Brightstar Lottery (BRSL) Valuation Check As New California Contract Extends Longstanding Partnership

Brightstar Lottery (BRSL) is back in focus after its subsidiary secured a six year instant ticket printing and services contract with the California Lottery, extending a long running relationship with this major lottery market.

See our latest analysis for Brightstar Lottery.

The contract news comes as Brightstar Lottery trades at $15.69, with a 30 day share price return of 4.74% but a 90 day share price return decline of 9.67%. The 1 year total shareholder return of 11.52% contrasts with a 3 year total shareholder return decline of 12.60%, suggesting short term momentum has picked up after a weaker multi year stretch.

If this kind of contract win has your attention, it might be a good moment to widen your watchlist and check out fast growing stocks with high insider ownership.

With shares at $15.69, a 31% discount to the average analyst price target of $20.50 and a recent contract win in hand, the key question is whether Brightstar is genuinely undervalued or if the market is already pricing in future growth.

Most Popular Narrative Narrative: 22.2% Undervalued

With Brightstar Lottery last closing at $15.69 versus a narrative fair value of about $20.17, the current setup hinges on how quickly earnings can scale.

Implementation and expansion of structural cost cutting initiatives (OPtiMa 3.0) are expected to drive $50 million in annualized savings by 2026 (60% realized this year), helping to offset temporary profit headwinds and support a rebound to normalized EBITDA and free cash flow, directly benefiting earnings in the coming years.

Curious what kind of revenue runway, margin lift, and future earnings multiple are included in that valuation gap? The full narrative lays out a detailed earnings path, contract timeline, and profit margin reset that together underpin this higher fair value.

Result: Fair Value of $20.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, tighter gambling rules in key markets or a slowdown in jackpot driven ticket demand could challenge the earnings path that underpins this undervalued thesis.

Find out about the key risks to this Brightstar Lottery narrative.

Another View: Market Ratios Paint A Different Picture

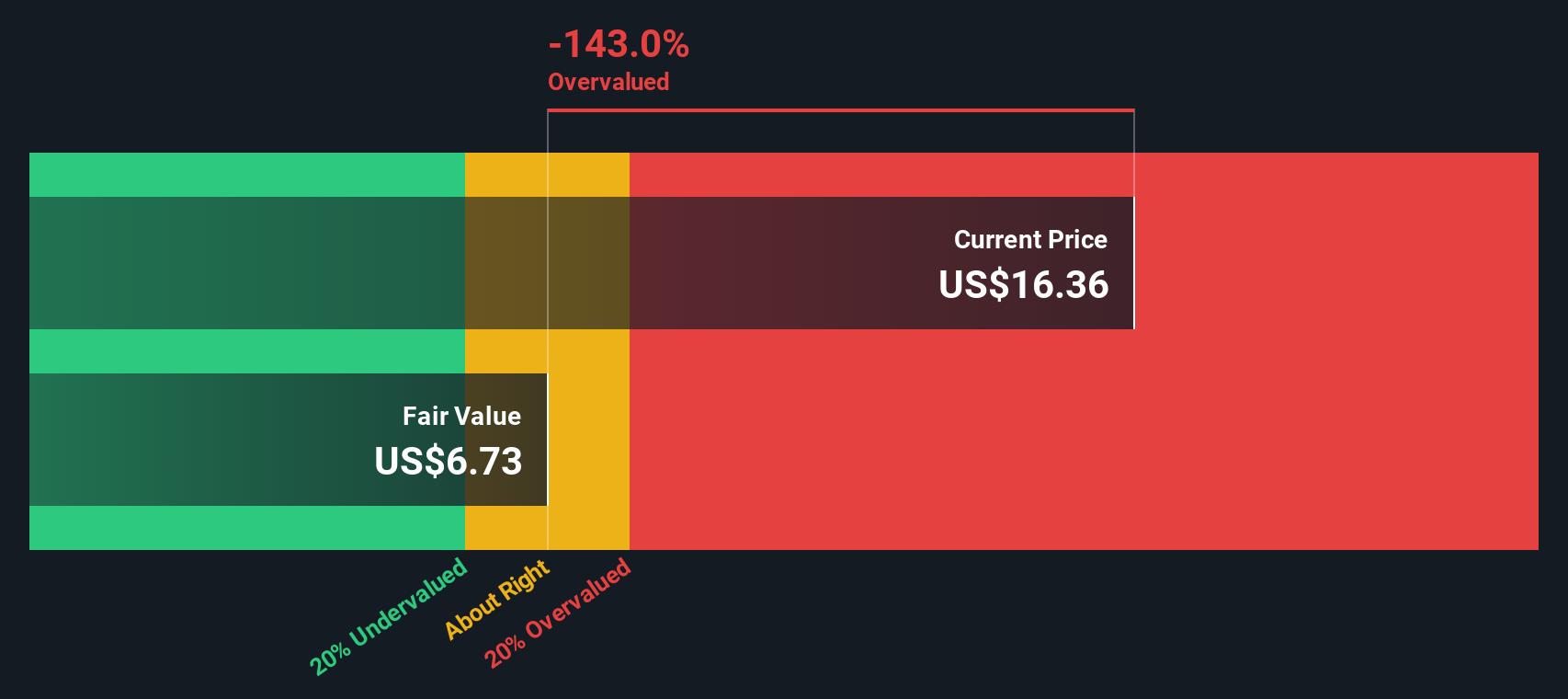

While the narrative fair value points to Brightstar Lottery being 22.2% undervalued, our DCF model tells a very different story. On that measure, the fair value sits at about $10.29 per share, which would leave the current $15.69 price looking expensive rather than cheap. Which lens do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Brightstar Lottery Narrative

If you look at the numbers and reach a different conclusion, or just prefer your own process, you can build a custom thesis in minutes with Do it your way.

A great starting point for your Brightstar Lottery research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready For More Investment Ideas?

If Brightstar has caught your eye, do not stop there, use curated stock screens to spot other opportunities that match the way you like to invest.

- Target potential high growth names at lower share prices by scanning these 3557 penny stocks with strong financials for companies with stronger financial footing.

- Ride the momentum of machine learning and automation trends by checking out these 26 AI penny stocks focused on businesses tied to this theme.

- Hunt for possible value opportunities by reviewing these 876 undervalued stocks based on cash flows that look relatively cheap based on their cash flow profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal