A Look At Credo Technology Group Holding (CRDO) Valuation After Analyst Support And Recent Share Price Weakness

Mizuho Securities’ defense of Credo Technology Group Holding (CRDO) after a sharp share-price drop, combined with strong revenue growth figures and upbeat analyst commentary, has put the stock firmly back on many investors’ watchlists.

See our latest analysis for Credo Technology Group Holding.

The recent selloff comes after a strong multi year run, with a very large 3 year total shareholder return and a 76.61% total shareholder return over the last year. At the same time, the 30 day share price return shows a 24.48% decline and shorter term moves have turned negative, suggesting momentum has cooled while investors reassess growth expectations and risk around key customers.

If Credo’s swings have you thinking about where else AI related demand might show up, this could be a useful moment to scan high growth tech and AI stocks for other potential ideas.

So with the share price pulling back, strong revenue and net income growth, and analysts setting higher price targets, is there still a genuine opportunity here, or is the market already pricing in the next leg of AI driven growth?

Most Popular Narrative Narrative: 38% Undervalued

With Credo Technology Group Holding’s last close at US$132.95 and a narrative fair value of about US$214, the gap between price and story is wide enough to matter.

The analysts have a consensus price target of $109.5 for Credo Technology Group Holding based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $140.0, and the most bearish reporting a price target of just $72.0.

Curious what kind of revenue ramp, margin profile, and future earnings multiple are baked into that fair value? The core assumptions are punchy. The earnings bridge to those targets is even more so. If you want to see exactly how growth, profitability, and valuation all fit together in this narrative, you will need the full picture.

Result: Fair Value of $214 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still have to weigh the risk that hyperscaler spending slows or protocol transitions slip. These factors could challenge the high growth and margin assumptions embedded here.Find out about the key risks to this Credo Technology Group Holding narrative.

Another Angle On Valuation

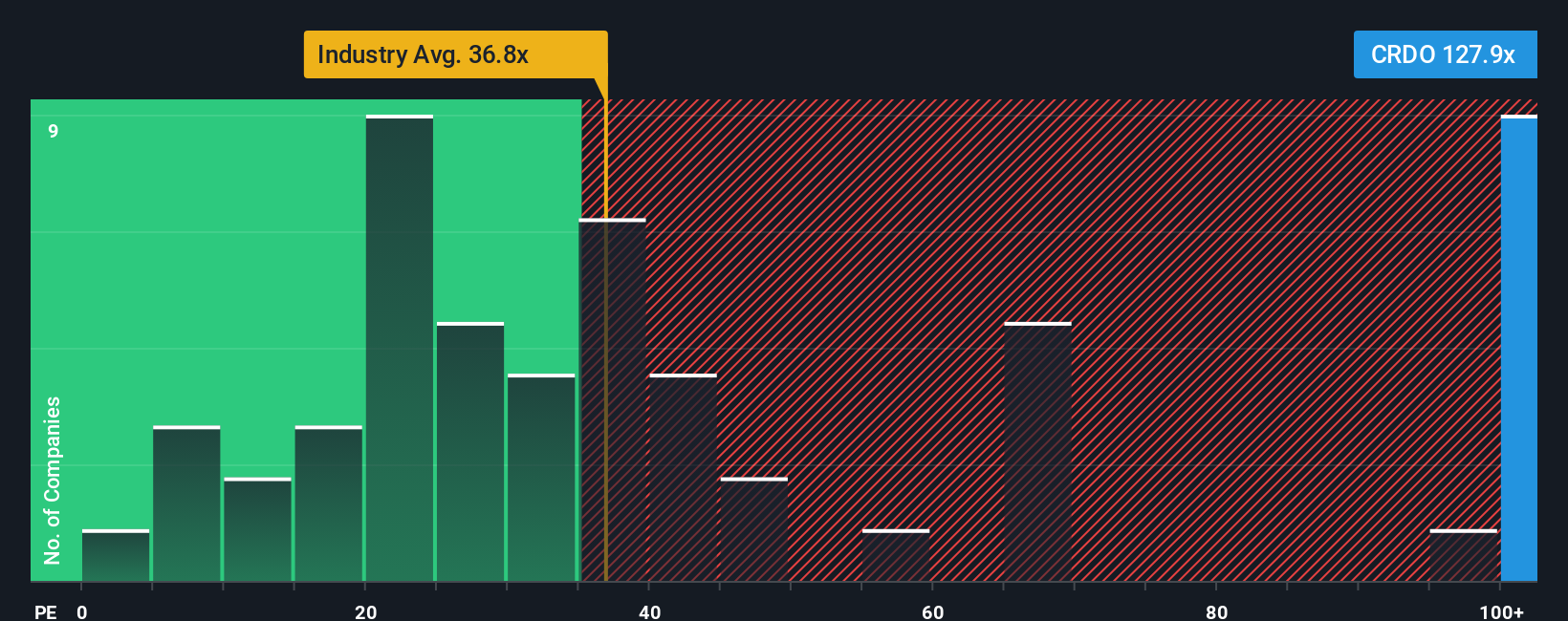

The narrative fair value points to Credo Technology Group Holding looking 38% undervalued, but the current P/E of 113.3x tells a different story. It is far above the US semiconductor industry at 41.2x, peers at 65.2x, and even the fair ratio of 74.2x. This raises the question of how much optimism is already in the price.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Credo Technology Group Holding Narrative

If you look at these numbers and reach a different conclusion, or simply prefer to test your own assumptions, you can build a custom Credo view in just a few minutes, starting with Do it your way.

A great starting point for your Credo Technology Group Holding research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Credo has your attention, do not stop here, the market is full of other stories that could suit your goals just as well or better.

- Target potential bargains with these 878 undervalued stocks based on cash flows that highlight companies where prices sit well below their estimated cash flow value.

- Tap into AI related themes by scanning these 25 AI penny stocks that focus on businesses tied to artificial intelligence growth.

- Zero in on income focused names through these 11 dividend stocks with yields > 3% that feature yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal