Assessing ASML Holding (ENXTAM:ASML) Valuation After Analyst Upgrades On AI And EUV Demand

Multiple analyst upgrades have pushed ASML Holding (ENXTAM:ASML) into the spotlight, as firms highlight strong demand for its exclusive extreme ultraviolet lithography tools related to AI and memory chip investment.

See our latest analysis for ASML Holding.

The recent wave of upgrades has arrived alongside sharp price momentum, with a 7 day share price return of 15.53% and a 90 day share price return of 24.56%. The 1 year total shareholder return of 45.09% and 5 year total shareholder return of 165.01% show how longer term holders have been rewarded as confidence around AI driven chip spending and ASML Holding’s position in advanced lithography has filtered into expectations.

If ASML Holding’s surge has caught your eye, it could be a good moment to see what else is moving in high growth tech and AI stocks and compare other chip and AI related names.

With the share price already close to analyst targets and years of AI optimism reflected in strong past returns, the key question now is simple: is there still genuine upside left here, or is the market already pricing in future growth?

Most Popular Narrative: 6.1% Overvalued

According to Investingwilly, the narrative fair value of €1,000 sits below ASML Holding’s last close at €1,061, which creates an immediate valuation gap worth unpacking.

ASML Holding N.V. is a Dutch company and the world’s only supplier of extreme ultraviolet (EUV) lithography machines, a critical technology used to produce the world’s most advanced computer chips. These machines are essential for manufacturing cutting-edge semiconductors found in everything from AI chips and smartphones to data centers and advanced computing systems.

Want to see what kind of revenue growth, profit margins and future earnings multiple Investingwilly uses to justify that fair value cut versus today’s price? The full narrative lays out a detailed cash flow path, a specific discount rate and a profit profile that all have to line up for €1,000 to make sense. If you are curious which assumptions do the heavy lifting in that model, the complete breakdown is where those numbers come together.

Result: Fair Value of €1,000 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are clear pressure points, including export restrictions to China and management’s own warning that sales growth could stall in 2026.

Find out about the key risks to this ASML Holding narrative.

Another Angle: Market Multiple Sends A Different Signal

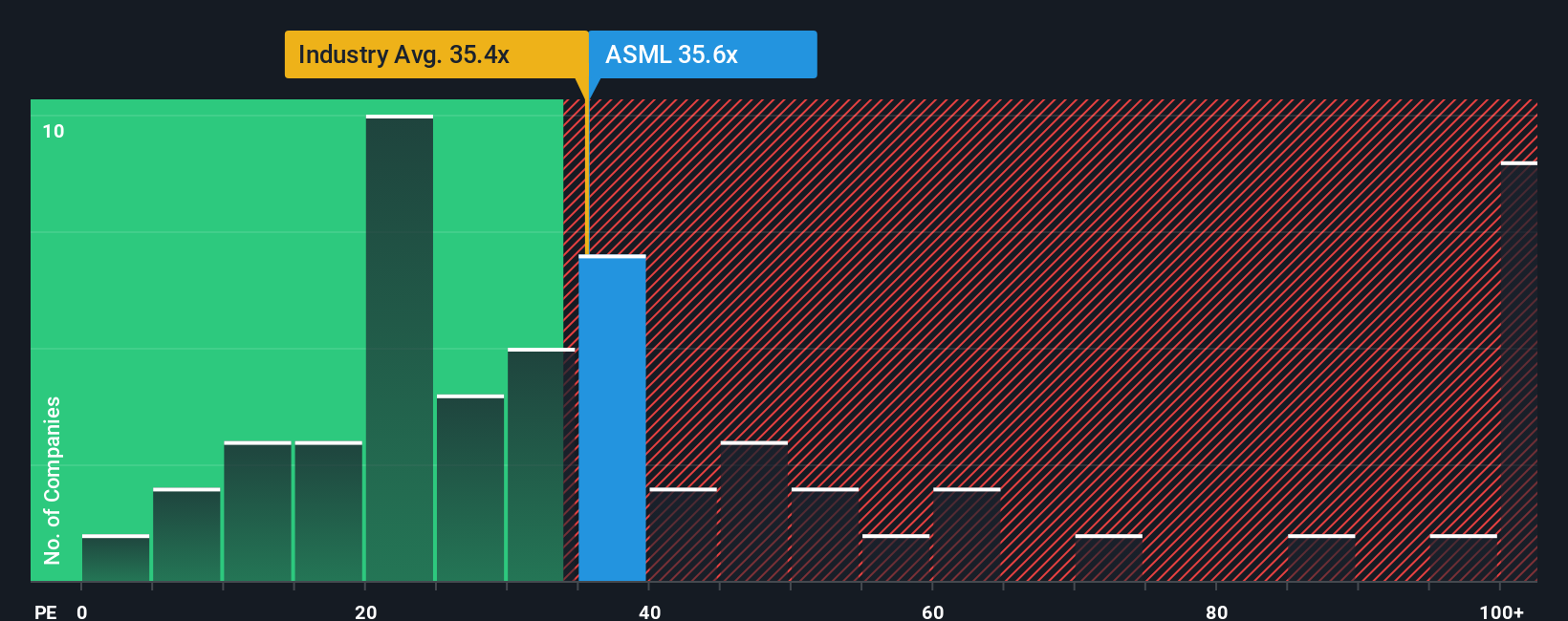

While Investingwilly’s narrative points to ASML Holding being 6.1% overvalued at €1,000 versus the €1,061 share price, the market’s own P/E story is more forgiving. ASML trades on 43.4x earnings, below its fair ratio of 47.3x and below peers at 49.7x, which suggests investors are not paying the top end of the range for this name.

That gap might reflect a margin of safety, or it could signal that expectations are already stretched if growth cools. Which story do you think better captures the real risk you are taking?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ASML Holding Narrative

If you prefer to weigh the numbers yourself or you simply see the story differently, you can test assumptions and build a custom thesis in minutes with Do it your way.

A great starting point for your ASML Holding research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If ASML Holding is on your radar, do not stop there. You owe it to yourself to scan other opportunities that might better fit your goals.

- Target income potential by checking out these 11 dividend stocks with yields > 3% that focus on cash returns through regular payouts.

- Hunt for mispriced opportunities using these 877 undervalued stocks based on cash flows sourced from discounted cash flow estimates.

- Position yourself early in future tech themes by reviewing these 29 quantum computing stocks tied to cutting edge computing breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal