A Look At Occidental Petroleum (OXY) Valuation After Mixed Recent Shareholder Returns

Intro

Occidental Petroleum (OXY) has drawn fresh attention after recent trading left the share price at $41.74, prompting investors to reassess how its current valuation lines up with recent returns and fundamentals.

See our latest analysis for Occidental Petroleum.

Occidental Petroleum's recent 1 day share price return of 1.24% and 7 day share price return of 0.68% come after a 1 year total shareholder return decline of 17.25%. The 5 year total shareholder return of 95.82% points to a much stronger longer term story, suggesting recent momentum has faded compared with the past.

If this kind of mixed performance has you looking around the energy patch, it could be a useful moment to compare Occidental with other aerospace and defense stocks that may be reacting differently to market conditions.

With Occidental trading at $41.74, a value score of 2, an implied 18.89% gap to analyst targets and an estimated intrinsic discount of 62.25%, you have to ask: is this a mispriced energy name, or is the market already baking in future growth?

Most Popular Narrative Narrative: 16.4% Undervalued

With Occidental Petroleum last closing at $41.74 against a narrative fair value of $49.92, the gap centers on future earnings power and profitability.

The company's accelerated expansion and commercialization of carbon capture, including imminent operational start of the STRATOS Direct Air Capture facility and newly contracted CDR volumes through 2030, positions Occidental to monetize carbon management via government incentives (e.g., 45Q credits) and growing CDR demand, supporting incremental, high-margin revenue and improved net margins.

Curious what kind of revenue mix and margin profile could justify that uplift from today’s price, even as growth assumptions ease off recent highs? The narrative leans on detailed projections for earnings, profitability, and the valuation multiple investors might accept a few years from now. The numbers behind that view are anything but simple.

Result: Fair Value of $49.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside view depends on oil markets cooperating and on OxyChem divestiture proceeds meaningfully strengthening the balance sheet, both of which could easily disappoint.

Find out about the key risks to this Occidental Petroleum narrative.

Another View: Market Ratios Paint a Very Different Picture

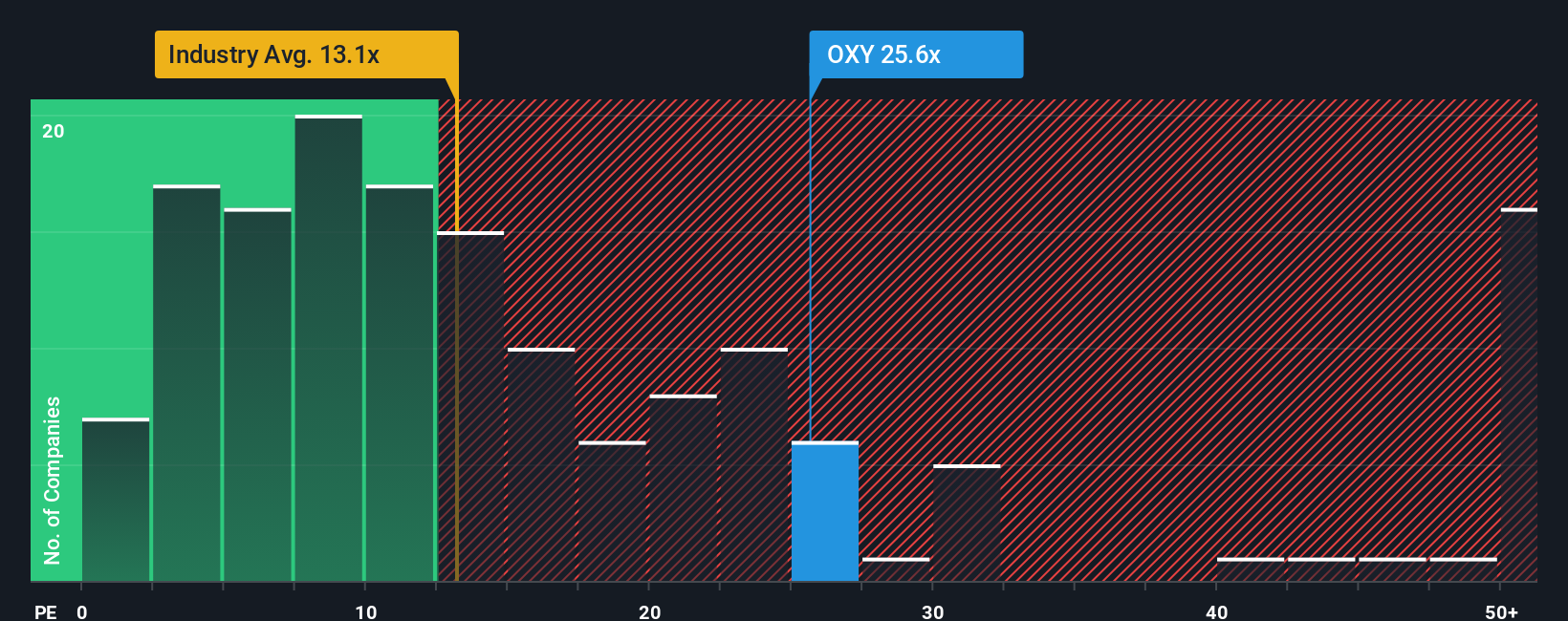

While the narrative fair value of $49.92 suggests Occidental Petroleum is 16.4% undervalued, the current P/E of 28.2x tells a tougher story. It sits well above the fair ratio of 16.6x, the peer average of 20.8x, and the US Oil and Gas industry at 13.1x, which points to meaningful valuation risk if sentiment cools.

Put simply, one framework flags underpricing, while another flags a rich P/E that the market could move closer to that 16.6x fair ratio or even nearer to peers and the wider industry. Which set of expectations do you think is more realistic for OXY over the next few years?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Occidental Petroleum Narrative

If you look at the numbers and come to a different conclusion, or just prefer your own process, you can build a custom view in minutes: Do it your way.

A great starting point for your Occidental Petroleum research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop at Occidental, you could miss other opportunities that fit your style. Use the screeners below to keep your watchlist working harder.

- Spot potential bargains early by checking out these 877 undervalued stocks based on cash flows, which financial metrics suggest may be trading below their underlying business strength.

- Target income-focused opportunities with these 11 dividend stocks with yields > 3% that could add more consistent cash flow to your portfolio.

- Ride emerging themes by scanning these 79 cryptocurrency and blockchain stocks that tie traditional equities to the growth of digital assets and blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal