Did Slowing Contract Growth and AI Jitters Just Shift Gartner's (IT) Investment Narrative?

- In recent months, Gartner reported a strong third quarter with earnings beating estimates and record share repurchases, but later reduced its revenue growth guidance after contract value growth slowed amid tariff-related decision delays and budget pressures.

- At the same time, investors are weighing cyclical softness in Gartner’s core research business and concerns about generative AI’s impact on its value proposition ahead of upcoming earnings.

- We’ll now examine how slowing contract value growth and these emerging AI concerns may influence Gartner’s existing investment narrative.

AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Gartner Investment Narrative Recap

To own Gartner, you need to believe its research, conferences and consulting will stay essential for decision makers even as clients experiment with generative AI and tighten budgets. Recent revenue guidance cuts and the projected profit decline ahead of Q4 results sharpen the focus on the same near term catalysts and risks: whether contract value growth stabilizes and how vulnerable Gartner’s subscription model is to cheaper AI driven alternatives. So far, the news does not fundamentally alter that debate.

What stands out to me is Gartner’s record share repurchases in Q3 2025, with US$1,049.19 million used to buy back 3,953,532 shares under an expanded authorization. That level of capital return sits alongside slowing contract value growth and softer earnings, so upcoming results will be watched for evidence that cash generation can comfortably support both ongoing buybacks and investments in AI tools like AskGartner.

Yet investors should be aware that if generative AI starts to displace Gartner’s subscription research more quickly than expected, it could...

Read the full narrative on Gartner (it's free!)

Gartner's narrative projects $7.4 billion revenue and $821.8 million earnings by 2028. This requires 4.7% yearly revenue growth and an earnings decrease of about $0.5 billion from $1.3 billion today.

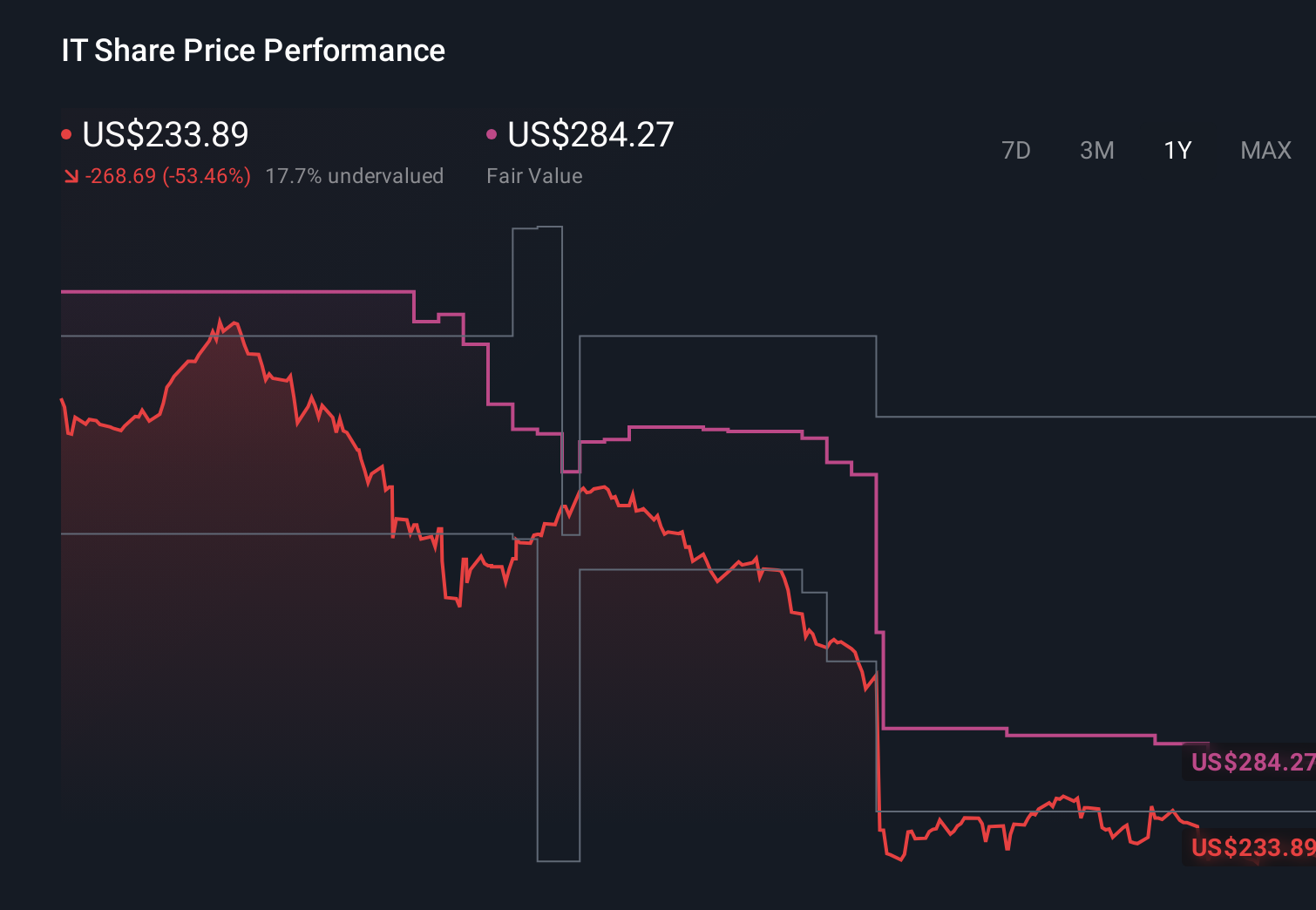

Uncover how Gartner's forecasts yield a $283.73 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community value Gartner between US$283.14 and US$420.71 per share, underscoring how far views can diverge. You should weigh those against the current concerns that generative AI could pressure Gartner’s core research revenues over time and consider what that might mean for future profitability and business resilience.

Explore 3 other fair value estimates on Gartner - why the stock might be worth as much as 71% more than the current price!

Build Your Own Gartner Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gartner research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Gartner research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gartner's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 39 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal