Eurozone inflation accurately reached the 2% standard, and the ECB's logic of stabilizing interest rates was further consolidated

The Zhitong Finance App learned that the latest data shows that the Eurozone inflation rate has fallen back to the target range set by the ECB, which confirms the opinion of policy makers — as long as there is no significant change in the economic outlook, the benchmark interest rate can be maintained at the current level.

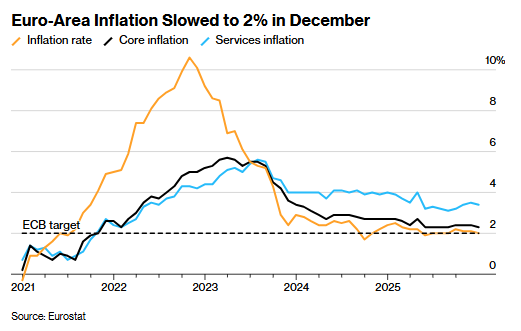

Eurostat's preliminary statistics show that in December of last year, consumer prices in the Eurozone rose 2% year on year, down from 2.1% in the previous January, and are completely in line with economists' forecasts. After excluding volatile food and energy prices, the core inflation rate slowed to 2.3%; the service sector inflation rate, which has received much attention from the market, also showed a downward trend.

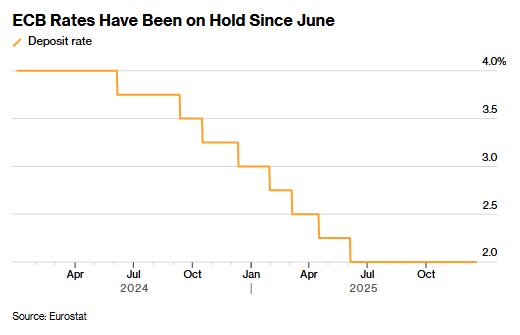

Over the past six months, price increases in the Eurozone have fluctuated around the target level of 2%, which has also enabled the ECB to keep the benchmark interest rate unchanged since June of last year. Economists and investors generally agree that the ECB will not adjust interest rates any further in the short term.

Traders, on the other hand, have increased their bets on monetary easing policies. Market pricing shows that interest rate cuts may reach 5 basis points before September this year, which is equivalent to a 20% chance of cutting interest rates by 25 basis points. Affected by this, the EUR/USD exchange rate reversed the decline in early trading and remained flat near 1.169.

David Powell, a senior economist in the Eurozone, said, “The slowdown in inflation in the Eurozone in December was good news for the ECB, but this change probably has little to do with monetary policy — the current decline in inflation is driven by lower energy costs, and the fall in volatile commodity prices such as air ticket prices may also be one of the reasons.”

Currently, most ECB policymakers agree that inflation is within a manageable range, but they are still cautious about the next policy direction, stressing the remaining uncertain risks in the global economy.

Nordea analysts Anders Svendsen and Tuuli Koivu wrote in the report: “We hold on to the long-standing view that the ECB will keep interest rates unchanged in 2026. The policy risk for the first half of the year was biased towards cutting interest rates rather than raising interest rates; in the long run, they are more inclined to raise interest rates. This judgment is in line with current market pricing, and it is likely that this view will not change significantly after the inflation data is released.”

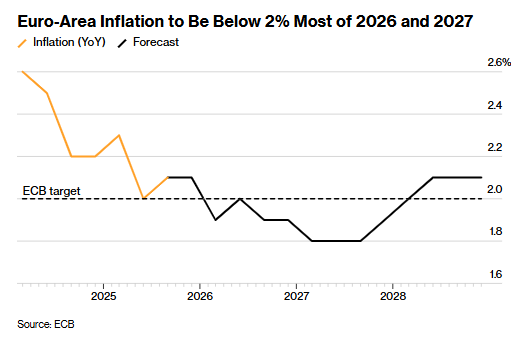

At the last monetary policy meeting in 2025, the ECB expected that this year's inflation rate will only fall slightly below the target level, up from previous forecasts, reflecting a slower slowdown in service sector costs than expected.

According to various data released earlier, price increases in Eurozone member countries have all declined, but there are differences in the pace of decline. Among them, Spain's inflation rate fell to 3%, France slowed to 0.7%, and Germany fell back to the target level of 2%.

The rate of inflation in the service sector has always been a difficult issue facing the ECB. Affected by the unexpectedly strong wage growth rate, the inflation rate in the service sector once rose slightly. In the third quarter of last year, the most comprehensive wage growth index remained at 4%, above the range that is thought to match price stability.

ECB President Lagarde said last month, “We are closely monitoring this trend.” However, at the same time, she stressed that after the wage level has basically kept up with the price increase after the pandemic, the wage growth rate is expected to slow down somewhat this year.

In addition to this, there are many factors that may cause the inflation rate to deviate from the target range, including the continued fermentation of the US tariff policy, the strengthening of the euro exchange rate, and Germany's fiscal expansion policy. According to the ECB's benchmark forecast, the average inflation rate in the Eurozone will be 1.9% in 2026. After that, the inflation rate will decline further and rise back to the target level of 2% by 2028.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal