Assessing SES AI (SES) Valuation As CES And Research Conference Appearances Draw New Attention

SES AI (SES) has moved into focus after confirming a packed January schedule, including CES 2026, the Gordon Research Conference on Electrochemistry, and other technical and investor events showcasing its AI driven lithium battery work.

See our latest analysis for SES AI.

The CES and conference circuit comes as SES AI trades at US$2.09, with a 7-day share price return of 16.76% and a 90-day share price return of 24.28%. The 1-year total shareholder return of 19.43% contrasts with a 3-year total shareholder return of 39.94%, suggesting recent momentum has picked up after a tougher multi-year stretch and that investors are reassessing both growth potential and risks around its AI driven battery ambitions.

If SES AI’s recent attention has you looking beyond a single name, it could be a good time to scan high growth tech and AI stocks that are drawing interest across the market.

So with SES AI still loss making, trading at US$2.09 and sitting below the average analyst price target, is the recent rally an early entry point, or are markets already pricing in the next leg of growth?

Most Popular Narrative: 30.3% Undervalued

With SES AI last closing at US$2.09 versus a narrative fair value of US$3.00, the current price sits well below that reference point.

Integration of the Molecular Universe AI platform into both energy storage and EV applications gives SES AI a unique edge as AI-driven materials discovery accelerates innovation cycles, improves battery safety, and enables differentiation in high-value markets, which supports future margin expansion and earnings growth.

Curious what kind of revenue surge and margin shift would justify that higher value? The narrative leans heavily on rapid scaling, richer software income and a premium future earnings multiple. Want to see exactly how those assumptions stack up over the next few years?

Result: Fair Value of $3.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat story can be shaken if key auto customers pull back or if Molecular Universe subscriptions fail to convert early trials into firm, recurring contracts.

Find out about the key risks to this SES AI narrative.

Another View: Price Versus Sales Sends A Different Signal

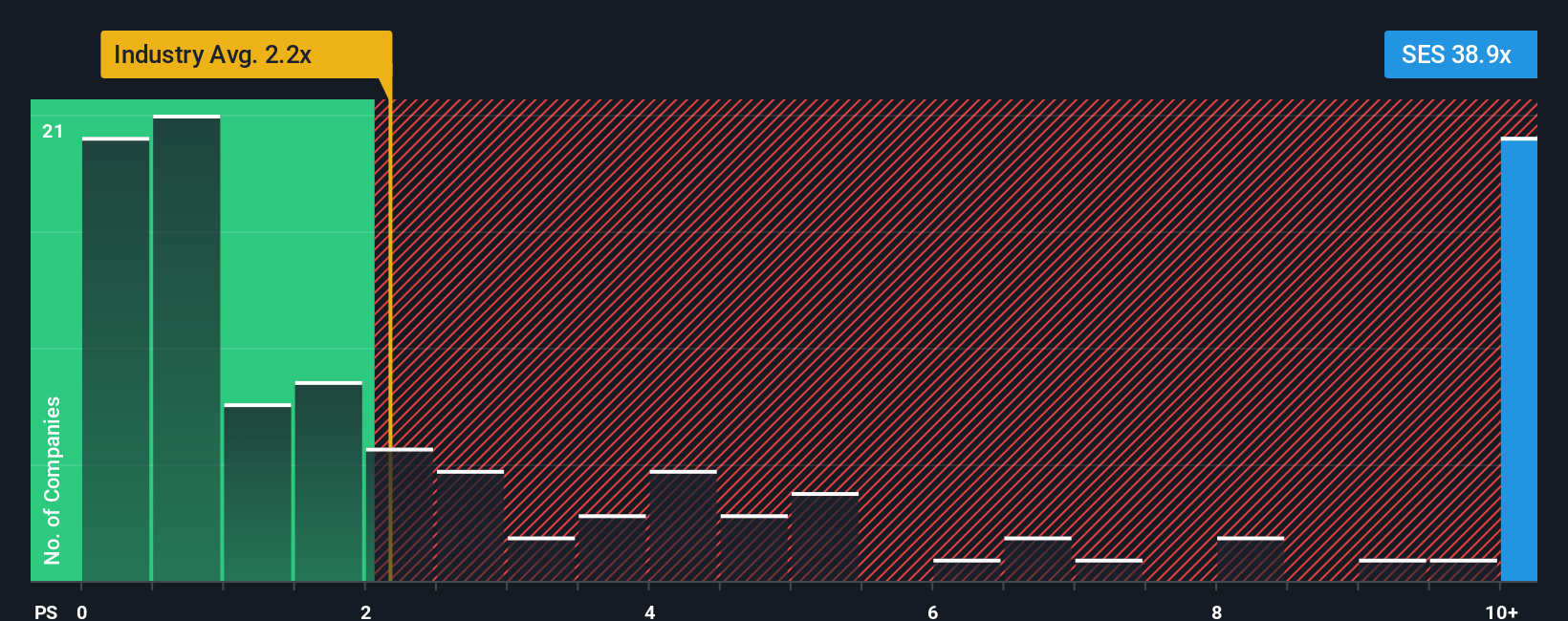

The narrative fair value suggests SES AI is undervalued, yet the current P/S ratio of 41.3x stands far above both the US Electrical industry at 2.1x and peers at 24.8x. Even the fair ratio of 56.4x implies the market is already baking in a lot of success. Is this a margin of safety or a tightrope?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SES AI Narrative

If parts of this story do not quite match your view, or you would rather test the numbers yourself, you can build a custom SES AI narrative in just a few minutes, starting with Do it your way.

A great starting point for your SES AI research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If SES AI has sparked your interest, do not stop here. Broaden your watchlist and give yourself more ways to pressure test your next move.

- Spot potential early movers by scanning these 3556 penny stocks with strong financials that pair smaller market caps with financial strength.

- Zero in on the future of automation and data by reviewing these 25 AI penny stocks that are tied directly to AI growth themes.

- Hunt for prices that may not fully reflect underlying cash flows by checking these 877 undervalued stocks based on cash flows ready for deeper research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal