Emerging Middle East Stocks To Watch In January 2026

The Middle East stock markets have been buzzing with activity, particularly as Saudi Arabia leads Gulf gains by opening its capital market to all foreign investors, a move that has lifted investor sentiment and boosted liquidity. In this dynamic environment, identifying promising stocks involves looking for companies that can capitalize on increased foreign investment and demonstrate resilience amidst evolving economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nofoth Food Products | NA | 21.36% | 25.28% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| MOBI Industry | 13.81% | 5.67% | 19.69% | ★★★★★★ |

| Amanat Holdings PJSC | 10.86% | 27.51% | -0.92% | ★★★★★☆ |

| Etihad GO Telecom | 0.85% | 38.36% | 57.78% | ★★★★★☆ |

| Ajman Bank PJSC | 53.89% | 16.11% | 18.02% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Sukoon Insurance PJSC (DFM:SUKOON)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sukoon Insurance PJSC offers a range of insurance solutions to individuals and businesses in the United Arab Emirates, with a market capitalization of AED1.89 billion.

Operations: The company's primary revenue streams include life insurance at AED212.20 million and non-life insurance at AED5.04 billion. Net investment income contributes AED280.88 million, while net insurance finance expenses amount to -AED29.27 million.

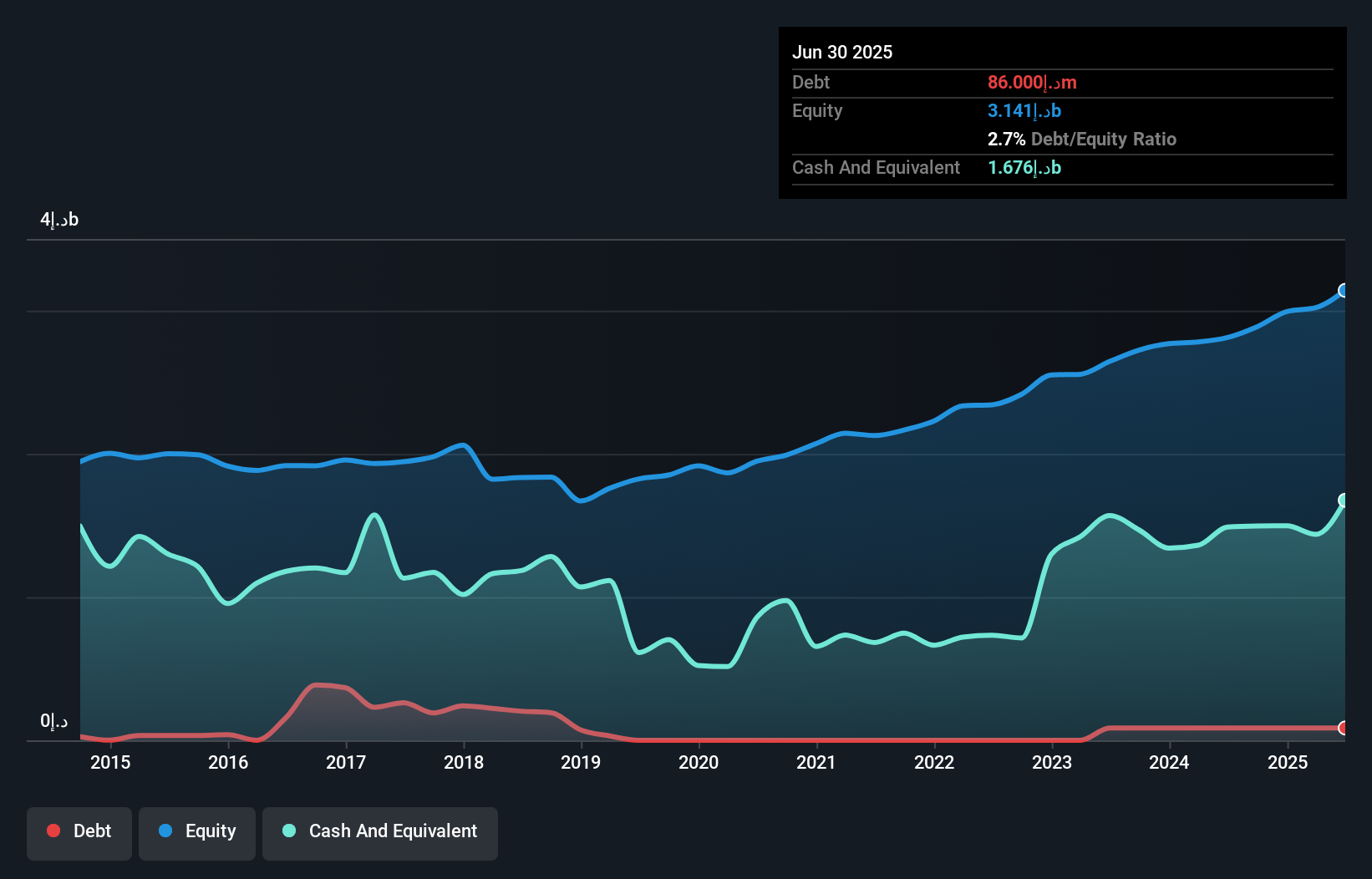

Sukoon Insurance PJSC, a small player in the Middle East insurance sector, has shown impressive financial health with earnings growth of 43% over the past year, outpacing the industry average of 28.1%. Despite an increase in its debt-to-equity ratio to 2.7% over five years, it maintains more cash than its total debt and boasts a robust interest coverage ratio of 88.3x EBIT. The company's price-to-earnings ratio stands at a favorable 5.4x compared to the market's 11.8x, suggesting potential value for investors seeking under-the-radar opportunities with solid earnings quality and free cash flow positivity (AED).

- Get an in-depth perspective on Sukoon Insurance PJSC's performance by reading our health report here.

Assess Sukoon Insurance PJSC's past performance with our detailed historical performance reports.

Mohammed Hadi Al-Rasheed (SASE:9601)

Simply Wall St Value Rating: ★★★★★☆

Overview: Mohammed Hadi Al-Rasheed Company specializes in the production of silica sand for various industrial applications and has a market capitalization of SAR1.42 billion.

Operations: The company generates revenue primarily from sales of silica sand, amounting to SAR273.90 million, and contracting services at SAR33.12 million.

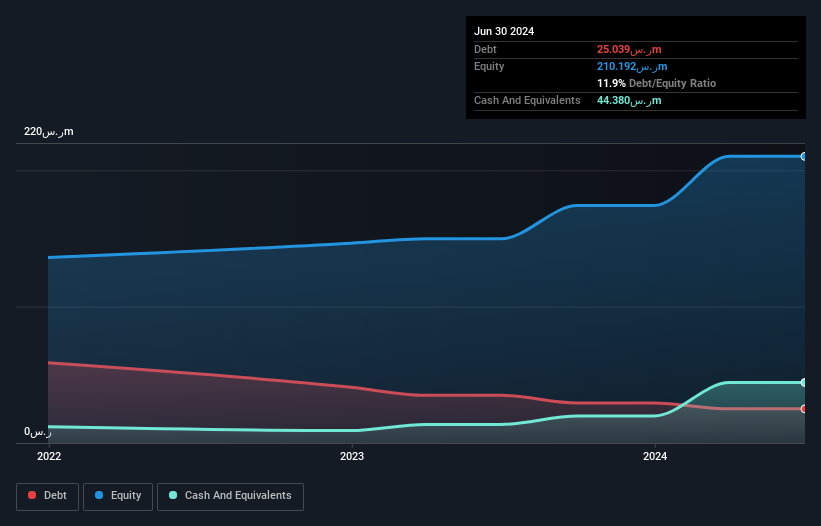

Mohammed Hadi Al-Rasheed, a relatively smaller player in its sector, has shown impressive financial performance with earnings growth of 80.6% over the past year, significantly outpacing the Basic Materials industry average of -4.2%. The company trades at 48.7% below its estimated fair value and boasts high-quality earnings. It also maintains a strong balance sheet, having more cash than total debt and covering interest payments by EBIT 92.7 times over. Recent strategic moves include signing a memorandum with Taif Shipping Company for potential investment opportunities in oil and gas services, though financial impacts are yet to be determined.

- Take a closer look at Mohammed Hadi Al-Rasheed's potential here in our health report.

Learn about Mohammed Hadi Al-Rasheed's historical performance.

Bank of Jerusalem (TASE:JBNK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bank of Jerusalem Ltd. offers commercial banking services in Israel with a market capitalization of ₪1.75 billion.

Operations: The bank generates revenue primarily from housing loans, contributing ₪216.50 million, and household services at ₪275.90 million. Private banking adds another ₪25.50 million to its revenue streams, while institutional investors contribute ₪5.90 million.

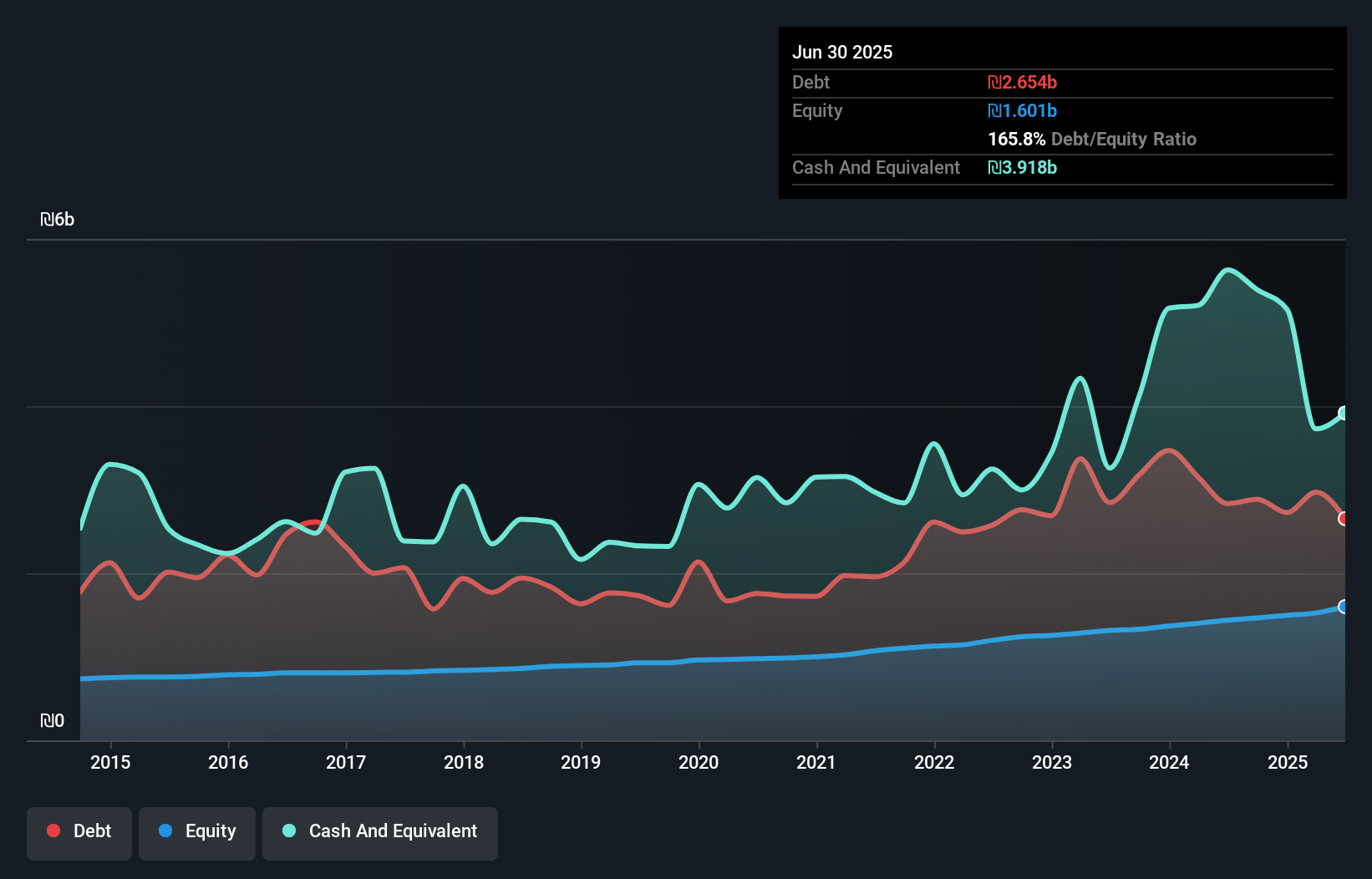

With total assets of ₪22.3B and equity at ₪1.6B, Bank of Jerusalem stands out with its robust foundation. The bank's earnings growth of 23.3% over the past year surpasses the industry average, showcasing its competitive edge. Customer deposits account for 86% of liabilities, indicating a low-risk funding profile that's less reliant on external borrowing. Despite a price-to-earnings ratio of 9.1x being below the IL market average, it suggests potential value for investors seeking opportunities in smaller entities within the financial sector. Recent earnings show net income rising to ₪59M from last year's ₪45M, reflecting solid financial performance amidst market challenges.

Taking Advantage

- Click here to access our complete index of 184 Middle Eastern Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal