Assessing Merck (MRK) Valuation After Recent Share Price Momentum And Modest Overvaluation Signal

Merck (MRK) is back in focus after recent trading, with the stock closing at $108.87 and short term returns showing movements over the past week, month, and past three months.

See our latest analysis for Merck.

That 1-day share price return of 1.33% and 30-day share price return of 9.18% sit alongside a 90-day share price return of 26.01% and a 1-year total shareholder return of 11.82%. Together these figures indicate momentum that has recently picked up after a more measured year to date.

If Merck has caught your attention, this could be a good moment to widen your research and look at other pharma stocks with solid dividends that might fit a similar income and healthcare theme.

With Merck trading near its recent price target and an indicated intrinsic discount of about 46%, the key question now is simple: are investors looking at an undervalued healthcare heavyweight, or is the market already pricing in future growth?

Most Popular Narrative: 2% Overvalued

With Merck closing at $108.87 against a narrative fair value of about $106.62, the current price sits slightly above that long term anchor.

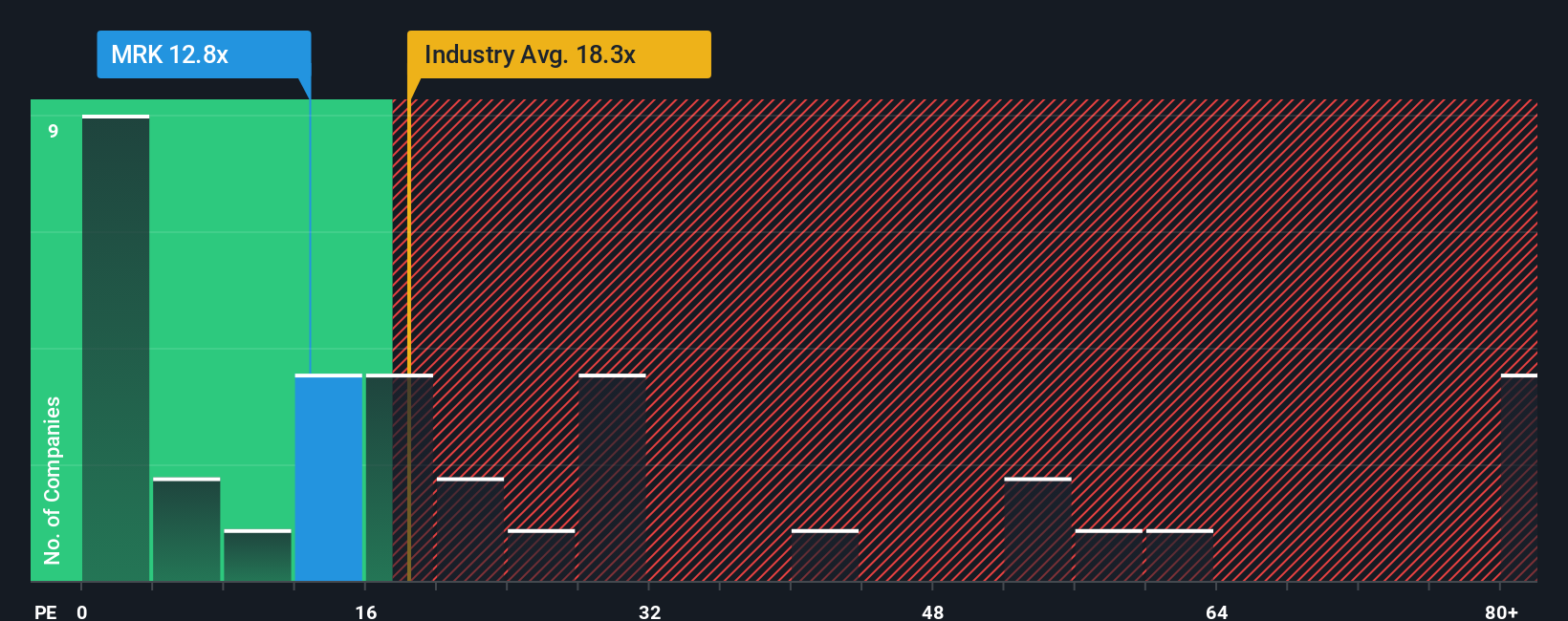

• In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.3x on those 2028 earnings, down from 12.9x today. This future PE is lower than the current PE for the GB Pharmaceuticals industry at 19.0x.

Curious what earnings path and margin profile sit behind that modest premium, and why the assumed future P/E steps down from today? The full narrative lays out those moving parts.

Result: Fair Value of $106.62 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that story can change quickly if Keytruda’s patent expiry hits harder than expected or if GARDASIL demand in China softens further and weighs on Merck’s global sales mix.

Find out about the key risks to this Merck narrative.

Another View: What The Market Multiple Is Saying

So while the popular narrative pins Merck at about 2% overvalued versus a fair value of US$106.62, the market is telling a different story through its P/E. At roughly 14.2x earnings, Merck trades well below both the US pharmaceuticals industry at 19.6x and its peer average of 18.6x, and also below our fair ratio of 29x.

That gap suggests the market is either being cautious about Merck's future earnings power or leaving room that some investors might see as opportunity, especially given the current discount to the estimated fair ratio. Which side of that trade do you feel more comfortable backing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Merck Narrative

If this narrative does not quite match your view and you would rather work directly with the numbers yourself, you can build a custom thesis in just a few minutes by starting with Do it your way.

A great starting point for your Merck research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Ready For More Investment Ideas?

If you stop with Merck, you might miss other angles entirely. Use the Simply Wall St screener to spot ideas that fit what you care about most.

- Target consistent income by reviewing these 11 dividend stocks with yields > 3% that could complement a healthcare name like Merck in a diversified portfolio.

- Tap into sector shifts by scanning these 79 cryptocurrency and blockchain stocks that are building businesses around blockchain and digital assets.

- Hunt for potential value opportunities through these 877 undervalued stocks based on cash flows that currently trade below estimates based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal