Assessing Teijin (TSE:3401) Valuation As Shares Show Recent Momentum Without A Clear Catalyst

With no single headline event driving Teijin (TSE:3401) today, recent share performance and fundamentals are drawing attention as investors weigh modest one-month and three-month returns against weak revenue and net income figures.

See our latest analysis for Teijin.

That recent 5.21% 1 month share price return comes on top of a more muted 2.27% year to date share price return, while the 1 year total shareholder return of 9.11% contrasts with a 5 year total shareholder return of 19.77% decline, hinting that momentum has picked up only recently as investors reassess Teijin’s risk and earnings outlook.

If Teijin has caught your eye, it can help to see what else is moving, so take a look at fast growing stocks with high insider ownership for more potential ideas.

With Teijin trading at ¥1,372 against an analyst price target of ¥1,246 and an estimated intrinsic discount of about 8%, the real question is whether today’s valuation hides an opportunity or already reflects any future recovery.

Most Popular Narrative: 10% Overvalued

Teijin closed at ¥1,372 against a widely followed fair value anchor of ¥1,246, so the current price sits ahead of that narrative benchmark.

Analysts are assuming Teijin's revenue will decrease by 3.4% annually over the next 3 years.

Analysts assume that profit margins will increase from 8.3% loss today to 2.5% profit in 3 years time.

Curious how weaker sales and higher margins can still support a higher valuation anchor? The narrative leans on a sharp earnings swing and a richer future earnings multiple. Want to see the exact path from today’s loss to that profit target, and how it feeds into the ¥1,246 figure using an 8.16% discount rate? The full narrative lays out every step.

Result: Fair Value of ¥1,246 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still clear risks here, including pressure on aramid and carbon fiber pricing and the potential for further restructuring costs if reforms disappoint.

Find out about the key risks to this Teijin narrative.

Another View: Market Ratios Tell a Different Story

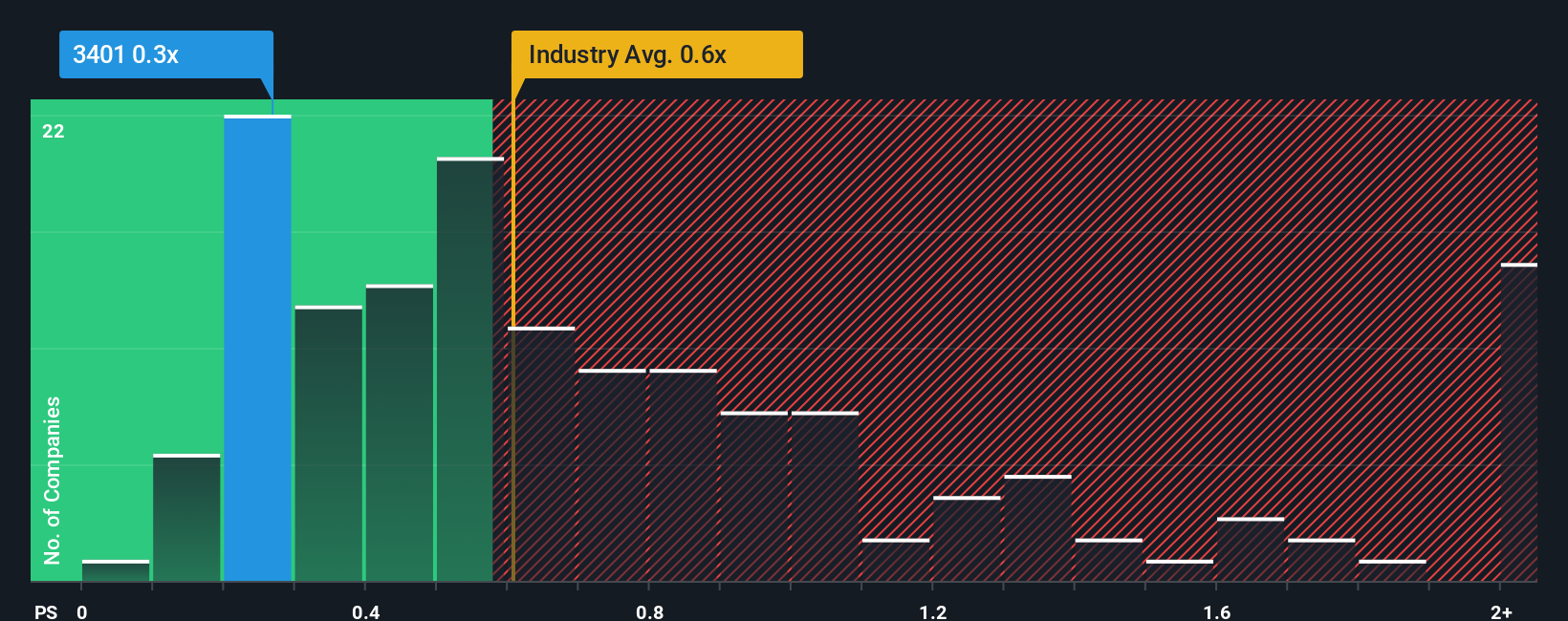

While the fair value narrative pegs Teijin at ¥1,246, our SWS fair ratio points in another direction. On P/S, Teijin trades around 0.3x, compared with a fair ratio of 0.6x and a peer and industry average of 0.6x, which suggests the market could move closer to that higher multiple over time.

That gap means the current price is implying a lot of caution on future sales, even though earnings are forecast to recover. The question is whether you see that discount as justified caution or a possible mispricing that could narrow if sentiment improves.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Teijin Narrative

If you read this and think the assumptions do not quite fit your view, or simply prefer to work from the raw numbers yourself, you can build a custom Teijin story in just a few minutes using Do it your way.

A great starting point for your Teijin research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Do not stop your research with a single company. Broaden your watchlist with focused sets of ideas that match how you like to invest.

- Target potential value opportunities by checking these 877 undervalued stocks based on cash flows, which flags companies where prices sit well below estimated cash flow based worth.

- Spot growth potential in cutting edge automation and machine learning by reviewing these 25 AI penny stocks, which groups businesses tied to artificial intelligence themes.

- Strengthen your income focus by scanning these 11 dividend stocks with yields > 3%, which highlights companies offering dividend yields above 3% based on recent data.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal