Assessing OPENLANE (OPLN) Valuation After Expanded Canadian Receivables Program And Growing Investor Attention

OPENLANE (OPLN) has drawn fresh attention after expanding its Canadian receivables program limit to C$500 million with major financial partners, alongside a recent NYSE ticker change and an upcoming Investor Day that is keeping investor interest elevated.

See our latest analysis for OPENLANE.

These financing moves and the ticker change have come alongside firm share price momentum, with OPENLANE’s 30-day share price return of 20.77% and 1-year total shareholder return of 58.01% pointing to building optimism rather than fading interest.

If this kind of renewed attention has you thinking more broadly about opportunities, it could be a good moment to scan fast growing stocks with high insider ownership for other fast moving ideas with committed insiders.

With OPENLANE trading close to its analyst price target and posting strong recent returns, the key question now is whether the current valuation still leaves upside or if the market is already pricing in future growth.

Most Popular Narrative Narrative: 1% Undervalued

With OPENLANE’s fair value estimate of about $31.81 sitting just above the last close at $31.57, the most followed narrative treats the current price as roughly in line with its long term fundamentals.

The analysts have a consensus price target of $30.5 for OPENLANE based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $34.0, and the most bearish reporting a price target of just $25.0.

Curious what kind of revenue path, margin lift and future earnings multiple are needed to support this valuation, especially with a modest discount rate built in? The full narrative lays out those moving parts in detail.

Result: Fair Value of $31.81 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this story could shift quickly if competition pressures margins or if regulatory changes around cross border trade and data handling increase costs and slow volume growth.

Find out about the key risks to this OPENLANE narrative.

Another View: Earnings Multiple Sends A Different Signal

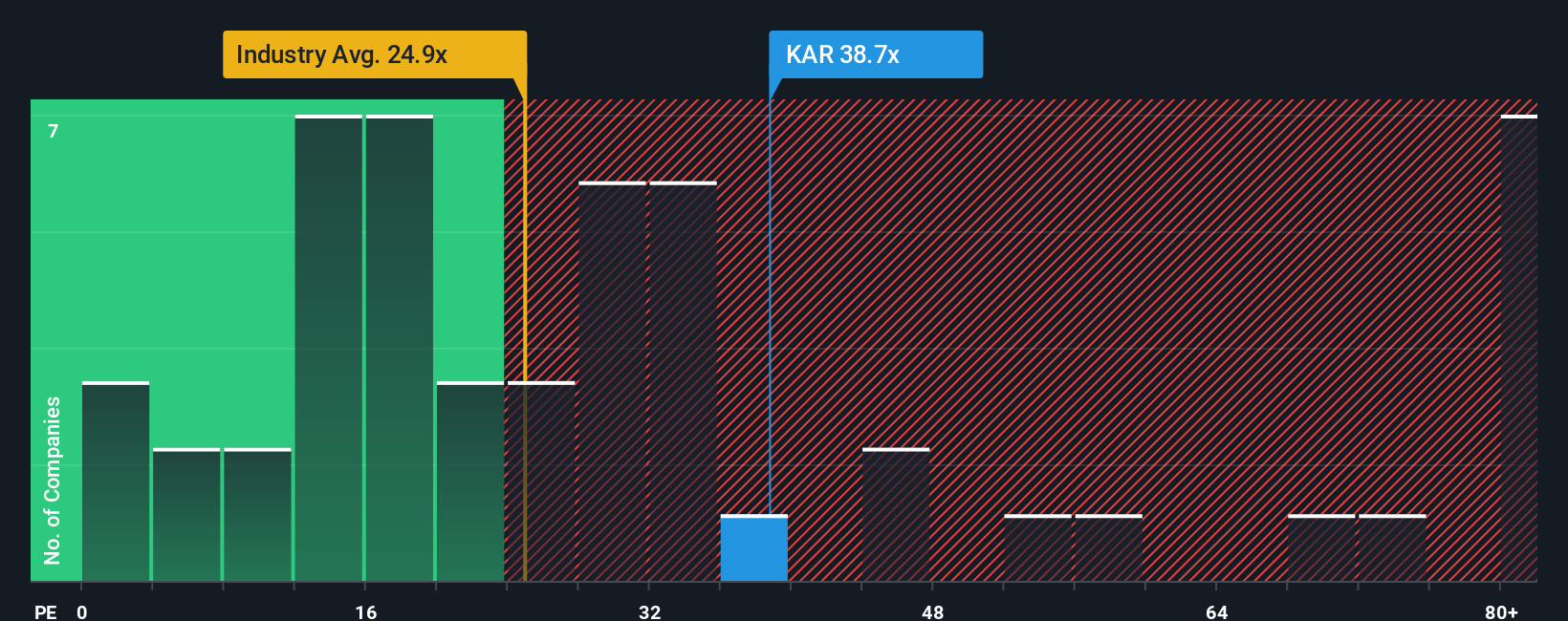

While the analyst fair value of about $31.81 suggests OPENLANE is roughly in line with long term fundamentals, its current P/E of 35.5x tells a different story. That compares with a fair ratio of 30.5x and a US Commercial Services average of 25x, as well as a peer average of 35.7x.

Put simply, the stock is priced above the fair ratio and above its broader industry, and roughly in line with closer peers. That gap can mean you are paying extra for the growth story. This raises the question: how comfortable are you with that premium if sentiment cools?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own OPENLANE Narrative

If you look at the numbers and come to a different conclusion, or just prefer to test your own assumptions against the data, you can build a personalized OPENLANE view in just a few minutes with Do it your way.

A great starting point for your OPENLANE research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If OPENLANE has sparked your interest, do not stop here. The next move could be spotting other opportunities that fit your style before everyone else piles in.

- Capture potential mispricings early by scanning these 876 undervalued stocks based on cash flows that may offer more value for every dollar you put to work.

- Ride powerful trends in automation and data by checking out these 25 AI penny stocks shaping how businesses use artificial intelligence.

- Boost your income focus by reviewing these 11 dividend stocks with yields > 3% that combine shareholder payouts with established business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal