Range Resources (RRC) Valuation Check After Early Redemption Of 8.25% Senior Notes

Range Resources (RRC) has moved to fully redeem its 8.25% senior notes due 2029, a US$600,000,000 issue, funded via its revolving credit facility. This transaction removes the higher coupon debt earlier than scheduled.

See our latest analysis for Range Resources.

At a share price of US$34.67, Range Resources has recently seen weaker momentum, with a 30 day share price return of a 7.99% decline and a 1 year total shareholder return of a 6.70% decline. However, the 5 year total shareholder return of 287.81% shows a very strong longer term result, so the early redemption of higher coupon notes may be viewed as another data point in how investors weigh growth potential against balance sheet risk.

If this kind of balance sheet reset has your attention, it could be a good moment to look beyond energy and scan fast growing stocks with high insider ownership for other ideas that might fit your style.

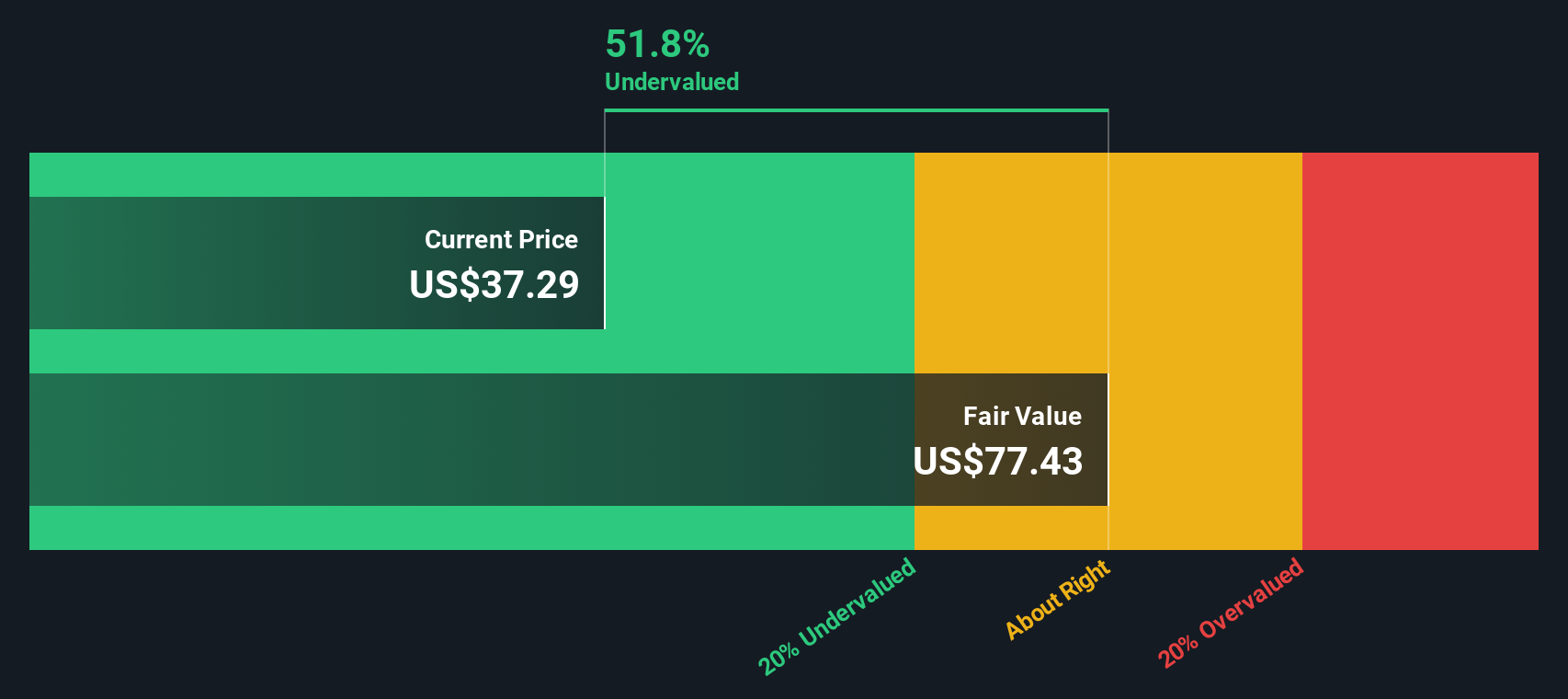

With revenue of US$2.89b, net income of US$572.64m and a value score of 5, plus a share price sitting at a sizeable discount to some analyst targets and intrinsic estimates, is there still upside here, or is future growth already priced in?

Most Popular Narrative: 17.3% Undervalued

With Range Resources last closing at US$34.67 against a narrative fair value of about US$41.91, the current setup focuses heavily on medium term demand and margin assumptions.

Analysts are assuming Range Resources's revenue will grow by 13.7% annually over the next 3 years.

Analysts assume that profit margins will increase from 17.1% today to 19.6% in 3 years time.

Curious how higher sales and fatter margins might intersect with a tighter share count and a premium future P/E multiple? The full narrative sets out the numbers behind that US$41.91 fair value and explains how they relate to long term cash generation.

Result: Fair Value of $41.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could be knocked off course if Appalachian infrastructure faces tougher regulation or if local gas supply builds faster than demand from data centers and LNG exports.

Find out about the key risks to this Range Resources narrative.

Another View: Earnings Multiple Sends A Mixed Signal

Our DCF work suggests Range Resources looks very cheap, with the shares at US$34.67 versus an internal fair value estimate of US$80.99, which screens as undervalued. Yet the stock already trades on a 14.3x P/E, slightly above the 13.1x US Oil and Gas average, even if it sits below a 20.7x fair ratio and well under a 42.4x peer average. Is this a genuine margin of safety or a sign the easy re rating has already happened?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Range Resources Narrative

If you are not fully convinced by these assumptions or simply prefer to weigh the data yourself, you can build a complete view in minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Range Resources.

Ready For More Investment Ideas?

If Range Resources has you thinking harder about risk and reward, do not stop here. Your next strong idea could be sitting just a few clicks away.

- Target potential mispricing by scanning these 886 undervalued stocks based on cash flows that the market may be pricing cautiously despite their cash flow support.

- Ride structural themes by checking out these 26 AI penny stocks that are tied to ongoing advances in artificial intelligence.

- Strengthen your income stream by reviewing these 12 dividend stocks with yields > 3% that offer yields above 3% alongside equity exposure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal