Assessing MGM Resorts (MGM) Valuation After Recent Share Price Pullback

Why MGM Resorts International is on investors’ radar

MGM Resorts International (MGM) has recently seen mixed share performance, with a 4.5% decline in the past day and a 6.5% drop over the past week, prompting investors to reassess the story.

See our latest analysis for MGM Resorts International.

While the recent 1-day and 7-day share price returns of 4.53% and 6.49% declines have put pressure on MGM Resorts International, the 90-day share price return of 5.15% and 1-year total shareholder return of 4.37% suggest momentum has been uneven rather than decisively weak.

If this recent pullback has you reassessing your portfolio mix, it could be a useful moment to broaden your view with fast growing stocks with high insider ownership.

With MGM shares under pressure recently, yet trading at about a 25% discount to analyst targets and a larger implied intrinsic discount, the key question is whether the pullback signals value or if the market already reflects future growth.

Most Popular Narrative: 19.7% Undervalued

With MGM Resorts International last closing at $34.12 versus a narrative fair value of $42.50, the valuation hinges on how future earnings power is framed.

MGM's strong focus on expanding its digital gaming and sports betting segments, including BetMGM North America and rapid progress in international markets like Brazil, is expected to unlock higher-margin, faster-growing revenue streams, which could positively affect both long-term revenue trends and company EBITDA margins.

Want to see what is baked into that future EBITDA story? Revenue creep is only part of it. The bigger swing factor is margin expansion and where the future earnings multiple lands. Curious what combination of growth, profitability and valuation gets to that higher fair value?

Result: Fair Value of $42.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on Macau recovery holding up, and large projects like Osaka and Dubai not running into cost overruns or prolonged regulatory delays.

Find out about the key risks to this MGM Resorts International narrative.

Another View: Multiples Paint a Very Different Picture

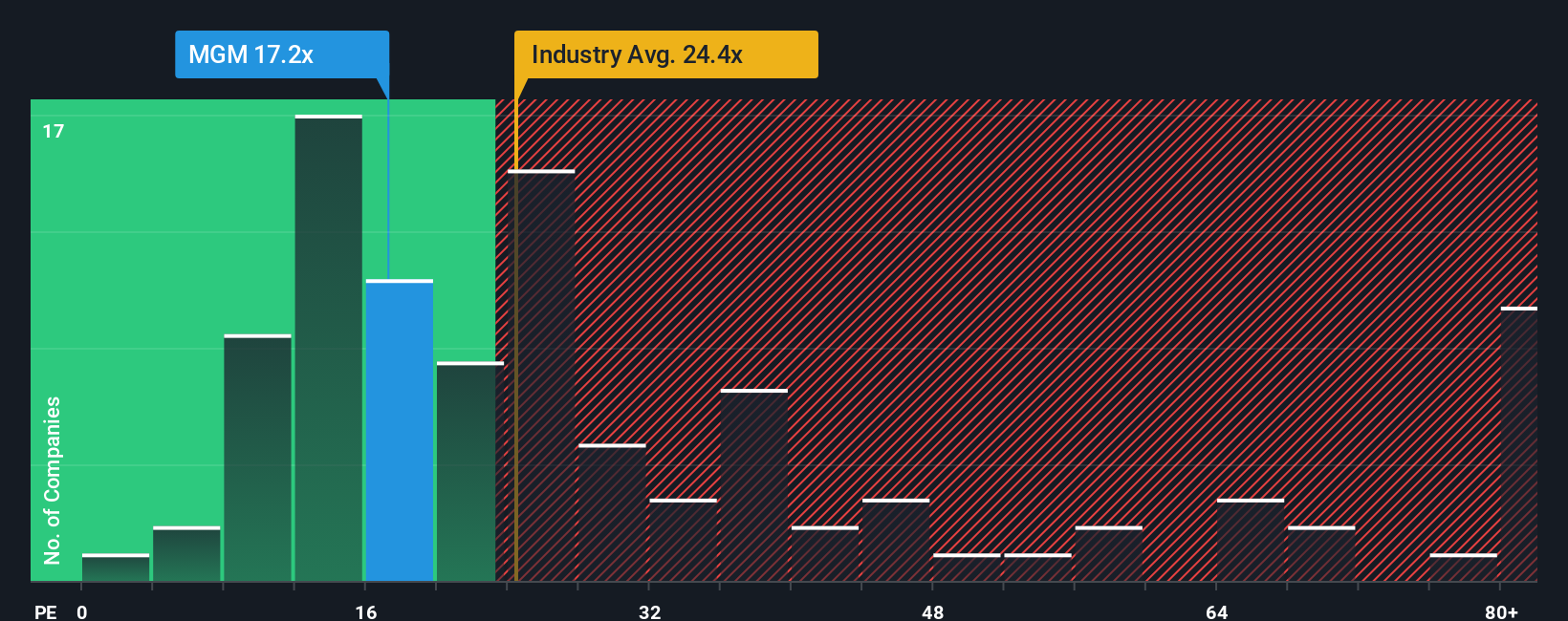

Our model suggests MGM is trading at a very high P/E of 138.9x, compared with a fair ratio of 40.2x, a peer average of 16.3x and a US Hospitality average of 22x. That gap points to meaningful downside risk if sentiment or earnings expectations reset. Which signal do you trust more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MGM Resorts International Narrative

If you see the numbers differently, or prefer to test your own assumptions against the data, you can build a custom view in minutes with Do it your way.

A great starting point for your MGM Resorts International research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If MGM has you thinking more broadly about your portfolio, this is the moment to widen your search and see what else the market is quietly offering.

- Spot potential bargains early by scanning these 885 undervalued stocks based on cash flows that currently trade below what their cash flows suggest.

- Ride the momentum in cutting edge automation and data science by reviewing these 26 AI penny stocks shaping the next wave of growth.

- Target income opportunities by checking out these 12 dividend stocks with yields > 3% that may offer more consistent cash returns than a single stock ever could.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal