A Look At United Community Banks (UCB) Valuation As Recent Returns Draw Investor Attention

Why United Community Banks Is On Investor Radars Today

United Community Banks (UCB) has drawn fresh attention after recent share price moves, with the stock closing at $32.53 as investors reassess its fundamentals and its longer term return profile.

See our latest analysis for United Community Banks.

The recent 1-day share price return of 0.84% and 7-day share price return of 4.20% build on a steadier 30-day share price return of 4.23% and year-to-date share price return of 3.43%, while total shareholder return over 1 year sits at 7.97% and 5-year total shareholder return is 20.02%. This suggests that momentum has been gradually building rather than surging.

If you are comparing banks with similar profiles, this could be a good moment to broaden your view and check out fast growing stocks with high insider ownership.

With United Community Banks trading at $32.53, around an 8.9% gap to the average analyst price target and a 41.1% discount to one intrinsic value estimate, you have to ask: is this a genuine value opportunity, or is the market already baking in future growth?

Most Popular Narrative: 6.8% Undervalued

With United Community Banks last closing at $32.53 and the most followed narrative pointing to fair value around $34.92, the gap is relatively modest yet noticeable.

Ongoing diversification of income streams, including fee income from wealth management, mortgage banking, and loan sales, reduces reliance on net interest income and stabilizes earnings. This particularly benefits long-term return on equity and helps mitigate downside risk from interest rate volatility.

Curious what earnings path and margin profile underpin that fair value? The narrative leans on steadier profits, richer fee income, and a tighter cost base. The full breakdown reveals how those building blocks feed into the revenue and earnings projections that support the current valuation range.

Result: Fair Value of $34.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on UCB continuing to win deposits and manage credit risk. Tougher competition or weaker commercial real estate trends could quickly challenge that story.

Find out about the key risks to this United Community Banks narrative.

Another View: What Earnings Multiples Are Signalling

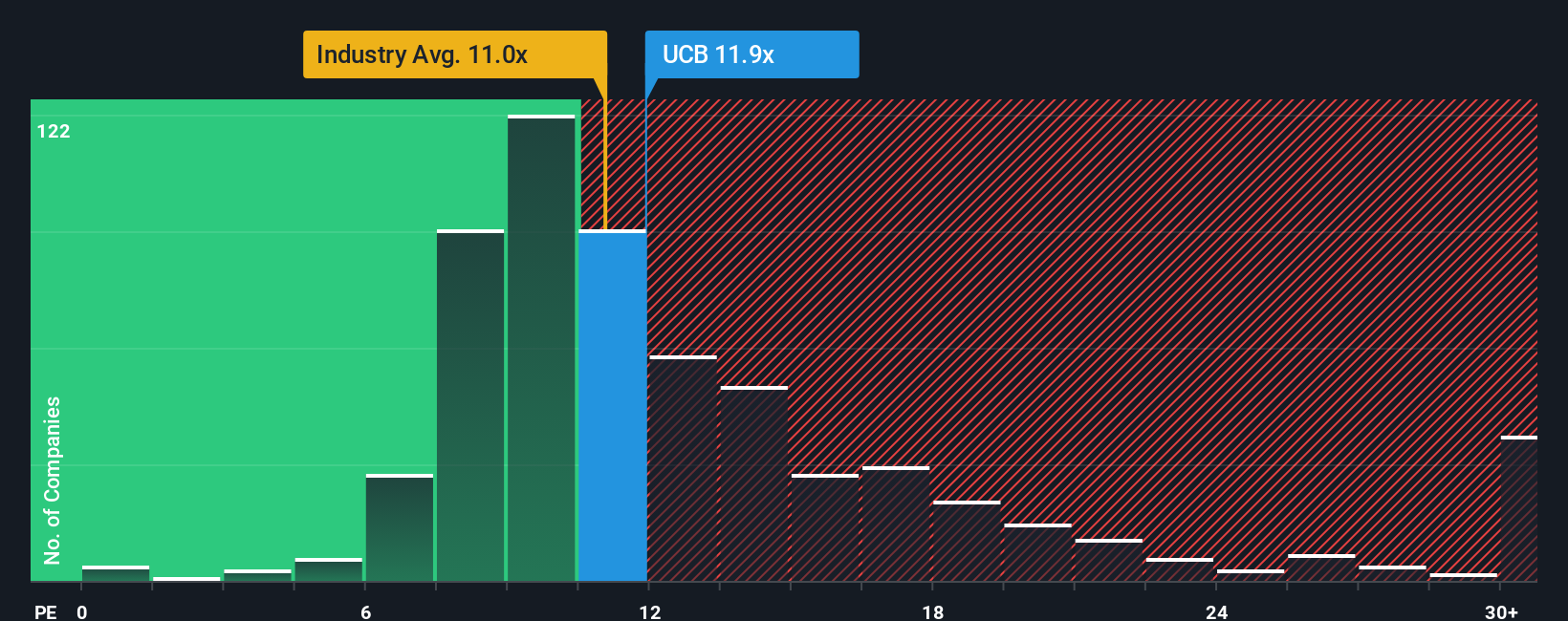

Our fair value work suggests United Community Banks looks cheap overall, yet the current P/E of 12.9x tells a more mixed story. It sits above the US Banks industry at 11.9x, slightly above a fair ratio of 12.7x, but well below peers at 21x.

So is the market cautiously pricing in bank specific risks, or quietly offering you a margin of safety that only shows up when you compare these different yardsticks side by side?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own United Community Banks Narrative

If you would rather test the numbers yourself or you see the story differently, you can build a custom view in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding United Community Banks.

Looking for more investment ideas?

If UCB has caught your attention, do not stop here; broaden your watchlist with other focused ideas that could round out your portfolio and sharpen your decisions.

- Target potential value by scanning these 886 undervalued stocks based on cash flows that might offer pricing that does not fully reflect their underlying cash flows.

- Spot emerging themes in digital assets with these 79 cryptocurrency and blockchain stocks and see which companies are tied to cryptocurrency and blockchain developments.

- Strengthen your income focus by reviewing these 12 dividend stocks with yields > 3% that offer yields above 3% for a more income oriented approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal