Assessing Endeavour Silver (TSX:EDR) Valuation After Production Target Update And Project Progress News

Endeavour Silver (TSX:EDR) drew fresh attention after management reiterated its medium term production targets and reported that a key growth project is progressing on schedule and within budget, despite ongoing concerns around dilution and cost control.

See our latest analysis for Endeavour Silver.

The recent operational update has come alongside a sharp shift in sentiment, with the share price at CA$14.61 and a 30 day share price return of 21.65% contributing to a very large 1 year total shareholder return of 159.50% and 3 year total shareholder return of about 3x. This suggests that momentum has been building as investors reassess both growth potential and project execution risks.

If you are looking beyond precious metals for what is moving, this could be a good moment to widen your search and check out fast growing stocks with high insider ownership.

With the shares at CA$14.61, trading only about 9% below the average analyst price target and with a recent 1 year return of 159.50%, you have to ask: is there still a genuine opportunity here, or is the market already pricing in the company’s future growth?

Most Popular Narrative: 8% Undervalued

Compared to the last close at CA$14.61, the most followed narrative points to a fair value of CA$15.88, suggesting some remaining upside based on its assumptions.

With the Terronera mine nearing commercial production and optimization of recoveries on track, Endeavour is described as being on the verge of a significant step-change increase in production and operating cash flows, which is expected in this narrative to contribute to revenue and margin expansion as the mine moves from commissioning losses to full contribution. Integration and potential expansion of the Kolpa mine to 2,500 tpd are also cited as possible factors that could increase production capacity in 2026, raise the company's operating leverage to higher silver prices, and support future revenue and earnings growth within this storyline.

Curious how that projected production shift translates into earnings and valuation? The narrative focuses on rapid top line growth, improving margins, and a richer future earnings multiple to reach that CA$15.88 figure.

Result: Fair Value of $15.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upbeat story could unravel if Terronera faces a tougher ramp up than expected, or if Kolpa's integration and cost profile do not line up with current assumptions.

Find out about the key risks to this Endeavour Silver narrative.

Another View: What The Ratios Are Saying

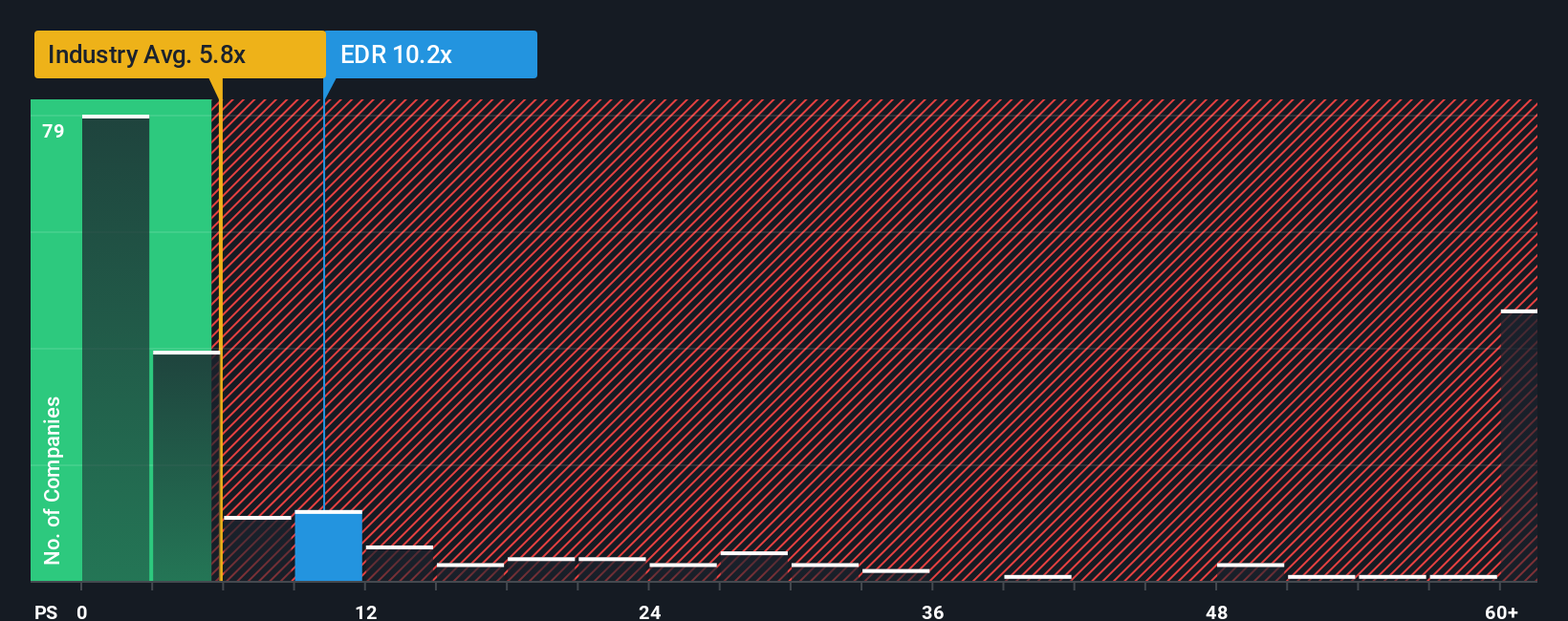

That CA$15.88 fair value comes from a narrative built around future earnings and margins. However, the current P/S of 9.2x tells a different story when you compare it with the Canadian Metals and Mining industry at 7.4x and a fair ratio of 3.9x.

In plain terms, the shares are priced much higher than both the industry average and where our fair ratio suggests the multiple could drift over time. This raises the risk that even small disappointments on growth or execution might hit the valuation harder than expected. Are you comfortable paying that kind of premium for this growth story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Endeavour Silver Narrative

If you see the numbers differently or prefer to test your own assumptions directly, you can build a bespoke view in just a few minutes by starting with Do it your way.

A great starting point for your Endeavour Silver research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about finding your next opportunity, do not stop at one silver producer when a whole menu of focused stock ideas is right in front of you.

- Spot potential value candidates early by checking out these 878 undervalued stocks based on cash flows that might line up better with your return expectations and risk comfort.

- Ride powerful tech trends by scanning these 25 AI penny stocks that are tied to artificial intelligence themes shaping many parts of the market.

- Target higher income potential by focusing on these 11 dividend stocks with yields > 3% that could help support a more income oriented portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal