SoundHound AI (SOUN) Valuation Check As Amelia 7 And Vision AI Expand In Car Commerce Partnerships

Recent interest in SoundHound AI (SOUN) has been sparked by its Amelia 7 agentic AI launch, Vision AI debut, and new in-car voice commerce partnerships with TomTom, OpenTable, and Parkopedia showcased at CES 2026.

See our latest analysis for SoundHound AI.

The latest Amelia 7 and Vision AI launches, along with TomTom, OpenTable, and Parkopedia tie ups, coincide with a 7 day share price return of 11.85% and a year to date share price return of 5.94%. At the same time, the 1 year total shareholder return is a 37.52% decline and the 3 year total shareholder return remains very large, suggesting short term momentum is building even as longer term holders have experienced significant swings.

If this kind of AI driven story has your attention, it could be a good moment to widen your radar with high growth tech and AI stocks.

With the stock still 37.52% below its 1 year total return level, yet trading about 49% under the average analyst price target of US$16.69, you have to ask whether there is mispricing here or whether markets are already baking in the growth story.

Most Popular Narrative Narrative: 34.7% Undervalued

With SoundHound AI last closing at US$11.23 against a most-followed fair value of US$17.19, the narrative frames a wide gap that hinges on ambitious growth and margin shifts.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 228.2x on those 2028 earnings, up from -23.0x today. This future PE is greater than the current PE for the US Software industry at 36.6x.

Curious what kind of revenue ramp, margin reset, and share count path have to line up to support that kind of future earnings multiple? The narrative spells out an aggressive growth curve, a sharp swing in profitability, and a heavy valuation overlay. If you want to see exactly how those moving parts stack together, the full story is worth a closer look.

Result: Fair Value of $17.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story can quickly change if heavy R&D and sales spending fails to translate into steadier revenue, or if large enterprise deals remain lumpy and unpredictable.

Find out about the key risks to this SoundHound AI narrative.

Another Way To Look At Valuation

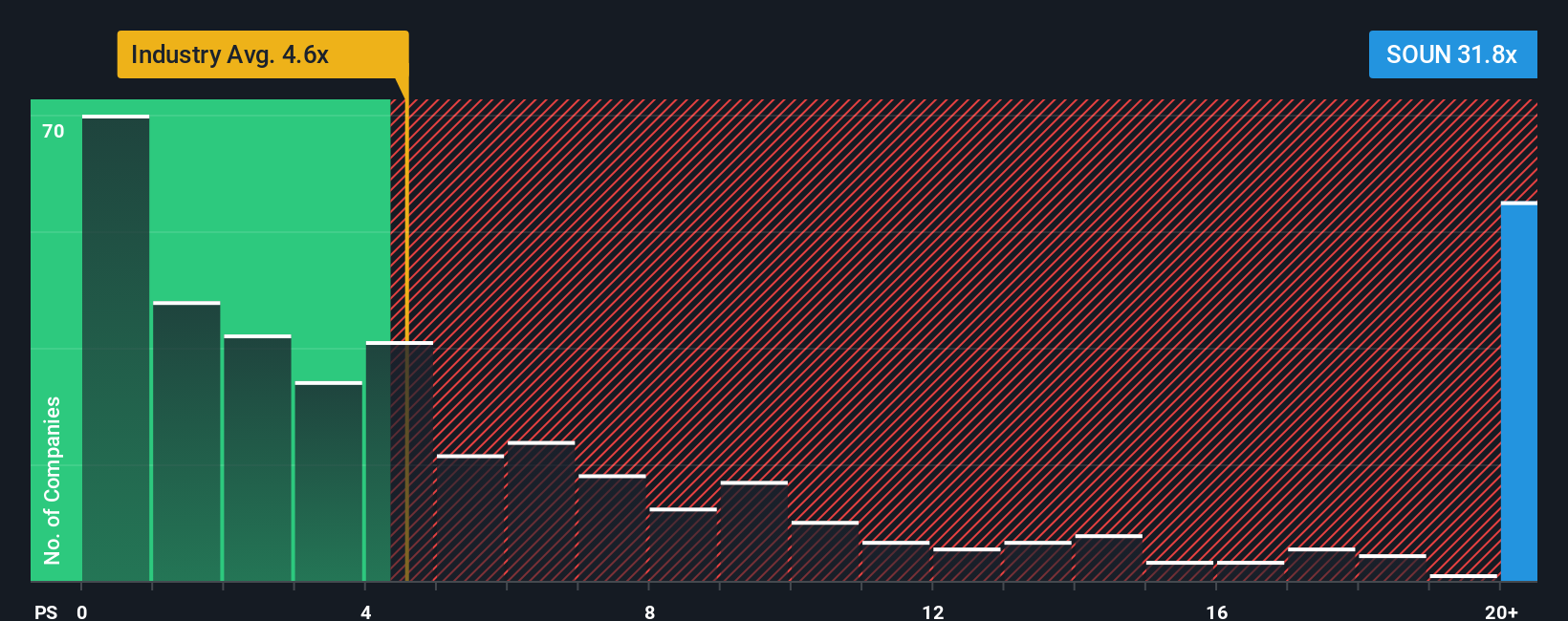

If you step away from the fair value narrative and just look at the current P/S, SoundHound AI trades at 31.8x sales. That is much higher than both the US Software industry at 4.8x and its peer average of 18.7x, and even the fair ratio of 6.1x that the market could move toward.

This kind of gap can sometimes reflect excitement around future growth, but it also raises the risk that any disappointment on revenue or margins could hit the share price hard. The real question is whether you think the business can grow into that valuation before sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SoundHound AI Narrative

If you look at the numbers and reach a different conclusion, or simply prefer to test the assumptions yourself, you can build a personalized view in just a few minutes with Do it your way.

A great starting point for your SoundHound AI research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If SoundHound AI has sparked your interest, do not stop here. Broaden your watchlist with ideas that target different return drivers and risk profiles.

- Target potential mispricings by scanning these 876 undervalued stocks based on cash flows where expectations and current prices may not fully line up.

- Ride the AI momentum by checking out these 25 AI penny stocks that are building tools, platforms, and services around artificial intelligence.

- Position for niche growth themes through these 29 healthcare AI stocks, bringing together companies using AI to tackle healthcare problems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal