How Investors Are Reacting To Williams Companies (WMB) Major $2.77 Billion Senior Notes Refinancing

- In early January 2026, The Williams Companies, Inc. completed several fixed-income offerings totaling about US$2.77 billion in callable senior subordinated unsecured notes across 2033, 2036, and 2056 maturities, primarily to refinance near-term debt and for general corporate purposes.

- This sizeable bond issuance reshapes Williams’ capital structure and interest burden at a time when short interest has risen but still trails its peer average, sharpening investor focus on balance sheet resilience.

- With this large senior notes issuance in mind, we’ll now examine how Williams’ expanded debt profile may influence its longer-term investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Williams Companies Investment Narrative Recap

To own Williams today, you need to believe in the durability of U.S. natural gas infrastructure demand, backed by long-term contracts and a visible project backlog. The recent US$2.77 billion senior notes issuance mainly reshapes the timing and cost of Williams’ leverage, but does not materially change the near term catalyst around LNG and power demand, or the key risk that higher leverage could constrain flexibility if conditions become less favorable.

The most relevant announcement is the completion of US$1.25 billion of 5.150% senior subordinated unsecured notes due 2036, alongside the broader US$2.77 billion package. Together with the 2033 and 2056 tranches, this extends Williams’ debt maturities and locks in fixed coupons, which matters because its long-cycle capital projects and elevated CapEx needs already lean on the balance sheet for funding.

Yet investors should be aware that higher leverage and interest costs could amplify the impact if...

Read the full narrative on Williams Companies (it's free!)

Williams Companies' narrative projects $14.5 billion revenue and $3.3 billion earnings by 2028. This requires 8.6% yearly revenue growth and a $0.9 billion earnings increase from $2.4 billion today.

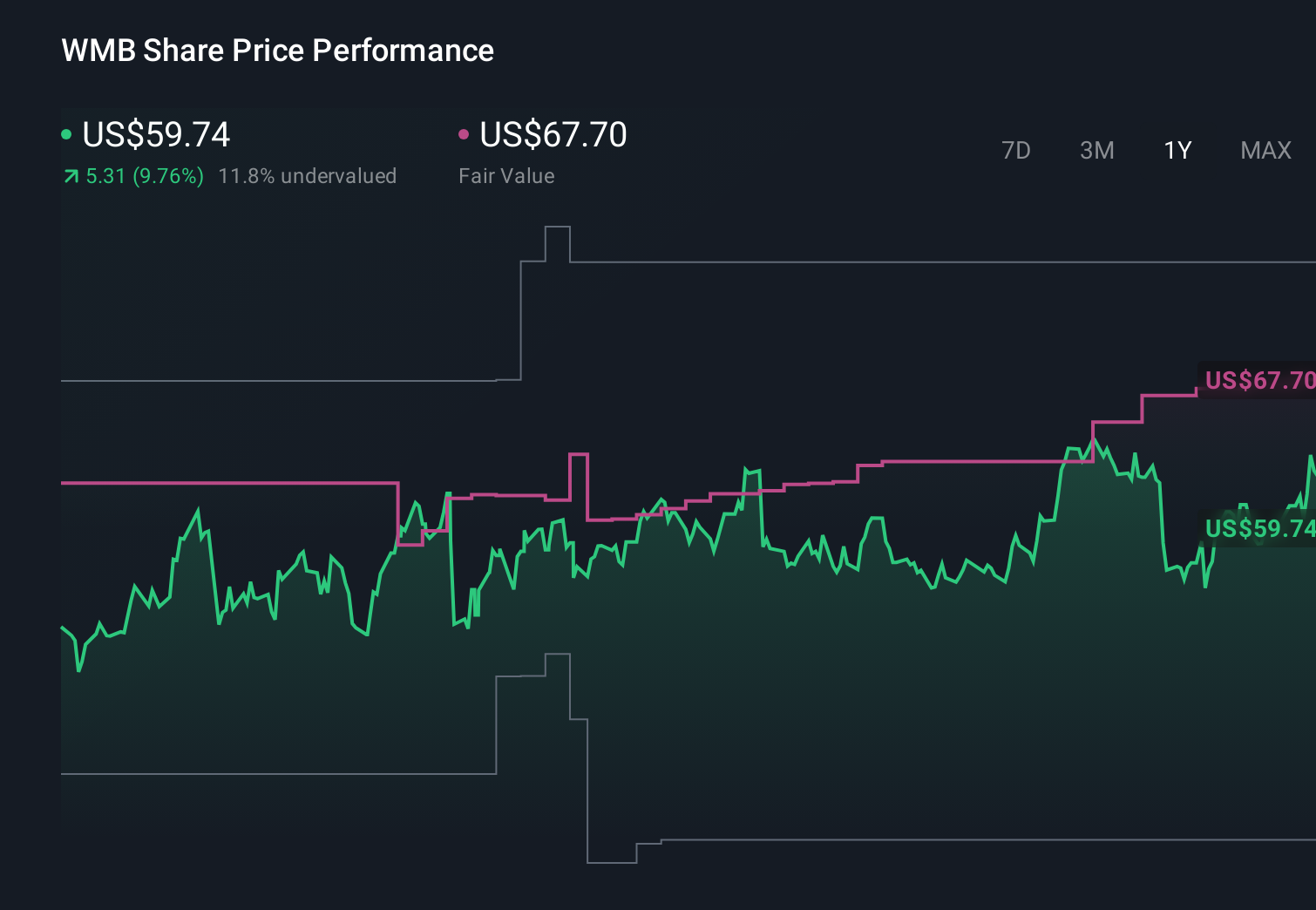

Uncover how Williams Companies' forecasts yield a $67.70 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Six members of the Simply Wall St Community currently see fair value for Williams between US$54.55 and US$87.74 per share, reflecting wide dispersion in expectations. You are weighing those views against the fact that Williams’ sizable new bond issuances add to an already busy capital program and could influence how resilient its balance sheet feels if conditions shift, so it pays to compare several perspectives before deciding where you stand.

Explore 6 other fair value estimates on Williams Companies - why the stock might be worth 8% less than the current price!

Build Your Own Williams Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Williams Companies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Williams Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Williams Companies' overall financial health at a glance.

No Opportunity In Williams Companies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 29 stocks that are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 39 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal