3 ASX Dividend Stocks Yielding Up To 20.9%

As the Australian market navigates through fluctuating inflation data and potential interest rate decisions, investors are closely watching how these factors could influence various sectors on the ASX. In such an environment, dividend stocks can offer a reliable income stream, making them an appealing choice for those looking to capitalize on steady returns amidst broader market uncertainties.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Treasury Wine Estates (ASX:TWE) | 7.74% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 6.22% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 8.11% | ★★★★★☆ |

| Steadfast Group (ASX:SDF) | 3.70% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.59% | ★★★★★☆ |

| Kina Securities (ASX:KSL) | 7.99% | ★★★★★☆ |

| Joyce (ASX:JYC) | 5.06% | ★★★★☆☆ |

| Fiducian Group (ASX:FID) | 4.19% | ★★★★★☆ |

| EQT Holdings (ASX:EQT) | 4.50% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 7.45% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top ASX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

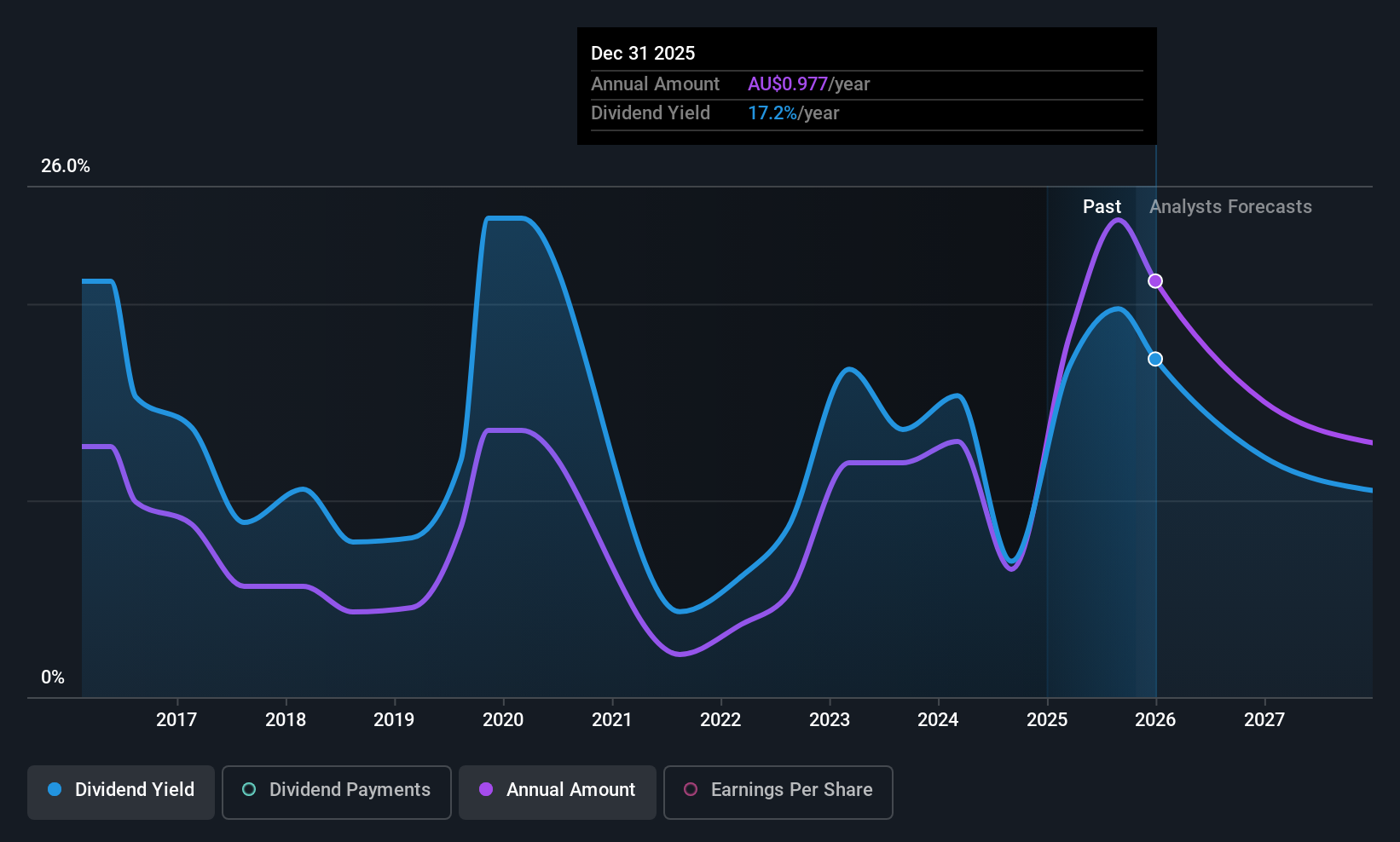

Helia Group (ASX:HLI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Helia Group Limited, along with its subsidiaries, operates in the loan mortgage insurance sector primarily in Australia and has a market capitalization of A$1.46 billion.

Operations: Helia Group Limited generates revenue of A$559.63 million from its operations in the loan mortgage insurance sector in Australia.

Dividend Yield: 20.9%

Helia Group's dividend yield is notably high at 20.93%, placing it in the top 25% of Australian dividend payers. However, the sustainability of this yield is questionable due to a high cash payout ratio of 209.7%, indicating dividends aren't covered by free cash flow. Although earnings have grown recently, future declines are anticipated, adding to concerns about reliability given past volatility in payments. The stock trades significantly below its estimated fair value, suggesting potential undervaluation despite these risks.

- Click here and access our complete dividend analysis report to understand the dynamics of Helia Group.

- Insights from our recent valuation report point to the potential undervaluation of Helia Group shares in the market.

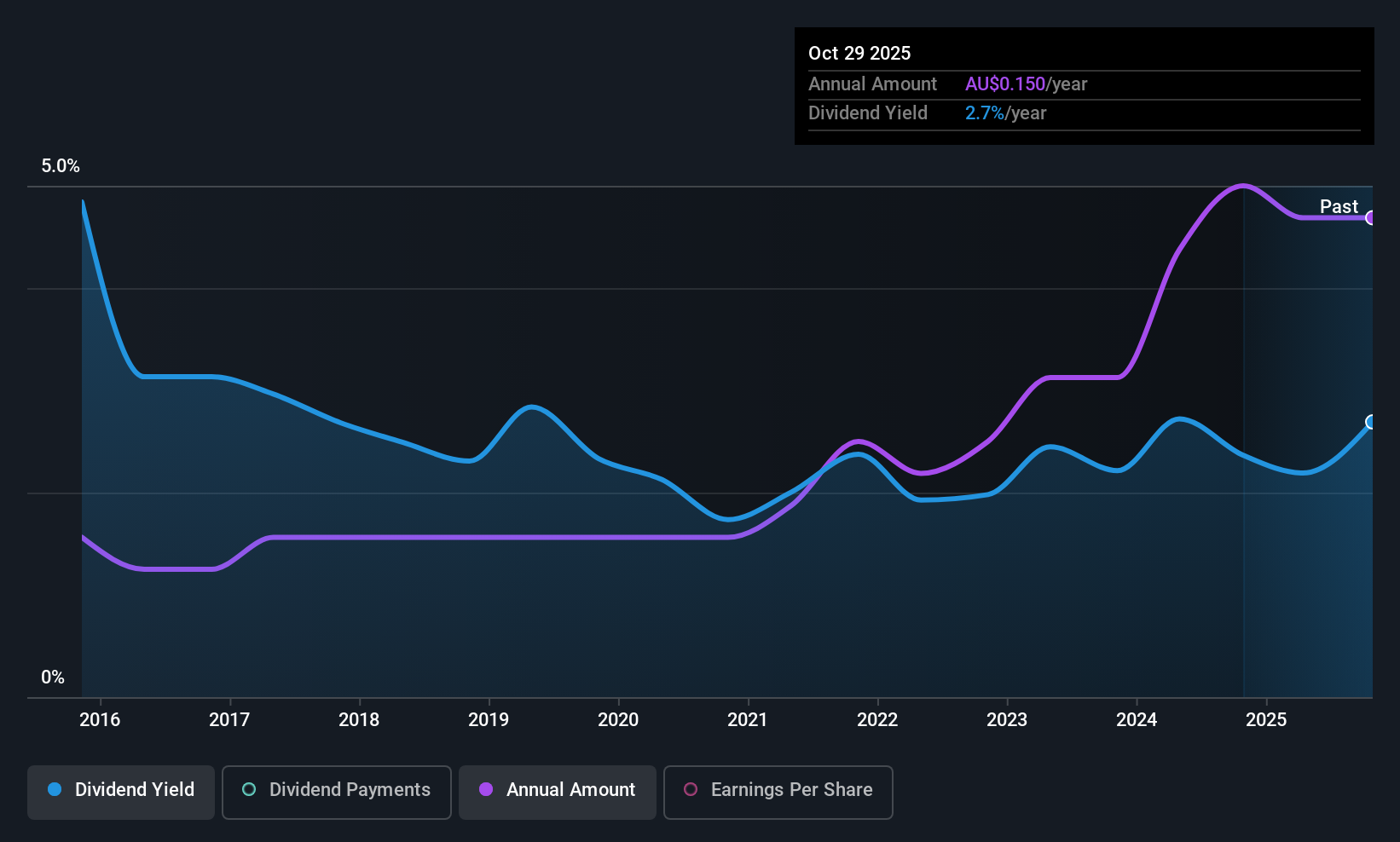

Waterco (ASX:WAT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Waterco Limited manufactures, wholesales, and exports equipment and accessories for swimming pools, spa pools, spa baths, rural pumps, irrigation, and water treatment across Australia, New Zealand, Asia, North America, and Europe with a market cap of A$175.82 million.

Operations: Waterco Limited's revenue segment is primarily derived from Building Products, amounting to A$254.93 million.

Dividend Yield: 3%

Waterco's dividend yield of 3% is below the top 25% of Australian dividend payers, and its track record shows volatility with significant annual drops. Despite this instability, dividends are well-covered by both earnings (55.1% payout ratio) and cash flows (29.1% cash payout ratio). The stock trades at a discount to its estimated fair value, suggesting potential undervaluation. However, profit margins have declined from last year, which may impact future payouts.

- Dive into the specifics of Waterco here with our thorough dividend report.

- The analysis detailed in our Waterco valuation report hints at an deflated share price compared to its estimated value.

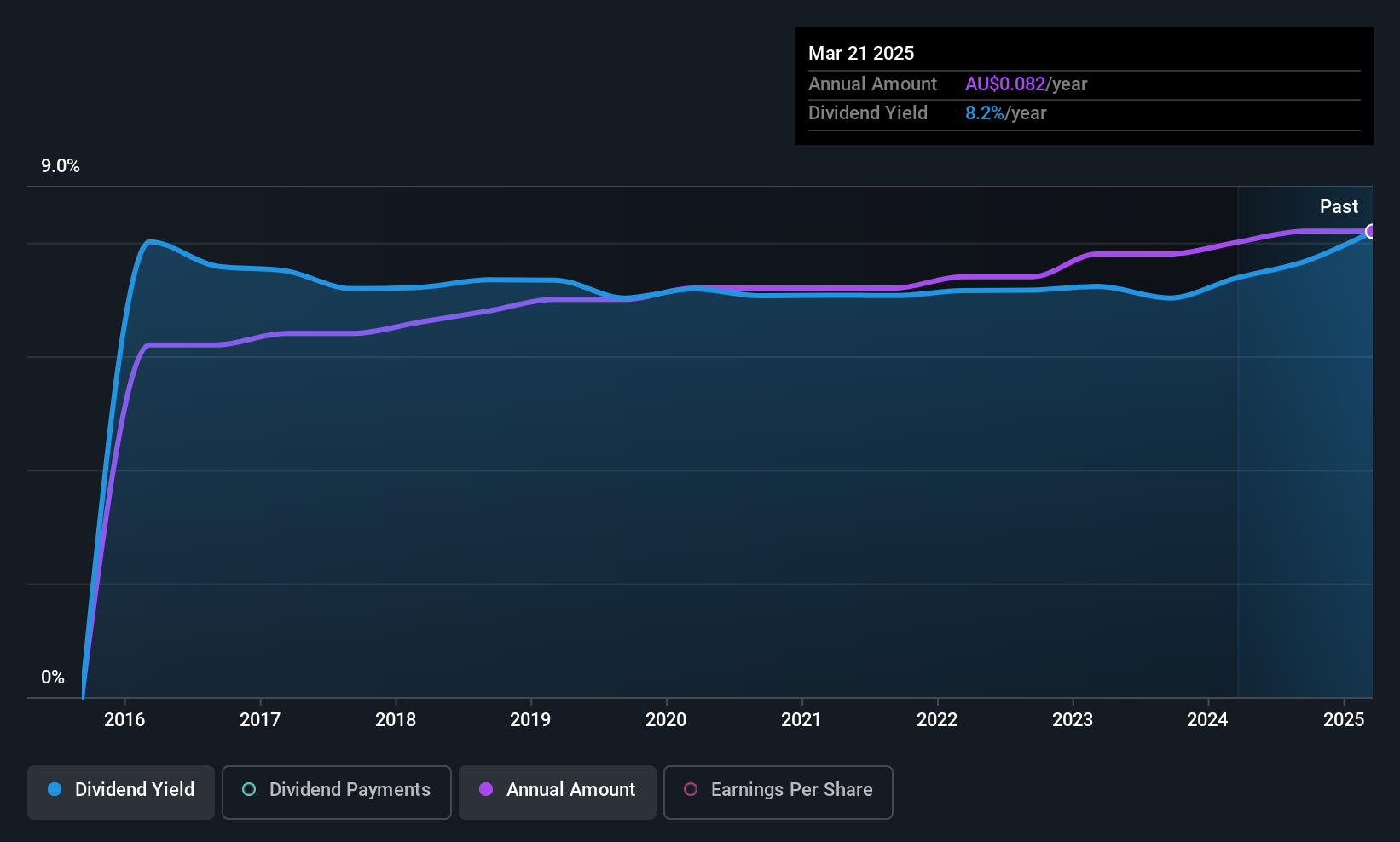

Sugar Terminals (NSX:SUG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sugar Terminals Limited provides storage and handling solutions for bulk sugar and other commodities in Australia, with a market cap of A$342 million.

Operations: Sugar Terminals Limited generates revenue primarily from the sugar industry, amounting to A$118.51 million.

Dividend Yield: 8.1%

Sugar Terminals offers a high dividend yield of 8.11%, placing it in the top 25% of Australian dividend payers. However, its dividends are not well-covered by free cash flows, with a cash payout ratio of 100.5%. Despite this, dividends have been stable and growing over the past decade. The stock trades at a significant discount to its estimated fair value. Recent executive changes may impact future strategic direction and dividend sustainability.

- Delve into the full analysis dividend report here for a deeper understanding of Sugar Terminals.

- Our comprehensive valuation report raises the possibility that Sugar Terminals is priced lower than what may be justified by its financials.

Key Takeaways

- Investigate our full lineup of 31 Top ASX Dividend Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal