European Dividend Stocks Eiffage And 2 More Top Picks

As the European market continues to thrive, with the STOXX Europe 600 Index hitting new highs and closing 2025 with its strongest annual performance since 2021, investors are increasingly looking towards dividend stocks for stable returns amidst an improving economic backdrop. In this environment, a good dividend stock is often characterized by a consistent payout history and solid fundamentals that can withstand varying market conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.22% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.39% | ★★★★★☆ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.73% | ★★★★★★ |

| Holcim (SWX:HOLN) | 3.95% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.74% | ★★★★★★ |

| Evolution (OM:EVO) | 4.84% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 3.99% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 4.86% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.39% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.09% | ★★★★★★ |

Click here to see the full list of 193 stocks from our Top European Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

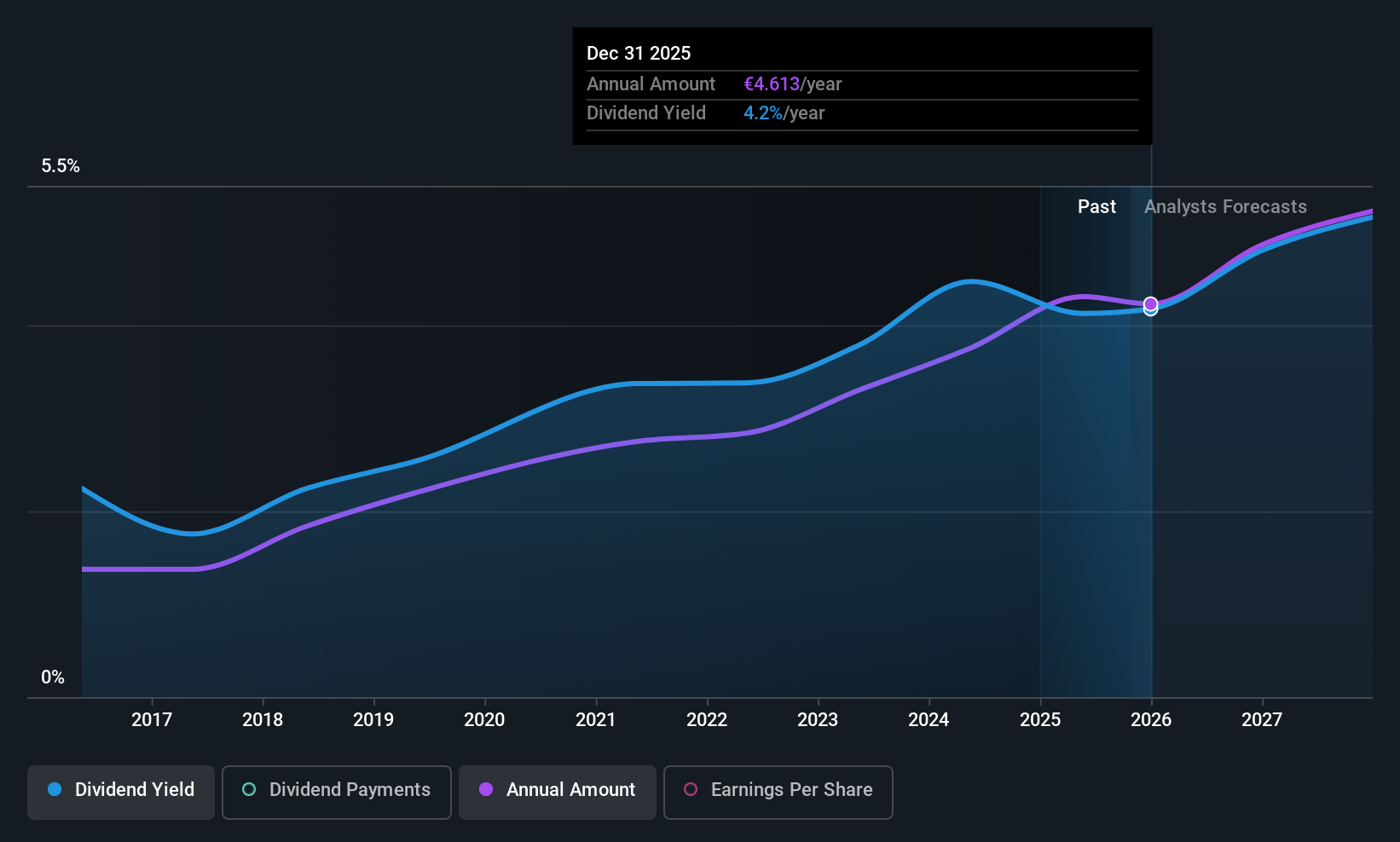

Eiffage (ENXTPA:FGR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eiffage SA operates in the construction and concessions sectors across France, Europe, and internationally, with a market cap of €12.36 billion.

Operations: Eiffage SA's revenue is primarily derived from its Infrastructures segment at €9.17 billion, followed by Energy Systems at €7.68 billion, Concessions at €4.18 billion, Construction at €4.10 billion, and Holding activities contributing €294 million.

Dividend Yield: 3.7%

Eiffage's dividend profile presents a mixed picture. While dividends are well-covered by earnings and cash flows, with payout ratios at 45.5% and 17.7% respectively, the company's dividend history has been volatile over the past decade. Recent inclusion in the CAC 40 index may enhance visibility, yet high debt levels could pose challenges. Despite trading below estimated fair value, its current yield of 3.66% is less competitive compared to top French dividend payers.

- Unlock comprehensive insights into our analysis of Eiffage stock in this dividend report.

- According our valuation report, there's an indication that Eiffage's share price might be on the cheaper side.

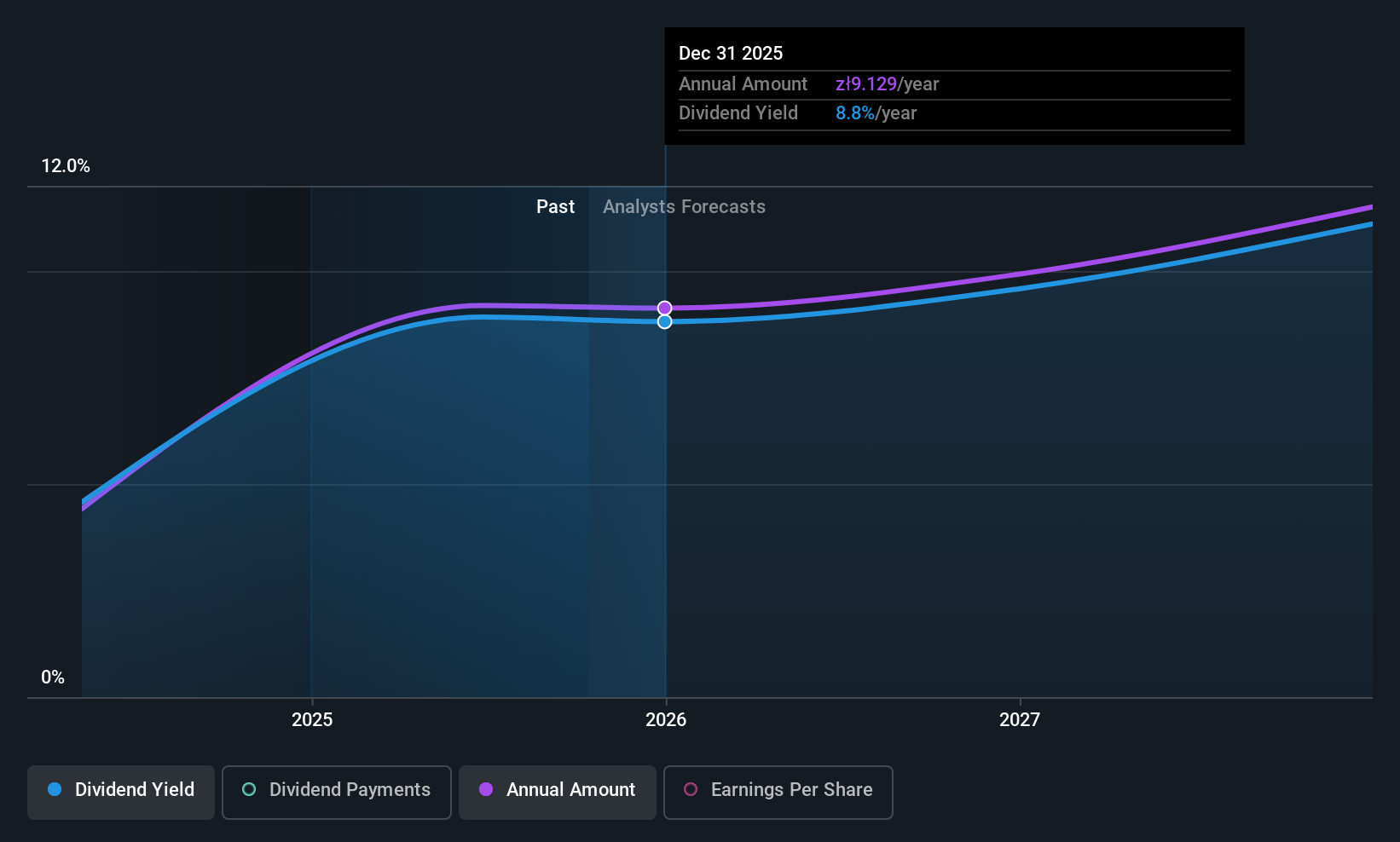

Alior Bank (WSE:ALR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Alior Bank S.A. offers a range of banking products and services to individuals, businesses, and enterprises in Poland with a market cap of PLN15.05 billion.

Operations: Alior Bank S.A. generates its revenue primarily from three segments: Treasury (PLN 891.36 million), Retail Customers (PLN 3.20 billion), and Business Customers (PLN 1.60 billion).

Dividend Yield: 8%

Alior Bank's dividend yield is among the top 25% in Poland, with a current payout ratio of 52.3%, indicating dividends are covered by earnings. However, its allowance for bad loans is low at 78%, and it has a high bad loan level of 5.9%. Although dividends have increased over two years, future earnings are expected to decline by 5.2% annually over three years, potentially impacting dividend sustainability despite being forecasted to be covered by earnings in three years.

- Click here and access our complete dividend analysis report to understand the dynamics of Alior Bank.

- Our expertly prepared valuation report Alior Bank implies its share price may be lower than expected.

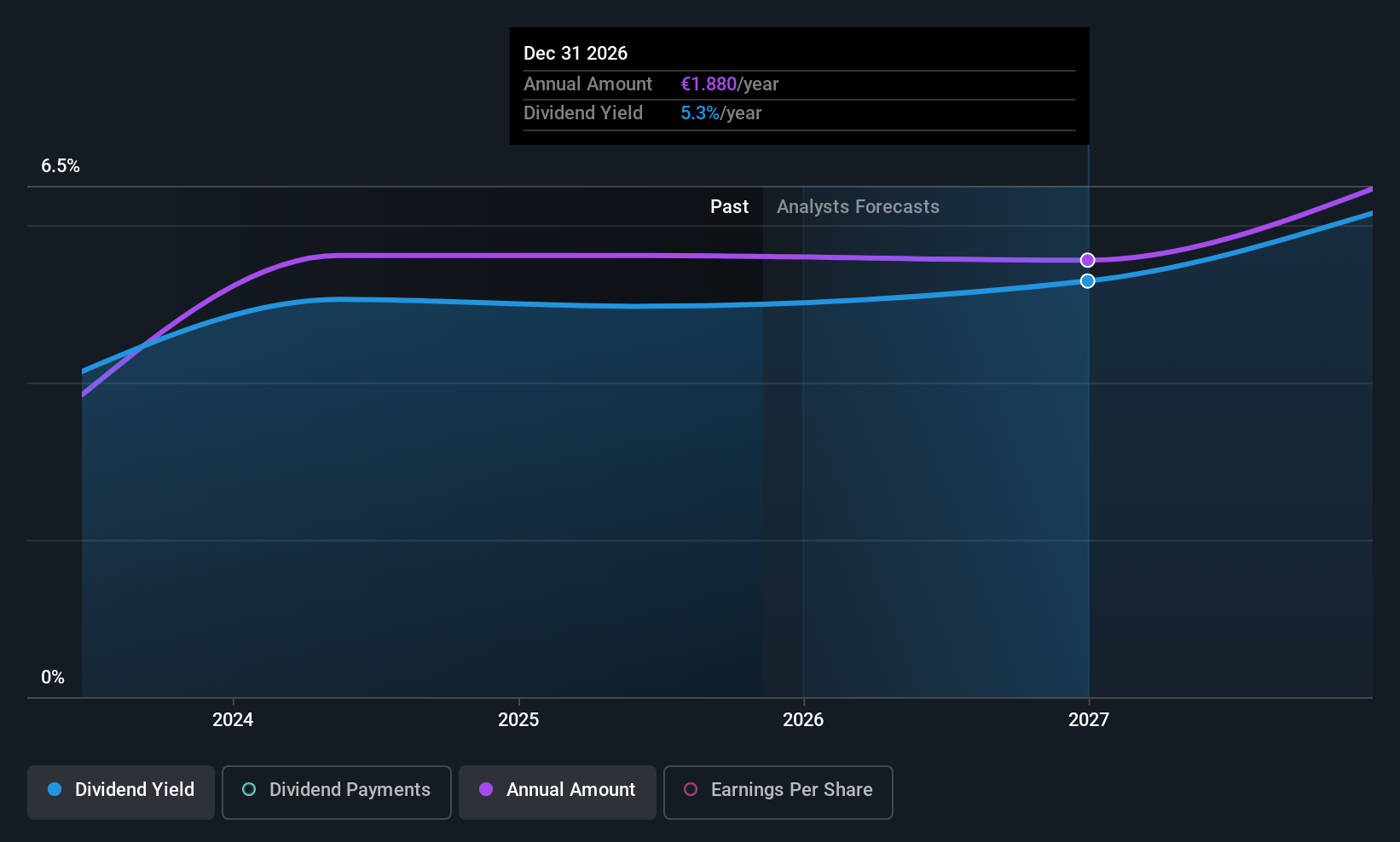

Daimler Truck Holding (XTRA:DTG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Daimler Truck Holding AG is a global manufacturer and seller of light, medium, and heavy-duty trucks and buses across Europe, North America, Asia, Latin America, and other international markets with a market cap of approximately €30.50 billion.

Operations: Daimler Truck Holding AG's revenue segments include Trucks North America (€20.47 billion), Mercedes-Benz Trucks (€18.35 billion), Trucks Asia (€6.09 billion), Daimler Buses (€5.79 billion), and Financial Services (€3.49 billion).

Dividend Yield: 4.8%

Daimler Truck Holding offers a dividend yield of 4.76%, placing it in the top 25% of German dividend payers, with dividends covered by earnings and cash flows at payout ratios of 66.2% and 57.1%, respectively. While dividends have been stable, they lack a long history, having only been paid for three years. Recent partnerships to expand electric charging infrastructure could bolster long-term growth prospects despite current challenges in profitability and sales performance.

- Navigate through the intricacies of Daimler Truck Holding with our comprehensive dividend report here.

- The analysis detailed in our Daimler Truck Holding valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Explore the 193 names from our Top European Dividend Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal