High Growth Tech Stocks in Global Market Analyzed

As global markets navigate a complex landscape marked by rising home sales in the U.S., mixed performances across major indices, and evolving economic conditions in regions like Europe and Japan, investors are keenly observing high-growth tech stocks that have the potential to thrive amid these dynamics. In this environment, a good stock is often characterized by its ability to leverage technological advancements and maintain robust growth prospects despite broader market fluctuations.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Gold Circuit Electronics | 31.06% | 37.22% | ★★★★★★ |

| Shengyi TechnologyLtd | 22.69% | 33.40% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Hacksaw | 32.86% | 37.50% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| CD Projekt | 33.20% | 51.75% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

Bonree Data Technology (SHSE:688229)

Simply Wall St Growth Rating: ★★★★★☆

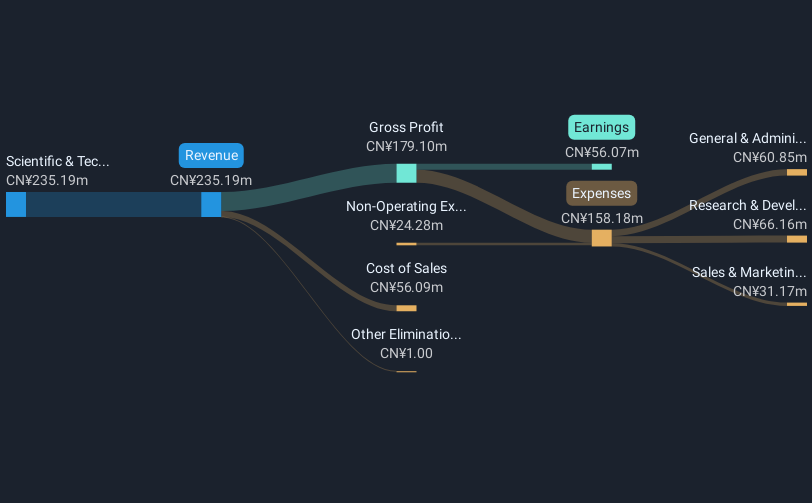

Overview: Bonree Data Technology Co., Ltd offers application performance management services for enterprises in China and has a market capitalization of CN¥2.80 billion.

Operations: Bonree Data Technology focuses on delivering application performance management services to enterprises in China. The company generates revenue primarily through these services, contributing significantly to its financial profile.

Despite recent challenges, Bonree Data Technology showcases potential with a projected revenue growth of 26.7% annually, outpacing the Chinese market forecast of 14.5%. This growth is particularly notable given the firm's transition towards profitability, with earnings expected to surge by 113.6% per year. The company's commitment to innovation is evident from its recent R&D investments, aligning with industry trends towards enhanced data solutions. However, investors should note the high volatility in its share price and current unprofitability which may pose risks in the short term. Looking ahead, Bonree's strategic focus on expanding its technological capabilities could position it well within the competitive tech landscape, provided it navigates its financial challenges effectively.

Guangdong Naruida Technology (SHSE:688522)

Simply Wall St Growth Rating: ★★★★★★

Overview: Guangdong Naruida Technology Co., Ltd. specializes in the production and sale of polarized multifunctional active phased array radars within China, with a market cap of CN¥12.26 billion.

Operations: The company generates revenue primarily from its Scientific & Technical Instruments segment, amounting to CN¥463.09 million.

Guangdong Naruida Technology, with its recent earnings report showing a surge in revenue to CNY 254.02 million from CNY 136.2 million year-over-year and net income increasing to CNY 73.16 million from CNY 26.01 million, demonstrates robust growth metrics that outpace broader market trends. This performance is underscored by an impressive annualized revenue growth rate of 50.8% and earnings growth of 58.3%, significantly higher than the Chinese market averages of 14.5% and 27.6%, respectively. The company's aggressive investment in R&D, essential for sustaining innovation and competitive edge in the tech sector, further solidifies its position within high-growth technology circles, promising a dynamic future if it continues on this trajectory.

Hubei Century Network Technology (SZSE:300494)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hubei Century Network Technology Inc. operates an online entertainment platform in China and internationally, with a market capitalization of CN¥6.09 billion.

Operations: The company generates revenue primarily through its online entertainment platform, catering to both domestic and international markets. It has a market capitalization of CN¥6.09 billion.

Hubei Century Network Technology has demonstrated significant financial progress, with a 10% increase in revenue year-over-year, reaching CNY 937.95 million. This growth is complemented by an impressive leap in net income from CNY 2.45 million to CNY 30.71 million within the same period, reflecting a robust annualized earnings growth of approximately 71.5%. The company’s commitment to innovation is evident from its R&D investments, crucial for maintaining competitive advantage in the rapidly evolving tech landscape. Moreover, their recent strategic shareholder meetings and transparent updates on share repurchases underscore a proactive approach to governance and investor relations, positioning them well for future expansions amidst high expectations of becoming profitable over the next three years.

- Get an in-depth perspective on Hubei Century Network Technology's performance by reading our health report here.

Learn about Hubei Century Network Technology's historical performance.

Make It Happen

- Click here to access our complete index of 242 Global High Growth Tech and AI Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal