Undervalued Small Caps With Insider Buying In Global For January 2026

As we enter January 2026, global markets are navigating a complex landscape marked by recent declines in U.S. stock indexes and significant gains in European markets, while geopolitical tensions and economic indicators like rising home sales continue to influence investor sentiment. Amidst these dynamics, small-cap stocks have shown resilience with the Russell 2000 Index posting a positive change year-to-date, suggesting potential opportunities for investors seeking growth prospects. In this context, identifying promising small-cap stocks often involves looking at factors such as insider buying activity and valuation metrics that indicate potential undervaluation relative to broader market trends.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| A.G. BARR | 14.1x | 1.6x | 49.45% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 39.76% | ★★★★★☆ |

| Tokmanni Group Oyj | 12.5x | 0.3x | 44.95% | ★★★★★☆ |

| Eurocell | 16.1x | 0.3x | 40.21% | ★★★★☆☆ |

| Chinasoft International | 21.5x | 0.7x | -1206.46% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 43.04% | ★★★★☆☆ |

| Ever Sunshine Services Group | 6.5x | 0.4x | -425.97% | ★★★☆☆☆ |

| PSC | 9.9x | 0.4x | 18.66% | ★★★☆☆☆ |

| CVS Group | 49.5x | 1.4x | 20.81% | ★★★☆☆☆ |

| Senior | 28.2x | 0.9x | 17.17% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

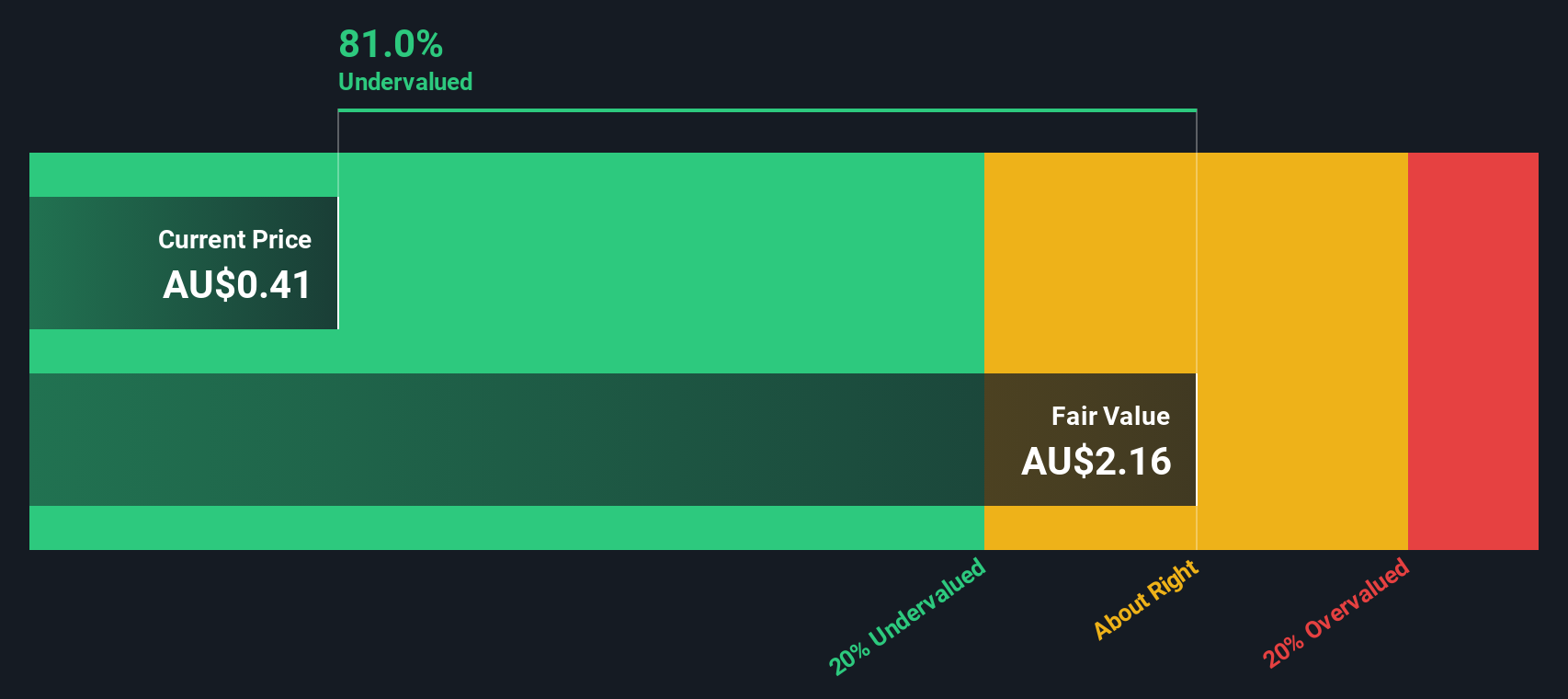

29Metals (ASX:29M)

Simply Wall St Value Rating: ★★★★☆☆

Overview: 29Metals is a mining company focused on the exploration and production of base and precious metals, with operations primarily at Golden Grove and Capricorn Copper, and a market capitalization of A$1.05 billion.

Operations: Golden Grove is the primary revenue driver, contributing significantly more than Capricorn Copper. The company's gross profit margin has shown a downward trend, moving from 24.00% in late 2019 to -0.02% by the end of 2024 before improving slightly to 7.50% in mid-2025. Operating expenses and non-operating expenses have been notable cost components impacting financial performance over recent periods.

PE: -27.2x

29Metals, a smaller company in the mining industry, is catching attention with its forecasted earnings growth of 45% annually. Despite relying solely on external borrowing for funding, which presents higher risk, insider confidence is evident through recent share purchases. The appointment of Nick Cernotta to the board adds substantial mining expertise and operational insight. His experience could drive improvements in safety and efficiency across operations. These elements position 29Metals as a potential opportunity amidst market uncertainties.

- Click here and access our complete valuation analysis report to understand the dynamics of 29Metals.

Gain insights into 29Metals' past trends and performance with our Past report.

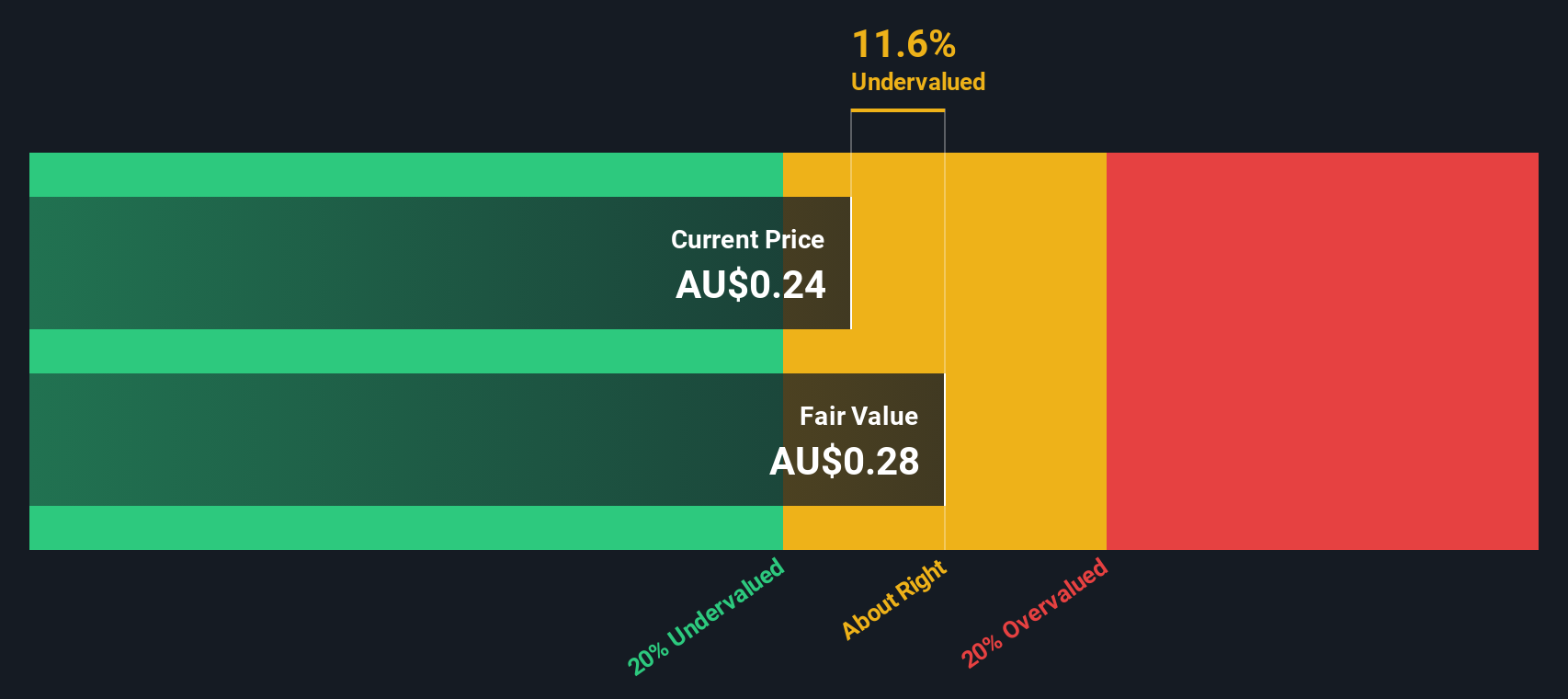

Paragon Care (ASX:PGC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Paragon Care is a healthcare company that provides medical equipment, devices, and consumables primarily in Australia and New Zealand with a smaller presence in Asia, and has a market capitalization of A$0.09 billion.

Operations: ANZ is the primary revenue stream, contributing significantly more than Asia. As of the latest period, gross profit margin showed an upward trend reaching 8.97%. Operating expenses are primarily driven by general and administrative costs, followed by sales and marketing expenses.

PE: 19.7x

Paragon Care, an emerging player in its sector, shows potential despite relying entirely on external borrowing for funding. The recent appointment of Brendon Pentland as CFO brings seasoned expertise to the financial helm, promising strategic investments and acquisitions. Insider confidence is evident with notable share purchases over the past year. Earnings are expected to grow by 24% annually, suggesting upward momentum. However, interest payments aren't fully covered by earnings yet, indicating room for improvement.

- Click to explore a detailed breakdown of our findings in Paragon Care's valuation report.

Assess Paragon Care's past performance with our detailed historical performance reports.

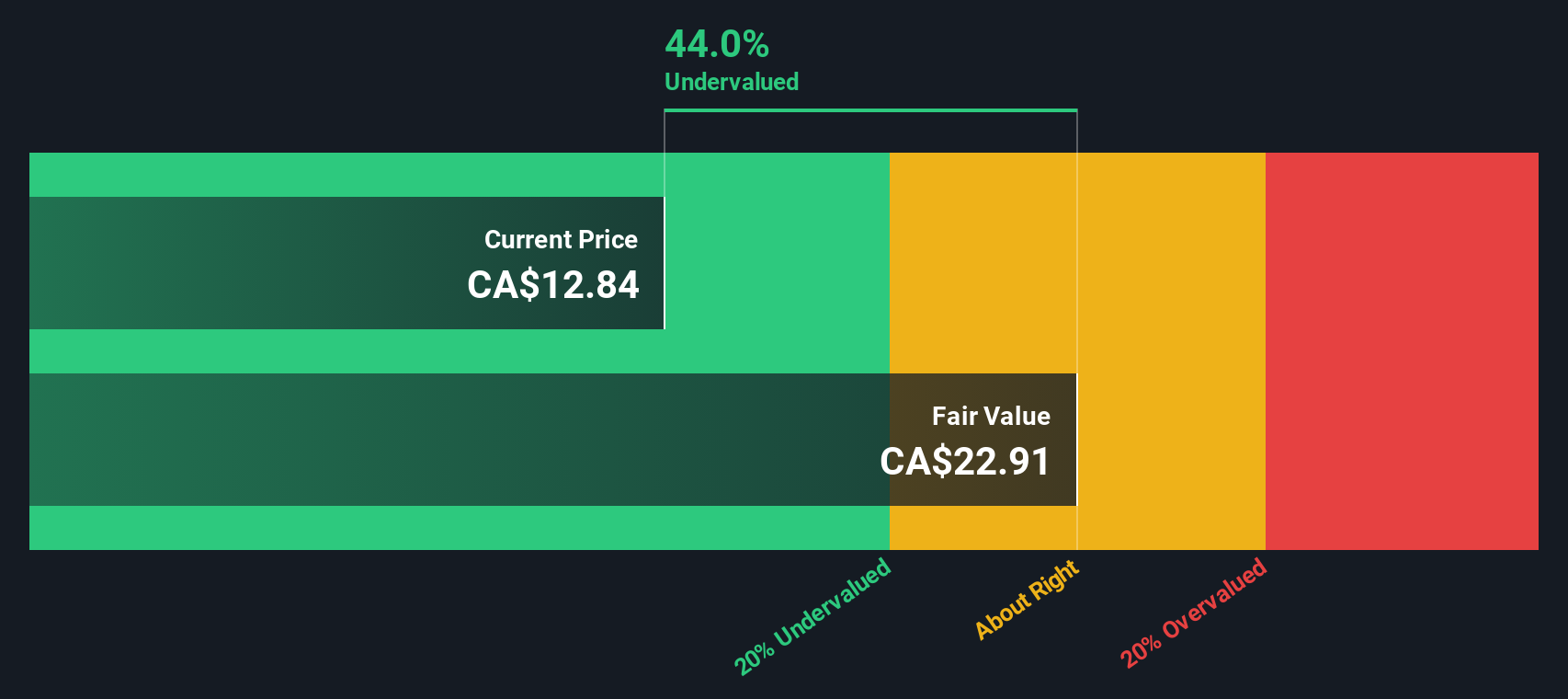

Dexterra Group (TSX:DXT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dexterra Group provides facilities management and operations solutions through its Support Services and Asset Based Services segments, with a market cap of approximately CA$0.34 billion.

Operations: Support Services and Asset Based Services are the primary revenue streams, contributing CA$844.20 million and CA$173.86 million, respectively. The gross profit margin has shown an upward trend, reaching 17.21% by September 2025 from a low of 9.95% in December 2019, reflecting improvements in cost management relative to revenue growth over time.

PE: 18.5x

Dexterra Group, with its smaller market capitalization, shows potential as an undervalued investment. Despite high debt levels and reliance on external borrowing, the company has demonstrated growth in earnings and revenue. For Q3 2025, sales reached C$281 million and net income increased to C$12.88 million from C$7.66 million a year prior. Insider confidence is evident with share repurchases totaling 234,700 shares for C$2.02 million by September 2025, signaling potential value recognition within the firm itself.

- Take a closer look at Dexterra Group's potential here in our valuation report.

Gain insights into Dexterra Group's historical performance by reviewing our past performance report.

Seize The Opportunity

- Take a closer look at our Undervalued Global Small Caps With Insider Buying list of 145 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal