Reassessing Molina Healthcare (MOH) Valuation After Recent Share Price Momentum

What recent performance tells you about Molina Healthcare

Molina Healthcare (MOH) has quietly shifted in recent weeks, with the stock showing a 1 day return of 1.06% and an 8.24% move over the past week, drawing fresh attention from investors.

Over the past month, the share price return of 21.64% contrasts with an 8.96% decline over the past 3 months. This pattern can prompt investors to reassess both recent momentum and longer term positioning.

See our latest analysis for Molina Healthcare.

At a share price of US$184.73, Molina Healthcare’s recent 1 month share price return of 21.64% sits against a year to date share price return of 3.51%, while the 1 year total shareholder return of 37.69% and 5 year total shareholder return of 22.35% point to a weaker longer run experience for holders. That kind of short term momentum often reflects shifting views on growth prospects or risk in managed care, even when longer term total shareholder returns have been under pressure.

If Molina’s move has you rethinking the sector, this can be a useful moment to scan a broader set of healthcare stocks that might fit your risk and return preferences.

With Molina Healthcare trading at US$184.73, sitting close to analyst price targets but carrying an implied 71.54% intrinsic discount estimate, you have to ask: is there real value left here, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 8.7% Overvalued

With Molina Healthcare closing at US$184.73 against a narrative fair value of US$170, the story hinges on how future earnings and margins play out.

The analysts have a consensus price target of $196.714 for Molina Healthcare based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $330.0, and the most bearish reporting a price target of just $153.0.

Want to see what is baked into those earnings expectations? Revenue growth, margin compression, and a lower future P/E are all doing heavy lifting in this narrative.

Result: Fair Value of $170 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, several things could flip this story, including tighter Medicaid funding or higher than expected medical costs that keep earnings and margins under the kind of pressure analysts already flag.

Find out about the key risks to this Molina Healthcare narrative.

Another View: What Earnings Ratios Are Signalling

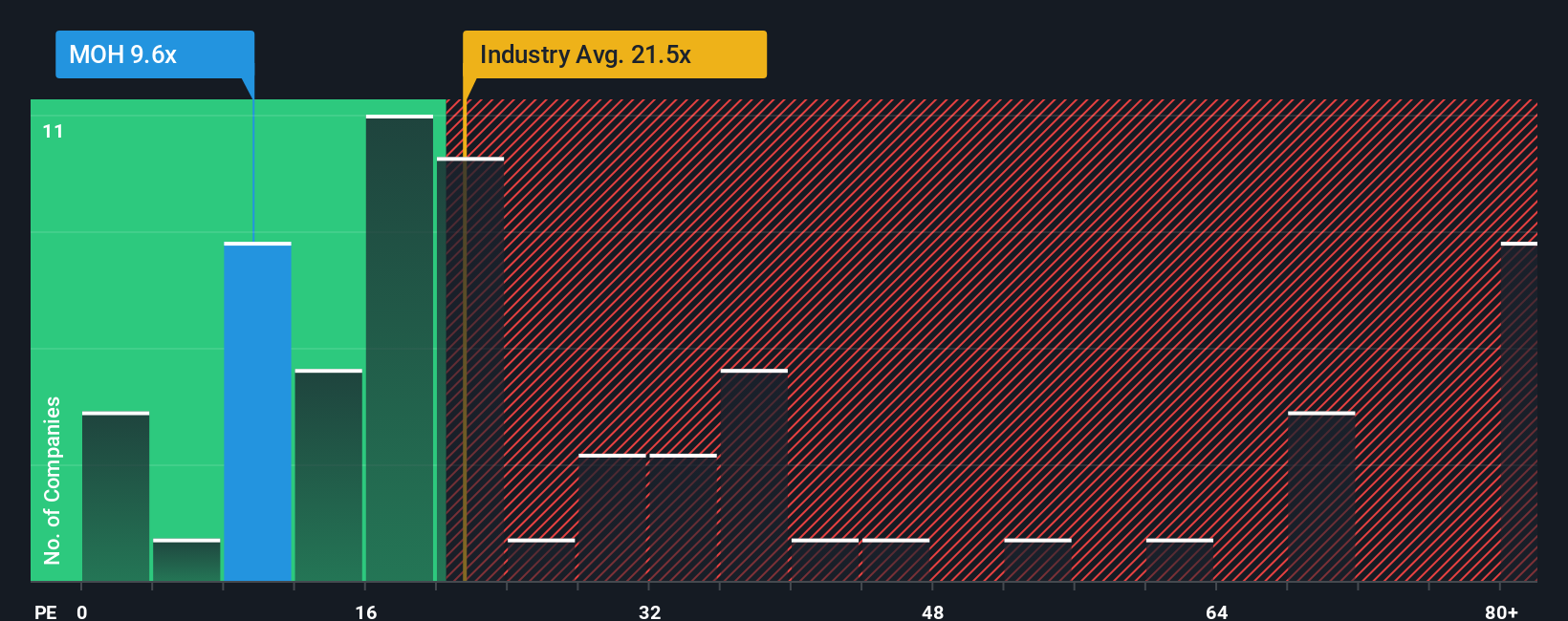

The narrative model flags Molina Healthcare as 8.7% overvalued at US$184.73 versus a fair value of US$170. Yet on simple earnings ratios, the picture looks very different. MOH trades on a P/E of 10.8x, compared with 23x for the US Healthcare industry and 31x for peers. Our fair ratio comes out at 22.1x.

That gap suggests the market is pricing in more risk, or less growth, than both the peer group and the fair ratio imply, even as the narrative still leans toward overvaluation. The question for you is whether current concerns about Medicaid and margins fully justify that discount, or if sentiment has swung too far.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Molina Healthcare Narrative

If you see the numbers differently or prefer to work from your own assumptions, you can build and adjust a Molina view yourself in minutes: Do it your way.

A great starting point for your Molina Healthcare research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Molina has sharpened your focus, do not stop here. Use this momentum to line up a few more watchlist candidates that genuinely fit your style.

- Spot potential value setups by checking out these 877 undervalued stocks based on cash flows that match your return goals and risk comfort.

- Target income focused opportunities by scanning these 11 dividend stocks with yields > 3% with the kind of yields that can matter in a long term portfolio.

- Position yourself early in emerging themes by reviewing these 79 cryptocurrency and blockchain stocks tied to digital assets and blockchain trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal