Assessing Ivanhoe Mines (TSX:IVN) Valuation After Initial Copper Anode Production At Kamoa Kakula

Ivanhoe Mines (TSX:IVN) has begun producing copper anodes at its Kamoa-Kakula smelter in Africa, an operational shift that turns stockpiled concentrate into 99.7% pure copper and could reshape how investors view the business mix.

See our latest analysis for Ivanhoe Mines.

The copper anode news lands as Ivanhoe Mines’ share price trades at CA$16.67, with recent momentum evident in a 13.25% 1 month share price return. This comes even though the 1 year total shareholder return shows a 4.91% decline, in contrast with a 127.11% gain over five years, suggesting long term holders have still seen strong compounding.

If this type of operational progress has your attention, it could be a good moment to broaden your search and check out fast growing stocks with high insider ownership.

With Ivanhoe Mines now producing copper anodes and the share price sitting at CA$16.67 after a mixed return profile, the key question is simple: is there still value on the table here or is the market already pricing in future growth?

Most Popular Narrative: 7.1% Undervalued

The most followed narrative sees Ivanhoe Mines’ fair value at CA$17.95 versus the CA$16.67 last close, framing the current price as slightly below estimated worth.

New project ramp-ups and expansions are set to drive significant revenue growth and margin improvement through higher production and lower costs.

Diversification, ongoing resource expansion, and strong copper market fundamentals position the company for sustained, long-term organic growth.

Curious what kind of revenue surge and margin reset sits behind that number, and which future earnings multiple ties it all together? The narrative lays out a detailed production build out, ambitious top line expansion and a profitability path that has to line up precisely with that valuation. If you want to see how those assumptions stack up against your own expectations, the full story is worth a closer look.

Result: Fair Value of CA$17.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still need to weigh up real pressure points, such as operational setbacks at Kamoa-Kakula and heavy capex commitments that could strain cash flows.

Find out about the key risks to this Ivanhoe Mines narrative.

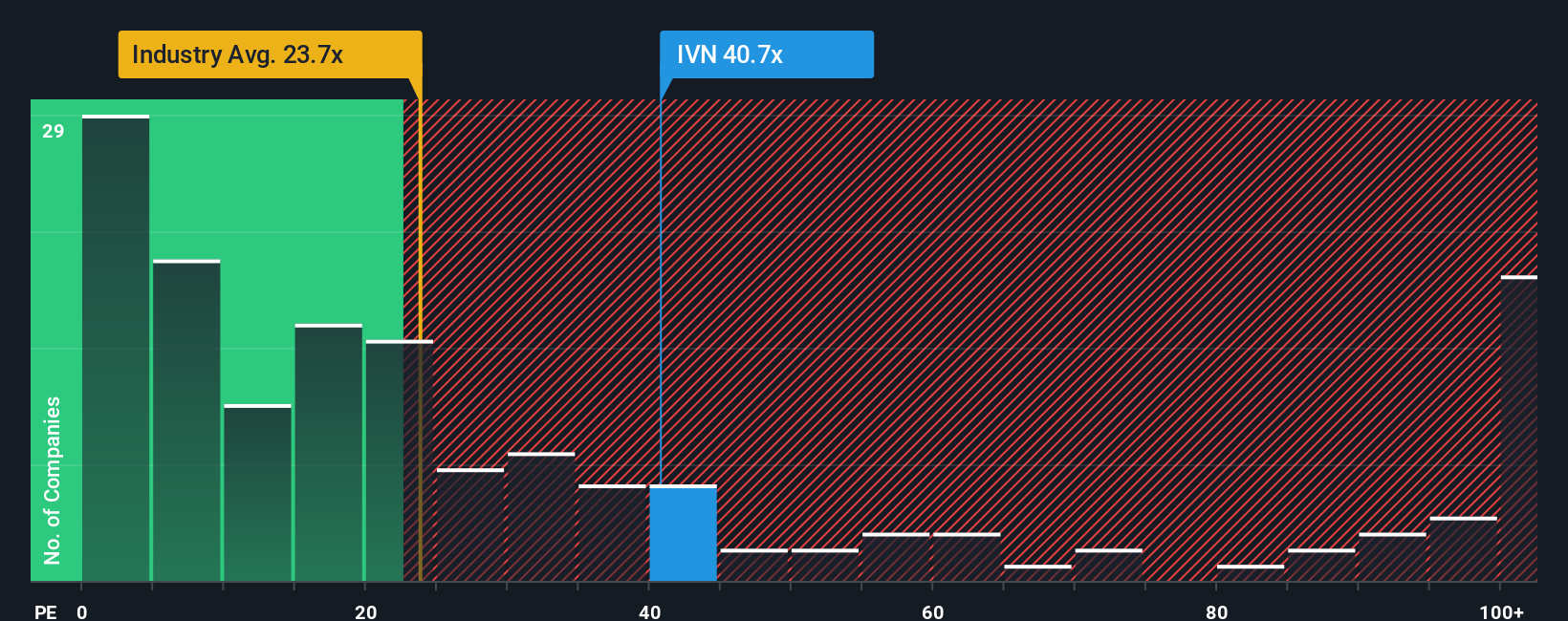

Another View: Earnings Multiple Flags Expensive Pricing

The AI narrative points to a 7.1% discount to fair value at CA$17.95, but the earnings multiple tells a tougher story. Ivanhoe Mines trades on a P/E of 56.1x, compared with 23.3x for the Canadian Metals and Mining industry and an estimated fair ratio of 27.5x.

That is more than double the peer average and well above the fair ratio the market could eventually move toward. This suggests meaningful valuation risk if expectations cool or projects slip. The question for you is whether the growth story is strong enough to justify paying that kind of premium.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ivanhoe Mines Narrative

If you interpret the numbers differently or prefer to test the assumptions yourself, you can build a full Ivanhoe Mines story in minutes with Do it your way.

A great starting point for your Ivanhoe Mines research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Ivanhoe Mines sits on your radar now, it is worth broadening your watchlist with other focused stock ideas that might fit your style and goals.

- Target potential value setups by scanning these 875 undervalued stocks based on cash flows that could align with your own view on pricing and fundamentals.

- Spot income angles by checking out these 11 dividend stocks with yields > 3% that might suit a portfolio built around regular cash flows.

- Position yourself early in structural themes by reviewing these 79 cryptocurrency and blockchain stocks that are tied to digital assets and blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal