Can Textron’s (TXT) Special Olympics Airlift Role Quietly Reinforce Its Aviation Brand and Investor Narrative?

- Textron Aviation, a unit of Textron Inc., announced that Prent Corporation will serve as Dove 1 for the 2026 Special Olympics Airlift arrivals, leading the nationwide mission to fly athletes and coaches into St. Paul Downtown Airport Holman Field on June 19, 2026.

- This high-profile community initiative, alongside investor focus on Textron’s upcoming fourth quarter 2025 earnings release and outlook call, is drawing renewed attention to how the company balances aviation, defense, and industrial operations.

- We’ll now explore how Textron’s role in the Special Olympics Airlift may influence its investment narrative around aviation demand and brand strength.

Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Textron Investment Narrative Recap

To own Textron, you generally need to believe in its ability to compound value across aviation, defense, and industrial platforms while managing margins and product mix. The Special Olympics Airlift is positive for brand and aviation visibility, but it does not materially change the near term focus on Q4 2025 earnings or the key risks around segment profitability and industrial demand.

The upcoming Q4 2025 earnings release and outlook call on January 28, 2026 is the announcement that ties most directly to this renewed attention on Textron. As the company showcases its community role in aviation, many investors will be watching that call for updates on aviation mix, aftermarket performance, and progress in reshaping the Industrial segment, which together may matter more for the investment case than any single event.

Yet behind the positive headlines, investors should be aware that weaker product mix and pressure on net margins could...

Read the full narrative on Textron (it's free!)

Textron's narrative projects $16.2 billion revenue and $1.1 billion earnings by 2028. This requires 4.8% yearly revenue growth and roughly a $284 million earnings increase from $816.0 million today.

Uncover how Textron's forecasts yield a $92.57 fair value, a 5% upside to its current price.

Exploring Other Perspectives

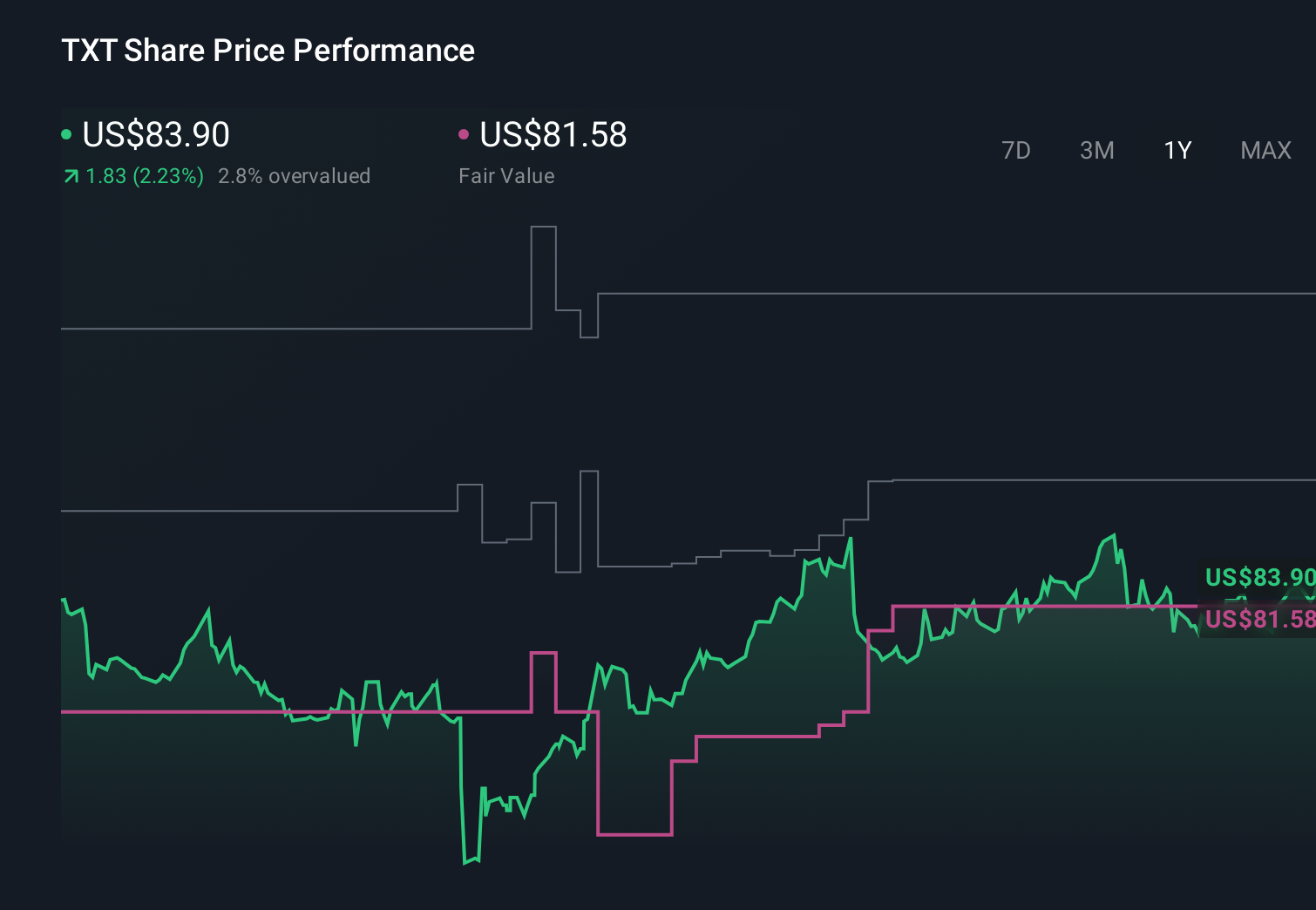

Five members of the Simply Wall St Community currently see Textron’s fair value between US$76.01 and US$134.26, illustrating how far apart individual views can be. Set against this, concerns about declining segment profit and margin pressure may influence how you weigh those different value estimates and which scenarios for the business you consider most credible.

Explore 5 other fair value estimates on Textron - why the stock might be worth as much as 52% more than the current price!

Build Your Own Textron Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Textron research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Textron research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Textron's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal