A Look At BXP (BXP) Valuation After Recent Share Price Move And Perceived Discount To Fair Value

Event context and why BXP is on investors’ radar

BXP (BXP) is back in focus after its recent share move, with the stock last closing at $68.10, which is putting fresh attention on how its returns and fundamentals stack up today.

See our latest analysis for BXP.

BXP’s recent 1 day share price return of 1.51% comes after a softer patch, with the 90 day share price return of 6.75% decline contrasting with a 3 year total shareholder return of 20.12%. This suggests that longer term holders have seen steadier progress even as near term momentum has cooled.

If BXP’s recent move has you reassessing opportunities in real estate and beyond, this can be a good moment to broaden your watchlist with fast growing stocks with high insider ownership.

With BXP trading at $68.10, alongside an intrinsic value estimate that suggests a 29.4% discount and a value score of 4 out of 10, you have to ask: is this a genuine opportunity or is future growth already priced in?

Most Popular Narrative: 14.3% Undervalued

With BXP last closing at $68.10 against a most-followed fair value estimate of about $79.43, the narrative frames the shares as trading at a meaningful discount while relying on specific growth and profitability assumptions to get there.

BXP's aggressive capital recycling and asset sales strategy (targeting $600 million in non-core dispositions), along with redevelopment and adaptive reuse of assets for mixed-use and multifamily, is expected to unlock higher-yielding income streams, fortify net margins, and provide non-dilutive funding for growth, supporting future FFO and earnings resilience.

Curious how modest top line growth, a sharp margin shift, and a higher future earnings multiple come together to justify that gap? The full narrative unpacks the earnings bridge, the valuation math and the assumptions that need to hold for this fair value to make sense.

Result: Fair Value of $79.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still clear pressure points, including softer leasing in some markets and capital intensity at projects like 343 Madison, that could challenge this upbeat scenario.

Find out about the key risks to this BXP narrative.

Another view on BXP’s valuation

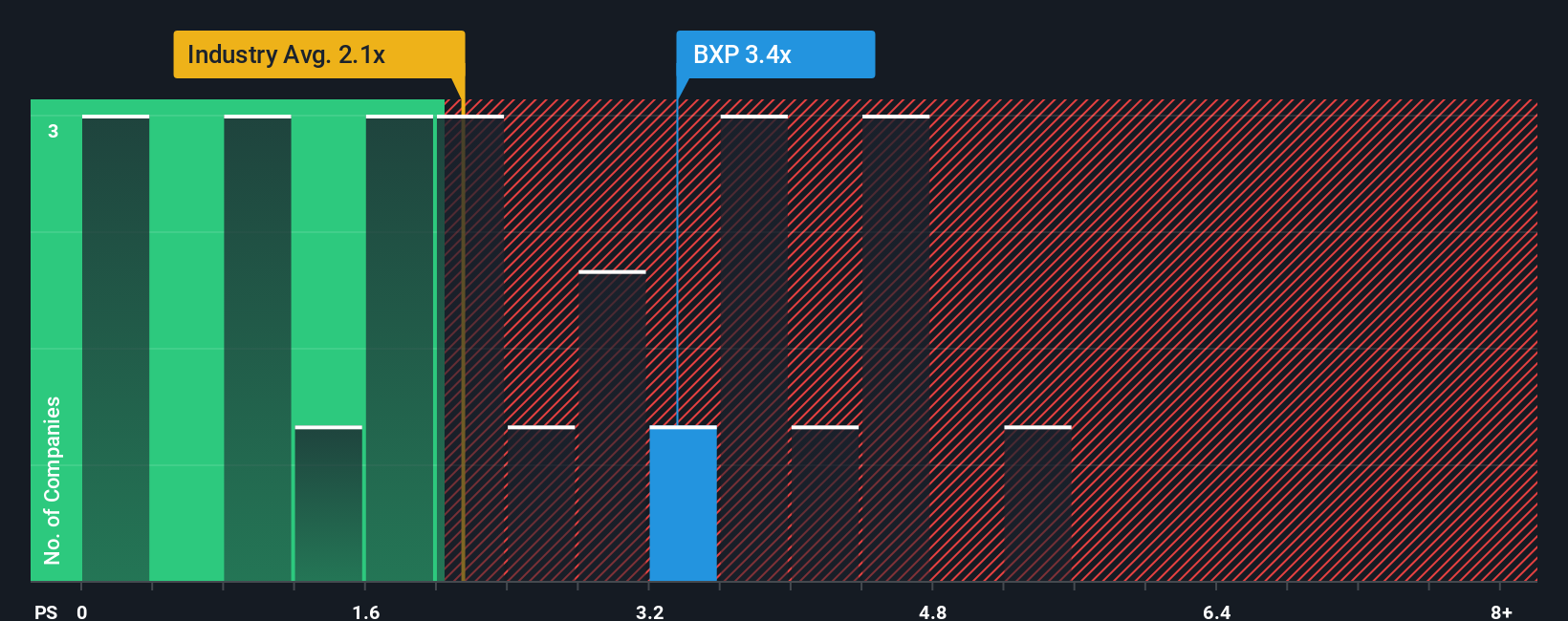

The narrative and analyst targets frame BXP as undervalued, but its P/S of 3.2x is higher than the US Office REITs average of 2.0x and below the peer average of 4.1x, while our fair ratio sits at 4.6x. Is the current discount compensation for risk, or is it a sign the market is still cautious?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BXP Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalized BXP story in just a few minutes, starting with Do it your way.

A great starting point for your BXP research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If BXP has sharpened your focus, do not stop there. Broaden your research now or you risk missing out on other compelling setups across sectors.

- Spot potential bargains backed by cash flow strength by scanning these 877 undervalued stocks based on cash flows that already meet strict valuation filters.

- Ride the momentum behind machine learning and automation by checking out these 25 AI penny stocks positioned at the heart of this technology shift.

- Position yourself early in the next wave of decentralised finance by reviewing these 79 cryptocurrency and blockchain stocks tied to blockchain and digital asset themes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal