Humana (HUM) Valuation Check After Recent Share Price Recovery And Mixed Long Term Returns

What Humana’s recent performance means for investors

Humana (HUM) has drawn fresh attention after recent trading left the shares with a 1 day return of about a 2% decline, while the past week shows roughly 7% growth and the past month about a 7% gain.

See our latest analysis for Humana.

The recent 7 day share price return of 7.39% and 30 day share price return of 7.28% contrast with a 90 day share price decline of 5.35% and a 3 year total shareholder return loss of 42.35%. This suggests shorter term momentum is improving while longer term holders have seen weaker outcomes.

If Humana’s move has you reassessing your healthcare exposure, this could be a useful moment to scan other healthcare stocks that might fit your watchlist.

With Humana trading at $275.06, a value score of 3, annual revenue of about $126.4b and net income of $1.3b, investors may be weighing whether the current price represents a potential entry point for buyers or reflects expectations that are already fully incorporated into the share price.

Most Popular Narrative Narrative: 4.6% Undervalued

Humana’s most followed narrative puts fair value at about $288 per share compared with the recent close at $275.06. This frames a modest undervaluation built on detailed long term assumptions.

The analysts have a consensus price target of $298.955 for Humana based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $353.0, and the most bearish reporting a price target of just $250.0.

Want to see what earnings path and profit margins sit behind that fair value gap, and how a lower future P/E could still support it? The full narrative spells out the growth mix and valuation math that underpin this view without assuming sky high multiples.

Result: Fair Value of $288 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that fair value gap could shrink quickly if Medicare Advantage star rating appeals go against Humana or if margin recovery in key contracts proves slower and more volatile than expected.

Find out about the key risks to this Humana narrative.

Another View: What the P/E ratio is saying

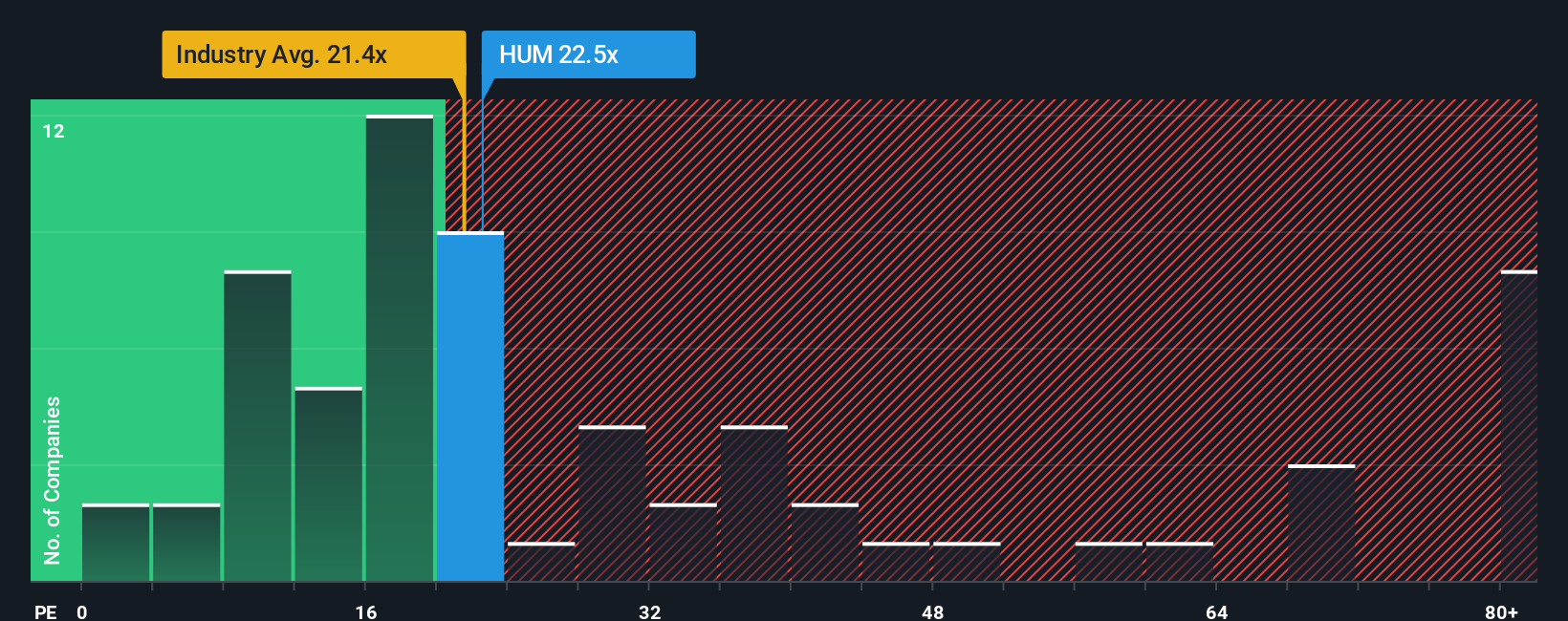

Humana’s shares trade on a P/E of 25.6x, which is higher than both the US Healthcare industry at 23x and its peer average at 21.5x, yet below a fair ratio estimate of 37.2x. So is the stock priced for comfort or leaving some room for disappointment if earnings fall short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Humana Narrative

If you look at the numbers and reach a different conclusion, or just prefer to test your own view, you can build a personalised narrative in a few minutes: Do it your way.

A great starting point for your Humana research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Humana has you thinking differently about your portfolio, do not stop here. The next strong idea you shortlist could come from looking just one level wider.

- Target future growth potential by scanning these 26 AI penny stocks that might reshape how technology and automation show up in your portfolio.

- Strengthen your hunt for mispriced quality by filtering for these 885 undervalued stocks based on cash flows that align with your risk and return expectations.

- Add a different source of income potential by reviewing these 12 dividend stocks with yields > 3% that may complement growth focused holdings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal