Assessing Regions Financial (RF) Valuation As Stability Returns After Regional Bank Volatility

Recent commentary around Regions Financial (RF) has centered on the stock stabilizing after a volatile stretch for regional banks, with investors focusing on its risk management, cost discipline, and ongoing digital transformation efforts.

See our latest analysis for Regions Financial.

The recent focus on credit quality, cost control, and technology coincides with firmer momentum, with a 30-day share price return of 9.25% and a 1-year total shareholder return of 25.61%. This points to improving sentiment after last year’s volatility.

If this kind of steady banking story interests you, it could be a good moment to see how other U.S. lenders compare using solid balance sheet and fundamentals stocks screener (None results).

With a recent 1 year total return of 25.61% and an estimated intrinsic discount of 48.36%, the question now is simple: is Regions still quietly undervalued, or has the market already priced in the next leg of growth?

Most Popular Narrative: 1.4% Undervalued

With Regions Financial closing at US$28.71 against a narrative fair value of about US$29.12, the valuation gap is small but still in focus for followers of the story.

Analysts have modestly reduced their price target for Regions Financial to $27 from $30, citing a narrower upside profile amid elevated M&A expectations for likely bank acquirers and rising competitive pressures on the company’s low cost Southeast deposit base.

Want the full picture behind that small discount? The narrative leans on measured revenue growth, steady margins, and a forward P/E that edges above the broader bank group. Curious which assumptions really carry the weight in that fair value math? The details might change how you see this Sun Belt lender.

Result: Fair Value of $29.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this story can change quickly if Southeast deposit competition bites harder than expected, or if any acquisition misstep brings earnings dilution and integration hiccups into focus.

Find out about the key risks to this Regions Financial narrative.

Another View: P/E Paints a Richer Picture

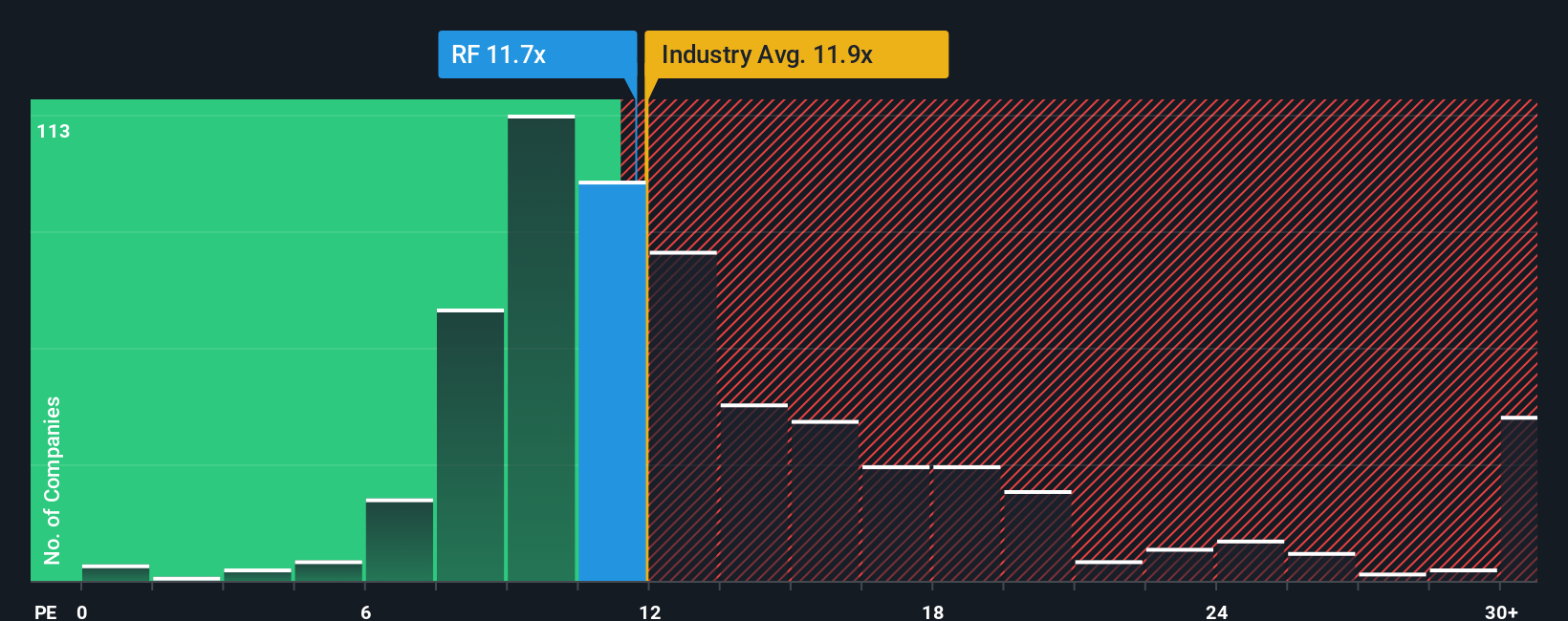

The story looks different when you switch from fair value models to the simple P/E ratio. Regions trades on 12.3x earnings, which is higher than the US Banks industry at 11.8x, yet below peers at 14x and under a fair ratio of 13.5x. That mix hints at both some optimism already in the price and potential room for re rating. Which side of that tradeoff do you think matters more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Regions Financial Narrative

If you see the numbers differently or simply prefer to test your own assumptions, you can create a custom Regions story in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Regions Financial.

Ready For Your Next Investing Idea?

If Regions has sharpened your thinking, do not stop here. Put that momentum to work by scanning for other ideas that line up with your goals.

- Target potential mispricings by running your filters across these 877 undervalued stocks based on cash flows, so you are not relying on headline stories alone.

- Hunt for growth themes by checking out these 25 AI penny stocks, where you can focus on companies tied to real business adoption of artificial intelligence.

- Lock in income ideas by reviewing these 11 dividend stocks with yields > 3%, especially if you want yields above 3% to play a bigger role in your returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal