A Look At T1 Energy (TE) Valuation After Compliance Moves To Secure Clean Energy Tax Credits

T1 Energy (TE) recently moved to comply with the One Big Beautiful Bill Act by cutting foreign ownership tied to Trina Solar, revising its certificate of incorporation, and preserving access to key clean energy tax credits.

See our latest analysis for T1 Energy.

T1 Energy’s recent compliance moves come after a sharp run, with a 90 day share price return of 161.09% and a 30 day gain of 31.22%, even though the year to date share price return is slightly negative and the 3 year total shareholder return is still below zero. This suggests momentum has picked up recently while longer term holders have not yet recovered earlier losses.

If you are looking beyond T1 Energy, this is a good moment to scan fast growing stocks with high insider ownership and see what else is catching investors’ attention.

With T1 Energy still loss making but trading at $7.65, a value score of 3 and a sizeable intrinsic discount flag, the key question is whether the recent surge leaves a genuine opportunity or if the market is already fully pricing in future growth.

Most Popular Narrative Narrative: 14% Undervalued

With T1 Energy closing at US$7.65 against a widely followed fair value of US$8.90, the narrative frames that gap as grounded in future earnings power and adjusted risk assumptions.

The development of the 5 GW G2_Austin facility and ramp-up at G1_Dallas are creating line-of-sight to significant capacity expansion, allowing T1 to capitalize on the electricity demand supercycle and scale EBITDA meaningfully over the coming years as new production comes online. Growing commercial momentum with large utility customers, a strong offtake funnel, and early mover advantage in compliance with new policy requirements position T1 for enhanced pricing power, higher margin contracted revenues, and improved long-term cash flow generation.

Want to see what is sitting behind that higher fair value? The narrative leans heavily on aggressive revenue expansion, margin repair, and a richer future earnings multiple. Curious how those pieces fit together in the model?

Result: Fair Value of $8.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on continued U.S. policy support and smooth financing for projects like G2_Austin, and setbacks on either front could quickly weaken that upside story.

Find out about the key risks to this T1 Energy narrative.

Another Angle on Valuation

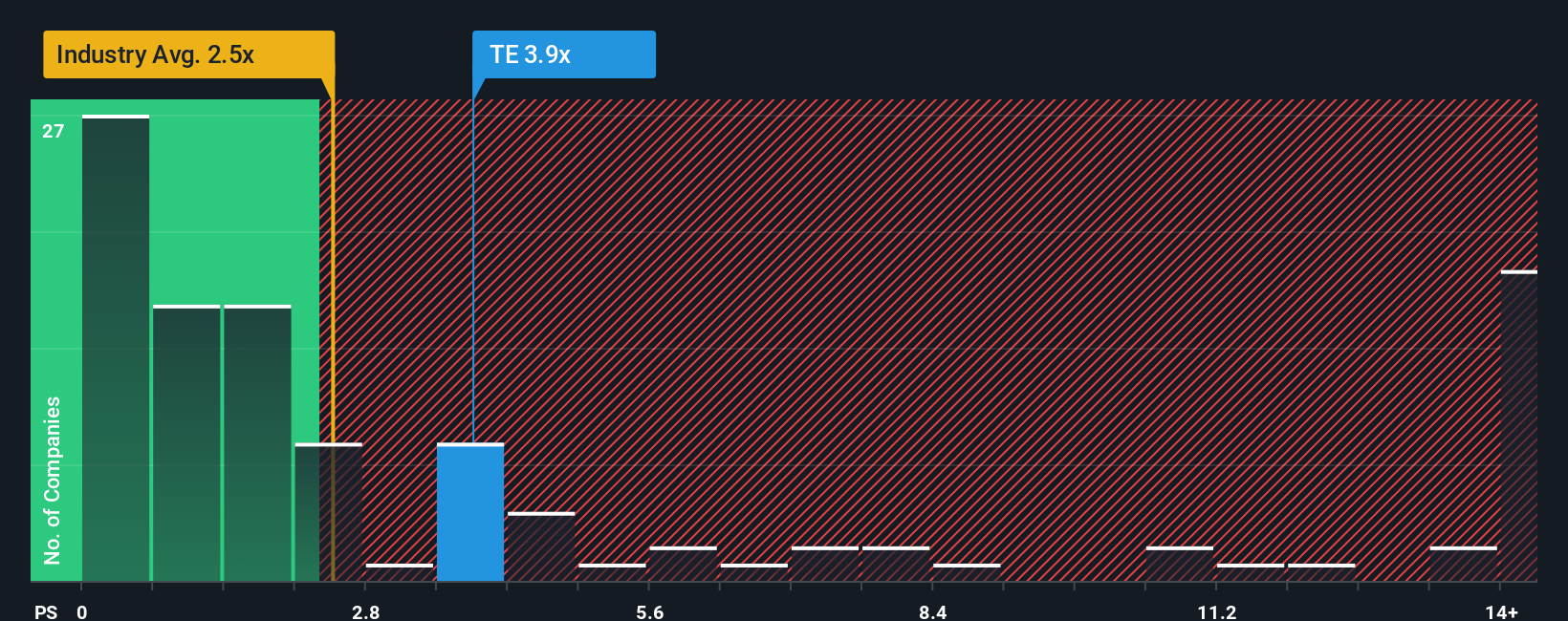

The fair value story here is not entirely one way. On a P/S ratio, T1 Energy trades at about 5x, which screens as expensive against both the US Electrical industry at 2.1x and an estimated fair ratio of 3.8x. That gap points to valuation risk even if the narrative argues for upside. Which signal do you weigh more heavily?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own T1 Energy Narrative

If you look at the numbers and come to a different conclusion, that is fine. You can test your own view in minutes with Do it your way.

A great starting point for your T1 Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If T1 Energy has sharpened your curiosity, do not stop here. Broaden your watchlist with focused stock ideas that match how you like to invest.

- Target potential mispricing by checking out these 875 undervalued stocks based on cash flows that may be trading below what their cash flows suggest.

- Ride the AI wave more deliberately by scanning these 26 AI penny stocks that are already building real products and revenue around artificial intelligence.

- Capture income opportunities by reviewing these 11 dividend stocks with yields > 3% that combine regular payouts with established business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal