Assessing ASM International (ENXTAM:ASM) Valuation As Chipmaking Role At 2 Nm And AI Demand Gains Attention

ASM International (ENXTAM:ASM) is back in focus as investors reassess its role in supplying atomic layer deposition and epitaxy tools that support 2 nm chips, advanced 3D architectures, AI, and high performance computing demand.

See our latest analysis for ASM International.

The recent focus on ASM International’s role in enabling 2 nm and advanced 3D chip architectures comes alongside strong momentum, with a 7 day share price return of 21.79% and a 3 year total shareholder return of 130.99%. This suggests interest has been building over time.

If ASM International’s move has caught your eye, this could be a good moment to see what else is shaping the future of chips and AI through high growth tech and AI stocks.

After a 3 year total shareholder return of 130.99% and a recent surge that leaves the share price close to analyst targets, the key question is whether ASM International still offers upside or if the market is already pricing in future growth.

Most Popular Narrative Narrative: 0% Overvalued

Compared to the last close of €630.40, the most followed narrative sees fair value slightly lower at about €627.47, implying a small premium that still hinges on specific growth and margin assumptions.

Record growth in the spares and services business, powered by an expanding installed base and high-value outcome-based services, creates recurring, higher-margin revenue streams that improve earnings stability and offset hardware order volatility. Strategic expansion of manufacturing capacity and localized production (e.g., new Arizona facility) is increasing operational flexibility to address both surging North American investment in semiconductor onshoring and potential trade/tariff issues. This supports both revenue growth and margin protection against geopolitical uncertainty.

Curious how this fair value leans so close to the current price? The narrative hangs on a specific growth rate, richer margins, and a premium earnings multiple working together. The mix is tighter than it looks at first glance.

Result: Fair Value of €627.47 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still a few pressure points to watch, particularly any prolonged softness in order intake and the ongoing uncertainty around China export controls and local competitors.

Find out about the key risks to this ASM International narrative.

Another View: Earnings Ratio Flags Less Downside

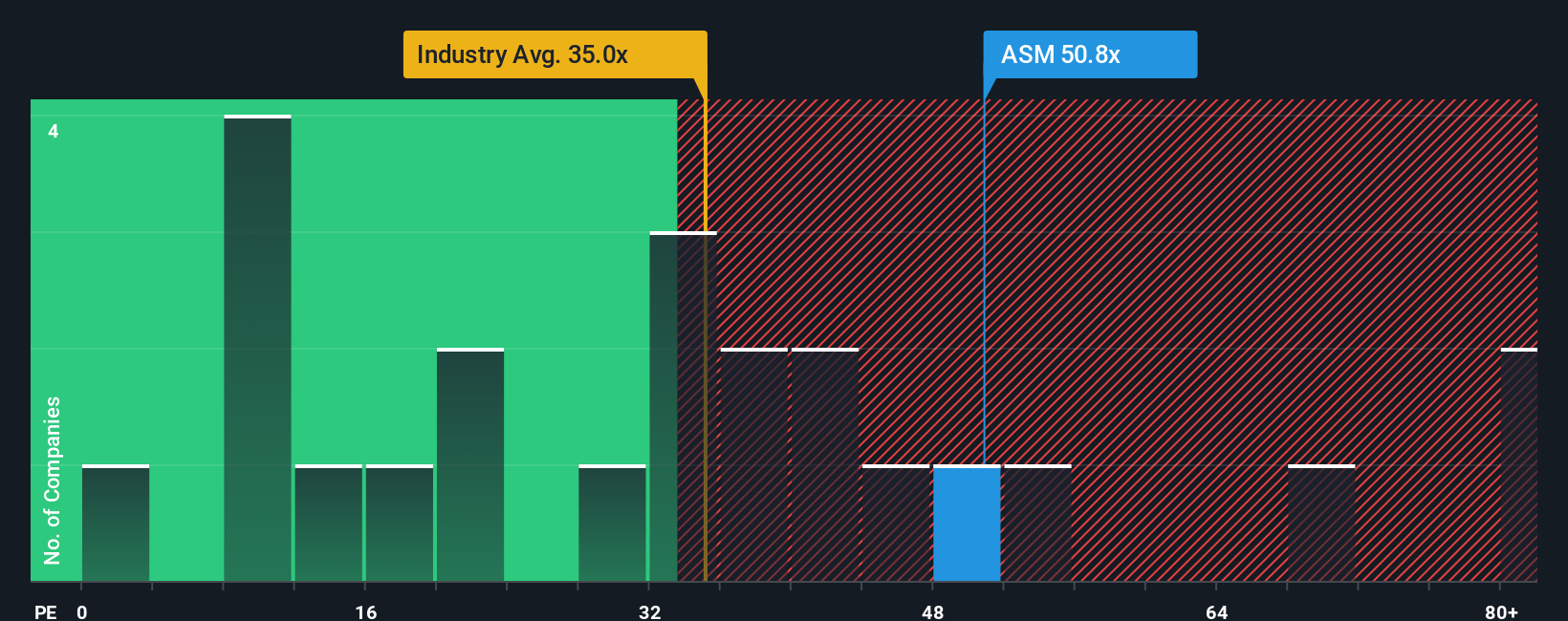

While the narrative based fair value of €627.47 suggests ASM International is slightly overvalued, the earnings ratio points in a different direction. The current P/E is 39.3x, compared with a fair ratio of 40.2x, the European Semiconductor industry at 42.3x, and peers at 64.1x.

This gap implies the market is not assigning ASM a premium relative to its sector or closest peers, even though the fair ratio points slightly higher. The tension between the narrative fair value and this earnings based view raises a simple question: which signal do you trust more right now?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ASM International Narrative

If your view differs or you simply want to put your own assumptions to the test, you can build a custom ASM International story in minutes with Do it your way.

A great starting point for your ASM International research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If ASM International has sharpened your thinking, do not stop here. Cast a wider net with focused screens that surface very different types of opportunities.

- Spot potential mispricing by checking out these 885 undervalued stocks based on cash flows that may offer more attractive entry points based on cash flows.

- Target growth at the frontier of computing by scanning these 29 quantum computing stocks working on next generation hardware and software.

- Seek income focused ideas by reviewing these 12 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal