Market Cool On Yatsen Holding Limited's (NYSE:YSG) Revenues Pushing Shares 27% Lower

Unfortunately for some shareholders, the Yatsen Holding Limited (NYSE:YSG) share price has dived 27% in the last thirty days, prolonging recent pain. Looking at the bigger picture, even after this poor month the stock is up 27% in the last year.

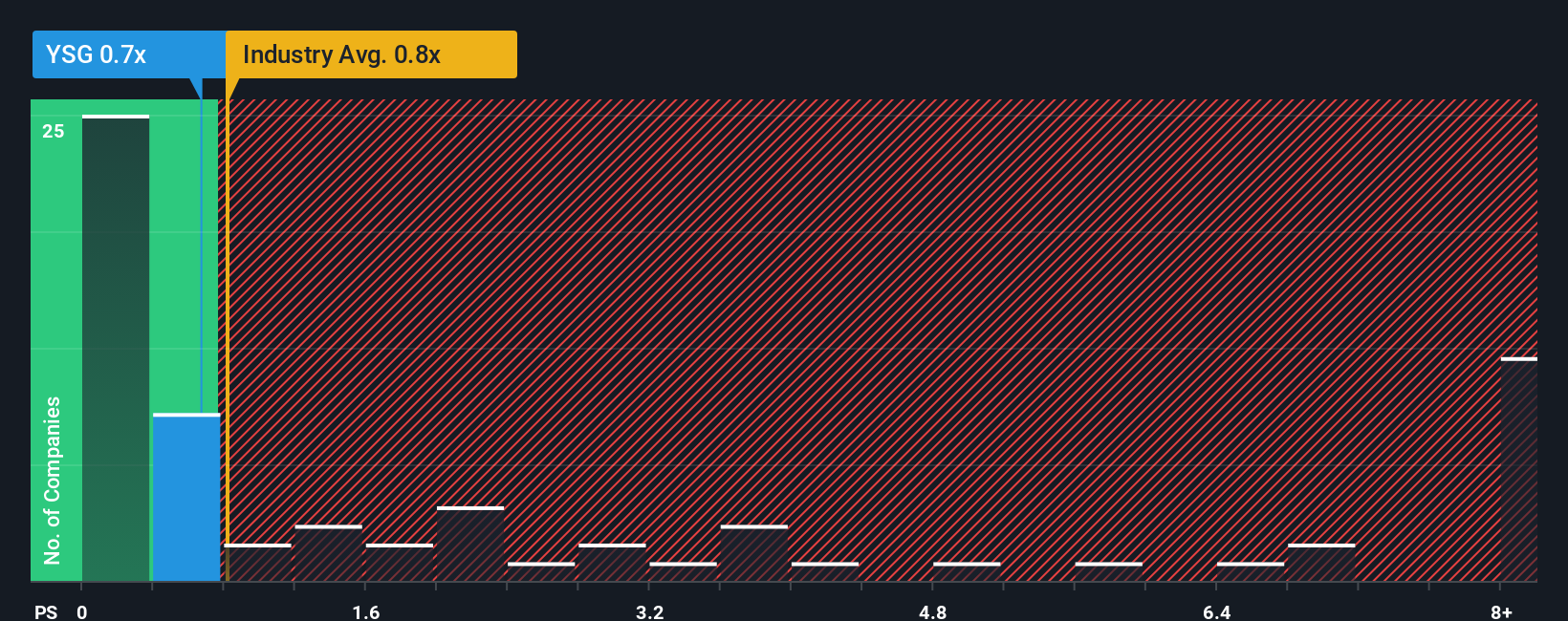

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Yatsen Holding's P/S ratio of 0.7x, since the median price-to-sales (or "P/S") ratio for the Personal Products industry in the United States is also close to 0.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Yatsen Holding

What Does Yatsen Holding's Recent Performance Look Like?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Yatsen Holding has been doing quite well of late. One possibility is that the P/S ratio is moderate because investors think the company's revenue will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Yatsen Holding.Is There Some Revenue Growth Forecasted For Yatsen Holding?

In order to justify its P/S ratio, Yatsen Holding would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 23% gain to the company's top line. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 3.8% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Turning to the outlook, the next year should generate growth of 17% as estimated by the dual analysts watching the company. With the industry only predicted to deliver 5.2%, the company is positioned for a stronger revenue result.

With this information, we find it interesting that Yatsen Holding is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Yatsen Holding's P/S?

Yatsen Holding's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite enticing revenue growth figures that outpace the industry, Yatsen Holding's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Yatsen Holding you should know about.

If these risks are making you reconsider your opinion on Yatsen Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal