Asian Penny Stocks To Watch In January 2026

As we enter January 2026, the Asian markets are capturing global attention with their mixed performance amid changing economic conditions. Penny stocks, a term that may seem outdated but remains significant, often refer to smaller or newer companies offering growth potential at lower price points. When these stocks are backed by strong financials and solid fundamentals, they can present compelling opportunities for investors seeking value and growth in under-the-radar companies.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.45 | HK$896.85M | ✅ 4 ⚠️ 1 View Analysis > |

| Asia Medical and Agricultural Laboratory and Research Center (SET:AMARC) | THB2.50 | THB1.05B | ✅ 3 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.56 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.105 | SGD54.97M | ✅ 2 ⚠️ 3 View Analysis > |

| Halcyon Technology (SET:HTECH) | THB2.92 | THB876M | ✅ 2 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.64 | SGD14.33B | ✅ 5 ⚠️ 1 View Analysis > |

| NagaCorp (SEHK:3918) | HK$4.64 | HK$20.52B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.00 | NZ$137.01M | ✅ 2 ⚠️ 5 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.40 | HK$51.08B | ✅ 4 ⚠️ 2 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.82 | NZ$235.47M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 958 stocks from our Asian Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Fenbi (SEHK:2469)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fenbi Ltd. is an investment holding company offering non-formal vocational education and training services in the People’s Republic of China, with a market cap of HK$4.77 billion.

Operations: The company's revenue is primarily derived from Tutoring Services, which generated CN¥2.26 billion, and Sales of books and others, contributing CN¥525.85 million.

Market Cap: HK$4.77B

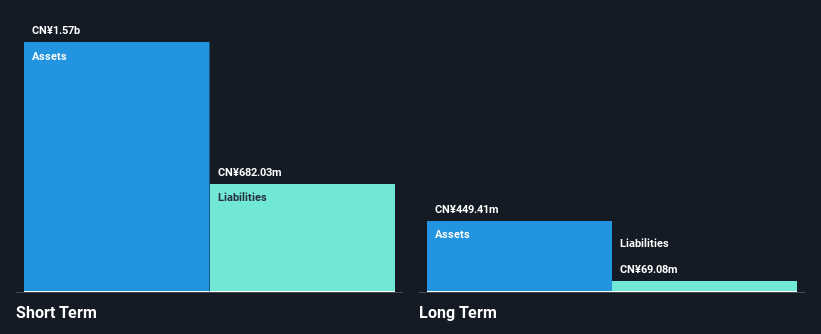

Fenbi Ltd. has shown resilience with its debt-free status and strong short-term asset position, which covers both short and long-term liabilities. Despite a decline in profit margins from 13% to 7.1% over the past year, the company remains profitable with earnings forecasted to grow at 26.42% annually. Recent share repurchase announcements aim to enhance net asset value per share, potentially benefiting shareholders by up to HK$200 million worth of buybacks. However, negative earnings growth of -51% last year poses challenges against industry benchmarks, while return on equity remains low at 12.8%.

- Get an in-depth perspective on Fenbi's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Fenbi's future.

China Oriental Group (SEHK:581)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Oriental Group Company Limited manufactures and sells iron and steel products for downstream steel manufacturers in the People’s Republic of China, with a market cap of HK$5.14 billion.

Operations: The company's revenue is primarily derived from its Iron and Steel segment, which generated CN¥40.14 billion, complemented by CN¥120.26 million from its Real Estate activities.

Market Cap: HK$5.14B

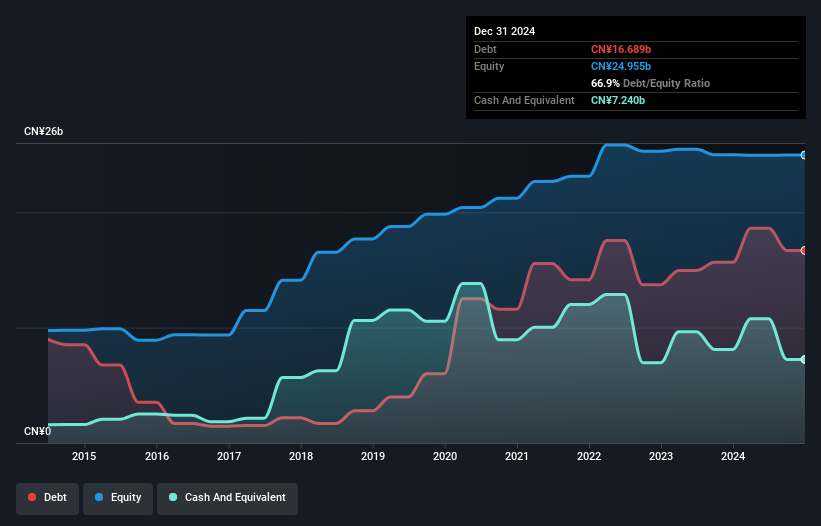

China Oriental Group, with a market cap of HK$5.14 billion, has recently become profitable, marking a significant turnaround despite past earnings declines. The company's iron and steel segment remains its primary revenue driver, generating CN¥40.14 billion. Its debt is well-covered by operating cash flow at 20.7%, and short-term assets exceed both short and long-term liabilities significantly, indicating strong financial health. Trading at 97% below estimated fair value suggests potential undervaluation opportunities for investors. However, the low return on equity of 1.4% highlights efficiency concerns despite stable weekly volatility over the past year at 6%.

- Take a closer look at China Oriental Group's potential here in our financial health report.

- Gain insights into China Oriental Group's outlook and expected performance with our report on the company's earnings estimates.

POSCO-Thainox (SET:INOX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: POSCO-Thainox Public Company Limited produces and sells cold-rolled stainless steel products across various international markets, with a market cap of approximately THB3.74 billion.

Operations: The company's revenue is primarily derived from its stainless steel segment, totaling THB13.98 billion.

Market Cap: THB3.74B

POSCO-Thainox, with a market cap of THB3.74 billion, has faced challenges as recent earnings show a decline in net income to THB38.88 million for Q3 2025 from THB60.84 million the previous year, and a net loss for nine months ending September 2025. Despite this, the company maintains strong financial health with short-term assets of THB8.7 billion exceeding liabilities and no debt concerns. However, profitability metrics such as return on equity at 0.6% and profit margins have declined compared to last year, reflecting operational inefficiencies amidst high share price volatility over recent months.

- Dive into the specifics of POSCO-Thainox here with our thorough balance sheet health report.

- Gain insights into POSCO-Thainox's historical outcomes by reviewing our past performance report.

Where To Now?

- Investigate our full lineup of 958 Asian Penny Stocks right here.

- Want To Explore Some Alternatives? Uncover 16 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal