Does UBS’s Margin Concerns on Eaton’s AI Expansion Change The Bull Case For ETN?

- Eaton was recently downgraded by UBS from Buy to Neutral, with the bank citing limited room for earnings upgrades and pressure on future operating margins as the company continues capacity expansions tied to AI and data center demand.

- While analysts broadly still rate Eaton as Outperform and point to strong revenue growth and profitability, the UBS downgrade has sharpened focus on how ongoing investment and expansion could influence the balance between growth and margins over the next few years.

- We’ll now examine how UBS’s more cautious margin outlook, amid Eaton’s aggressive data center expansion, may reshape the company’s investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Eaton Investment Narrative Recap

To own Eaton, you need to believe in a long-term buildout of electrification and AI-driven data center infrastructure, supported by solid profitability and cash generation. The key near term catalyst remains upcoming earnings and guidance around data center demand and margins. The biggest risk is that heavy spending on capacity and acquisitions weighs on operating margins longer than expected. The UBS downgrade highlights this risk but does not fundamentally change the core long-term electrification and data center thesis.

In that context, Eaton’s agreement to acquire Boyd Corp’s thermal management business for US$9.5 billion is especially relevant. It deepens Eaton’s exposure to data centers by adding liquid cooling technology, directly tying into the same capacity and margin questions UBS raised. How efficiently Eaton integrates Boyd and scales new capacity could influence whether data center growth translates into healthy incremental returns.

However, investors should also be aware that if Eaton’s heavy investment and expansion spending keeps margins under pressure for longer than expected, then...

Read the full narrative on Eaton (it's free!)

Eaton's narrative projects $33.7 billion revenue and $5.8 billion earnings by 2028. This requires 9.0% yearly revenue growth and about a $1.9 billion earnings increase from $3.9 billion today.

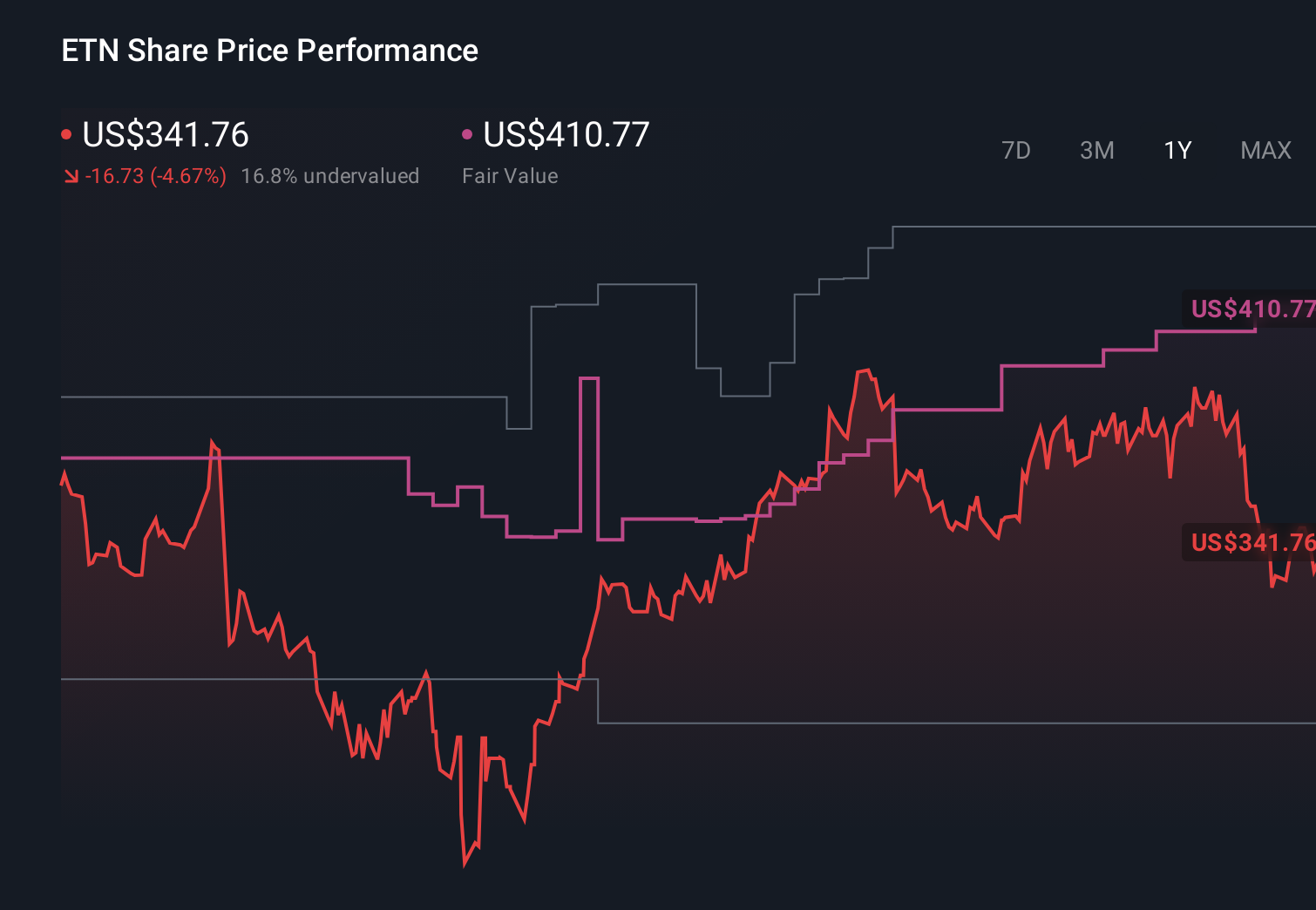

Uncover how Eaton's forecasts yield a $404.06 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community value Eaton between about US$239 and US$412 per share, showing a wide span of expectations. You should weigh those views against the margin pressure risk from Eaton’s ongoing AI and data center buildout, which could influence how the business performs over the next few years.

Explore 7 other fair value estimates on Eaton - why the stock might be worth 28% less than the current price!

Build Your Own Eaton Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eaton research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Eaton research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eaton's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are the new gold rush. Find out which 39 stocks are leading the charge.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal