Assessing Morgan Stanley (MS) Valuation As It Files To Launch Bitcoin And Solana Crypto ETFs

Morgan Stanley (MS) has filed to launch Bitcoin and Solana exchange traded funds, stepping directly into crypto products under its own brand and giving investors a fresh way to access regulated digital asset exposure.

See our latest analysis for Morgan Stanley.

The crypto ETF filings come after a period of strong momentum for Morgan Stanley, with a 90 day share price return of 20.62% and a 1 year total shareholder return of 52.12%, pointing to building interest in the stock over both shorter and longer periods.

If Morgan Stanley’s move into digital assets has your attention, it could be a good moment to widen your search and look at fast growing stocks with high insider ownership.

With the shares around $187.75, a value score of 3, strong multi year returns and the stock currently trading above the average analyst price target, you have to ask: is Morgan Stanley undervalued or is everything already priced in?

Most Popular Narrative: 10.8% Overvalued

The most followed narrative puts Morgan Stanley’s fair value at about US$169.52, compared with the recent US$187.75 share price, setting up a clear valuation gap.

Morgan Stanley's continued investment in technology (AI, digital platforms, E*TRADE enhancements) and workplace channel expansion are yielding improved operating efficiencies and productivity, which are likely to support net margin improvement over time. The international build out of the firm's advisory and asset management businesses, demonstrated by strong performance and market share gains in EMEA and Asia, offers diversification and new growth opportunities, positively impacting both revenues and overall earnings stability.

Curious how moderate revenue growth, slightly higher margins and a richer future earnings multiple add up to that valuation call? The full narrative spells it out.

Result: Fair Value of $169.52 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this outlook could be tested if low fee passive products continue to chip away at traditional advisory revenue, or if tighter global rules push up compliance costs.

Find out about the key risks to this Morgan Stanley narrative.

Another View: P/E Ratios Tell a Different Story

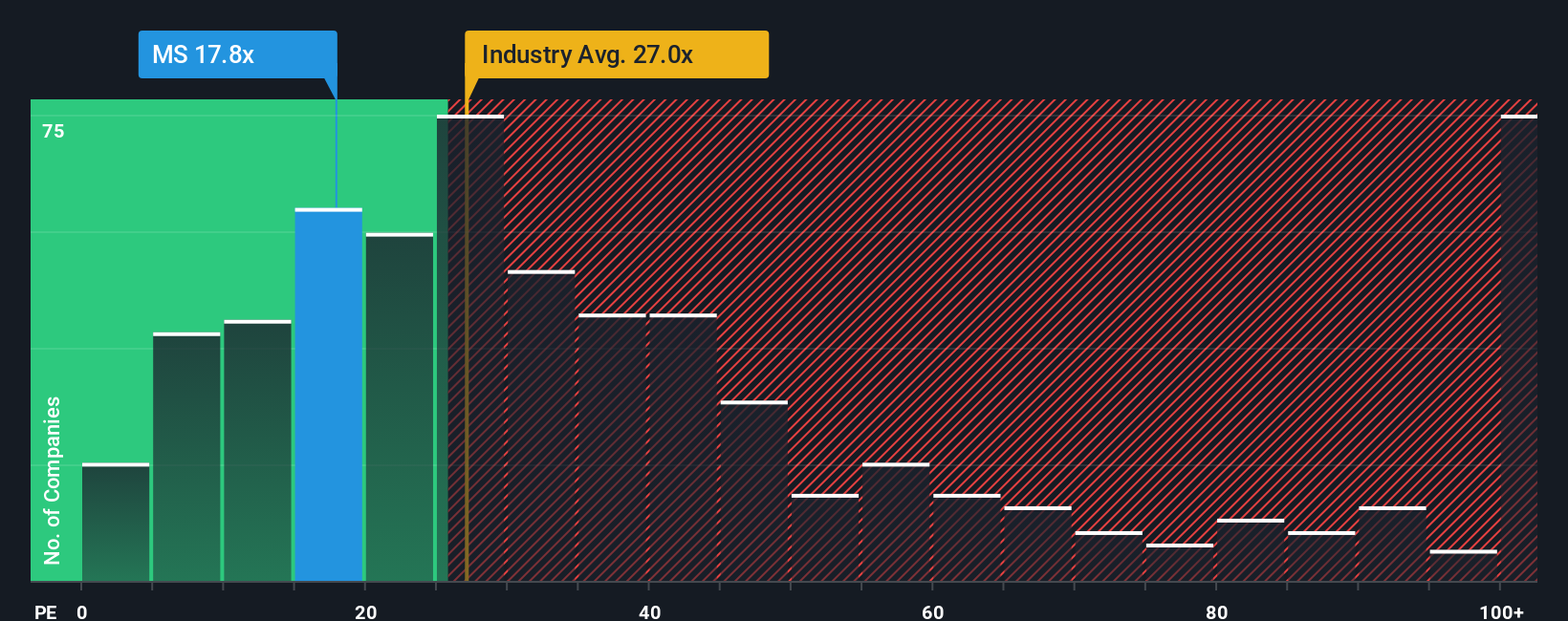

While the popular narrative points to Morgan Stanley trading about 10.8% above its fair value, the P/E picture is less clear cut. At 19.2x earnings, the shares sit below the US Capital Markets industry average of 25.7x and peer average of 32x, and only slightly under the fair ratio of 19.6x that the market could move towards.

That combination hints at limited room for multiple expansion but also avoids an obvious premium. The real question for you is whether the current price reflects quality and recent earnings strength, or leaves less margin for error if conditions turn.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Morgan Stanley Narrative

If you look at the numbers and come to a different conclusion, or just want to test your own assumptions, you can build a custom view in minutes with Do it your way.

A great starting point for your Morgan Stanley research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Morgan Stanley has sharpened your focus, do not stop here. The right screener can surface opportunities you might otherwise never put on your radar.

- Target potential bargains by checking out these 877 undervalued stocks based on cash flows that may be trading below what their cash flows suggest.

- Position yourself early in powerful tech shifts by scanning these 25 AI penny stocks shaping artificial intelligence trends.

- Capture income ideas by reviewing these 11 dividend stocks with yields > 3% that could complement a total return approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal