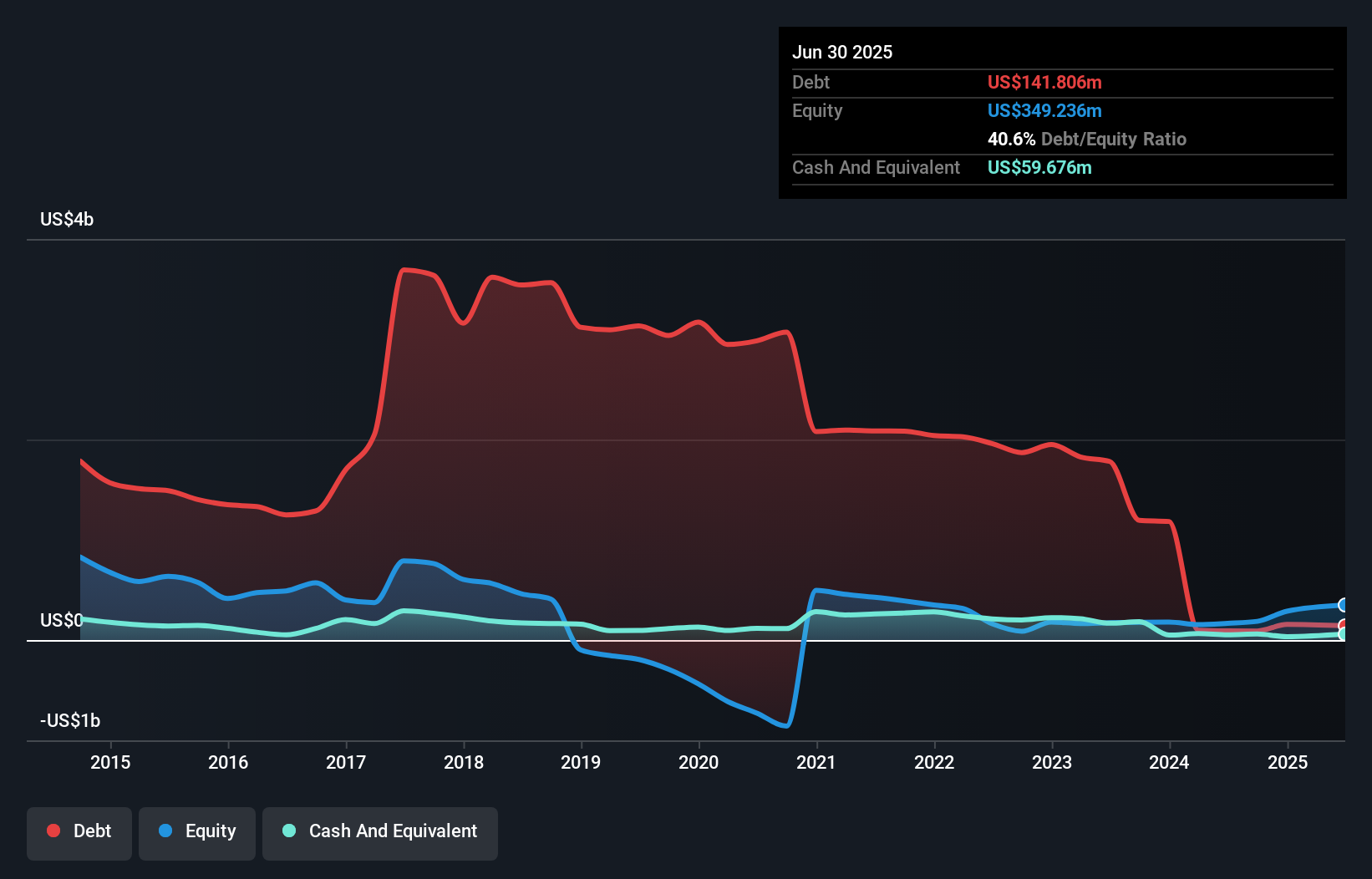

Overview: Solstad Offshore ASA is a company that owns and operates offshore service vessels, with a market capitalization of NOK3.82 billion.

Operations: Solstad Offshore generates revenue primarily through its fleet of offshore service vessels. The company's financial performance is reflected in a net profit margin of 7.5%, indicating the efficiency with which it converts revenue into profit.

Solstad Offshore, a promising player in the energy services sector, recently turned profitable, marking a significant shift from its previous negative shareholder equity position five years ago. The company reported a net income of US$26 million for Q3 2025, up from US$11 million the previous year. A noteworthy contract with Petrobras worth approximately US$73 million is set to commence in early 2026. Despite trading at about 41.8% below estimated fair value and having satisfactory debt levels with a net debt to equity ratio of 15.2%, interest coverage remains an area needing improvement at just 2.1x EBIT coverage.

- Navigate through the intricacies of Solstad Offshore with our comprehensive health report here.

Evaluate Solstad Offshore's historical performance by accessing our past performance report.

Taking Advantage

- Take a closer look at our European Undiscovered Gems With Strong Fundamentals list of 297 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal