CJ Cheiljedang Corporation's (KRX:097950) Shares May Have Run Too Fast Too Soon

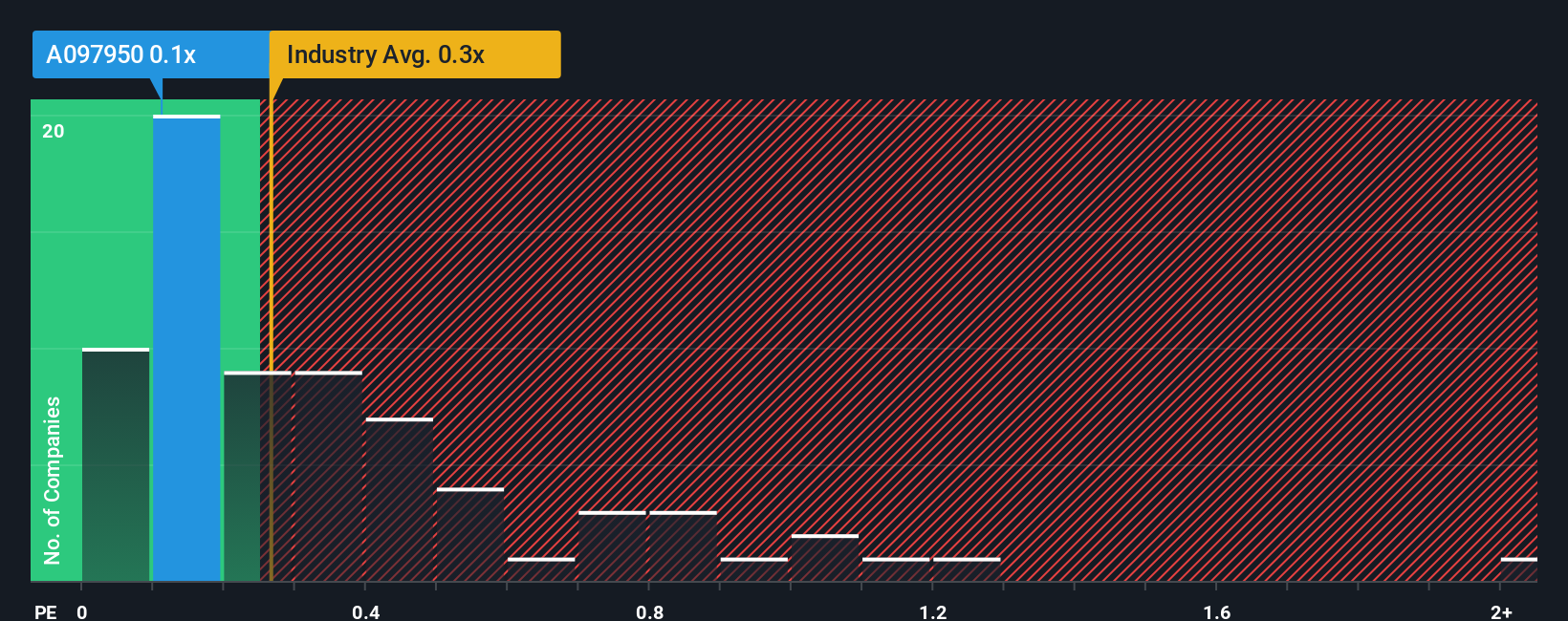

It's not a stretch to say that CJ Cheiljedang Corporation's (KRX:097950) price-to-sales (or "P/S") ratio of 0.1x right now seems quite "middle-of-the-road" for companies in the Food industry in Korea, where the median P/S ratio is around 0.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for CJ Cheiljedang

How Has CJ Cheiljedang Performed Recently?

Recent times haven't been great for CJ Cheiljedang as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on CJ Cheiljedang.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, CJ Cheiljedang would need to produce growth that's similar to the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. The longer-term trend has been no better as the company has no revenue growth to show for over the last three years either. So it seems apparent to us that the company has struggled to grow revenue meaningfully over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 2.0% over the next year. Meanwhile, the rest of the industry is forecast to expand by 13%, which is noticeably more attractive.

With this information, we find it interesting that CJ Cheiljedang is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What We Can Learn From CJ Cheiljedang's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Given that CJ Cheiljedang's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It is also worth noting that we have found 4 warning signs for CJ Cheiljedang (1 doesn't sit too well with us!) that you need to take into consideration.

If you're unsure about the strength of CJ Cheiljedang's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal