China Yuchai International (NYSE:CYD) Valuation Check After Strong One Year Share Price Performance

What recent performance says about China Yuchai International

Recent price moves in China Yuchai International (NYSE:CYD) have turned heads, with the stock showing a 6.7% gain over the past day, 14.2% over the past week, and 16.5% over the past month.

Those returns sit alongside a year to date gain of 9.5% and a 1 year total return of 292.5%. This performance is putting fresh attention on how the market is currently viewing the company’s fundamentals and valuation.

See our latest analysis for China Yuchai International.

With the share price now at $40.54 and a strong 1 year total shareholder return alongside meaningful recent share price gains, momentum appears to be building rather than fading. This can reflect shifting expectations for growth or risk around China Yuchai International’s engine and powertrain business.

If this kind of move has you looking beyond a single stock, it could be a good moment to widen your search with auto manufacturers as another way to spot opportunities in the vehicle space.

With China Yuchai International trading at $40.54, an analyst price target near $43 and an implied intrinsic value gap, the key question is whether the recent surge still leaves upside or if the market is already pricing in future growth.

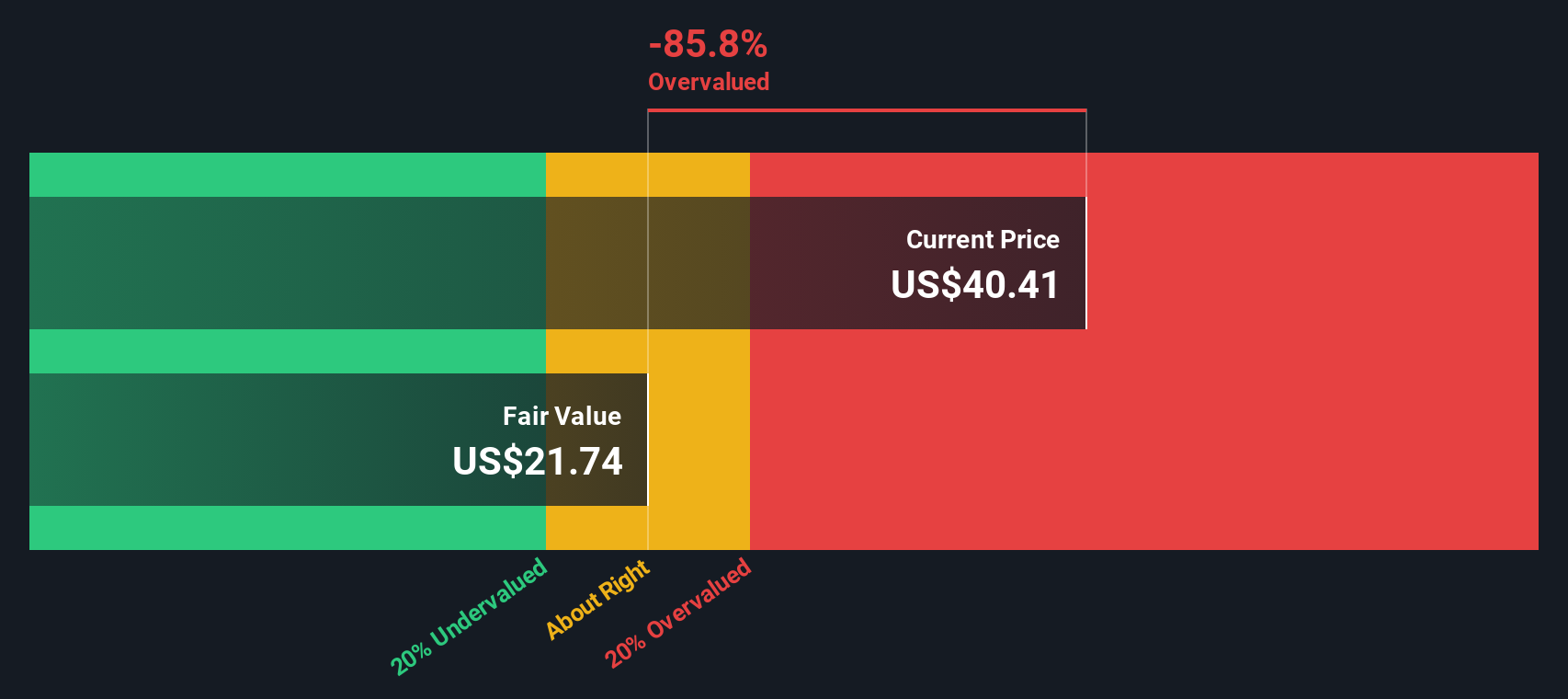

Most Popular Narrative: 19.6% Overvalued

Compared with the last close at $40.54, the most followed narrative points to a fair value closer to $33.91, setting up a clear valuation gap for investors to weigh.

The current high valuation may reflect investor optimism about China Yuchai's ability to sustain extraordinary export growth and market share gains despite signs that replacement and expansion demand in trucks, buses, and construction vehicles may plateau as the effects of urbanization and infrastructure investment in China and ASEAN normalize. This could create downside risk to future revenue growth if end-market demand reverts to mean levels.

Curious what earnings path and margin profile could still justify a lower fair value despite upbeat growth assumptions and sector comparisons? The full narrative lays out a detailed earnings roadmap, cash flow outlook, and valuation multiple that might surprise you.

Result: Fair Value of $33.91 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still clear risks that could flip this view, including faster growth in new energy engines and exports, as well as stronger than expected OEM partnerships and aftermarket demand.

Find out about the key risks to this China Yuchai International narrative.

Another View: Market Ratios Paint A Different Picture

Our DCF model points to a fair value of about $177.99 for China Yuchai International, compared with the current price of $40.54, which suggests a very large implied discount. That is a sharp contrast to the narrative fair value of $33.91, which tags the shares as 19.6% overvalued. Which story do you think is closer to reality: the cash flow model or the narrative-driven target?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own China Yuchai International Narrative

If you look at the numbers and reach a different conclusion, or simply prefer to test your own assumptions, you can build a fresh view in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding China Yuchai International.

Ready to scout your next investment idea?

If China Yuchai International has you thinking more broadly, now may be a good time to scan other ideas before the next move passes you by.

- Target potential mispricings with these 886 undervalued stocks based on cash flows that flag companies where cash flows and current prices appear out of sync.

- Zero in on future driven themes by checking these 26 AI penny stocks that focus on companies tied to artificial intelligence.

- Tap into income focused ideas with these 12 dividend stocks with yields > 3% that highlight businesses offering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal