Improved Revenues Required Before Fabryki Mebli FORTE S.A. (WSE:FTE) Stock's 26% Jump Looks Justified

Fabryki Mebli FORTE S.A. (WSE:FTE) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 5.1% over the last year.

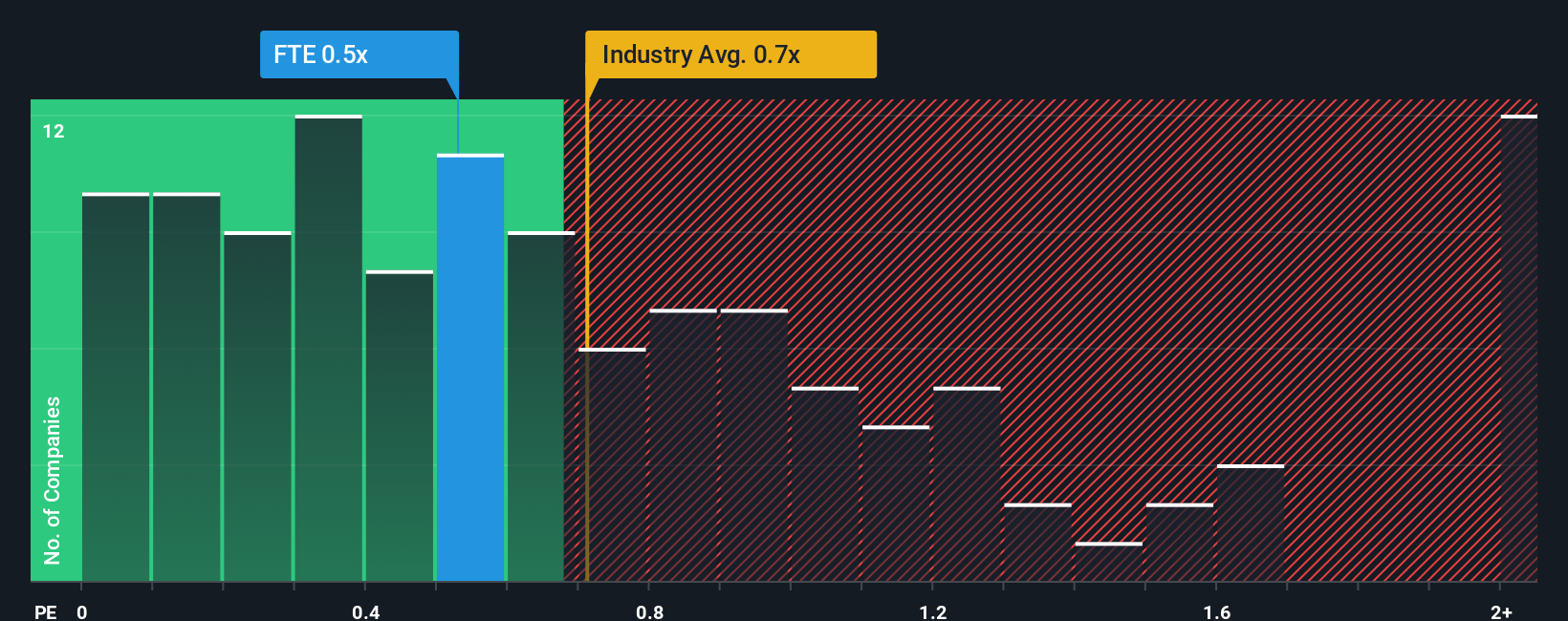

Even after such a large jump in price, when close to half the companies operating in Poland's Consumer Durables industry have price-to-sales ratios (or "P/S") above 1.5x, you may still consider Fabryki Mebli FORTE as an enticing stock to check out with its 0.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Fabryki Mebli FORTE

How Fabryki Mebli FORTE Has Been Performing

Recent times have been pleasing for Fabryki Mebli FORTE as its revenue has risen in spite of the industry's average revenue going into reverse. One possibility is that the P/S ratio is low because investors think the company's revenue is going to fall away like everyone else's soon. Those who are bullish on Fabryki Mebli FORTE will be hoping that this isn't the case and the company continues to beat out the industry.

Want the full picture on analyst estimates for the company? Then our free report on Fabryki Mebli FORTE will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Fabryki Mebli FORTE?

In order to justify its P/S ratio, Fabryki Mebli FORTE would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 13%. Still, lamentably revenue has fallen 11% in aggregate from three years ago, which is disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 0.07% over the next year. That's shaping up to be materially lower than the 62% growth forecast for the broader industry.

In light of this, it's understandable that Fabryki Mebli FORTE's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does Fabryki Mebli FORTE's P/S Mean For Investors?

Fabryki Mebli FORTE's stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of Fabryki Mebli FORTE's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Fabryki Mebli FORTE (1 can't be ignored!) that you should be aware of before investing here.

If you're unsure about the strength of Fabryki Mebli FORTE's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal