How L’Oréal’s Infrared Beauty Devices And AI Personalization Push At CES 2026 At L’Oréal (ENXTPA:OR) Has Changed Its Investment Story

- At CES 2026, L’Oréal showcased infrared-powered Light Straight + Multi-styler hair tools and ultra-thin LED Face and Eye Masks, aiming to offer at-home hair and skincare treatments using red and near-infrared light, with global launches planned in 2027 across several of its professional and luxury brands.

- By moving deeper into premium, tech-enabled beauty devices and combining AI personalization with wearable light-therapy hardware, L’Oréal is pushing its portfolio beyond traditional cosmetics toward higher-value, science-led beauty solutions that could reshape how consumers treat hair and skin at home.

- We’ll now assess how L’Oréal’s push into premium infrared beauty devices and AI-driven personalization may influence its broader investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

L'Oréal Investment Narrative Recap

L’Oréal’s investment case still rests on its global brand strength, premium positioning, and ability to turn science and digital capabilities into new beauty categories. The CES 2026 infrared devices showcase reinforces that narrative, but the news itself does not materially change the near term focus on restoring earnings momentum after recent profit softness or the key risk that rising competition and shifting skincare preferences could pressure volumes and pricing.

The most relevant recent announcement here is L’Oréal’s continued spend on digital and AI tools for content production, which complements its push into AI-personalized, infrared-powered devices. Together, these moves highlight how the company is leaning on technology across marketing and product to support premiumization, one of the core catalysts underpinning the current growth expectations and valuation.

Yet behind the appeal of premium tech beauty, investors still need to consider intensifying competition in skincare and makeup, especially in Asia, as a risk that...

Read the full narrative on L'Oréal (it's free!)

L'Oréal's narrative projects €50.7 billion revenue and €8.0 billion earnings by 2028. This requires 5.0% yearly revenue growth and about a €1.9 billion earnings increase from €6.1 billion today.

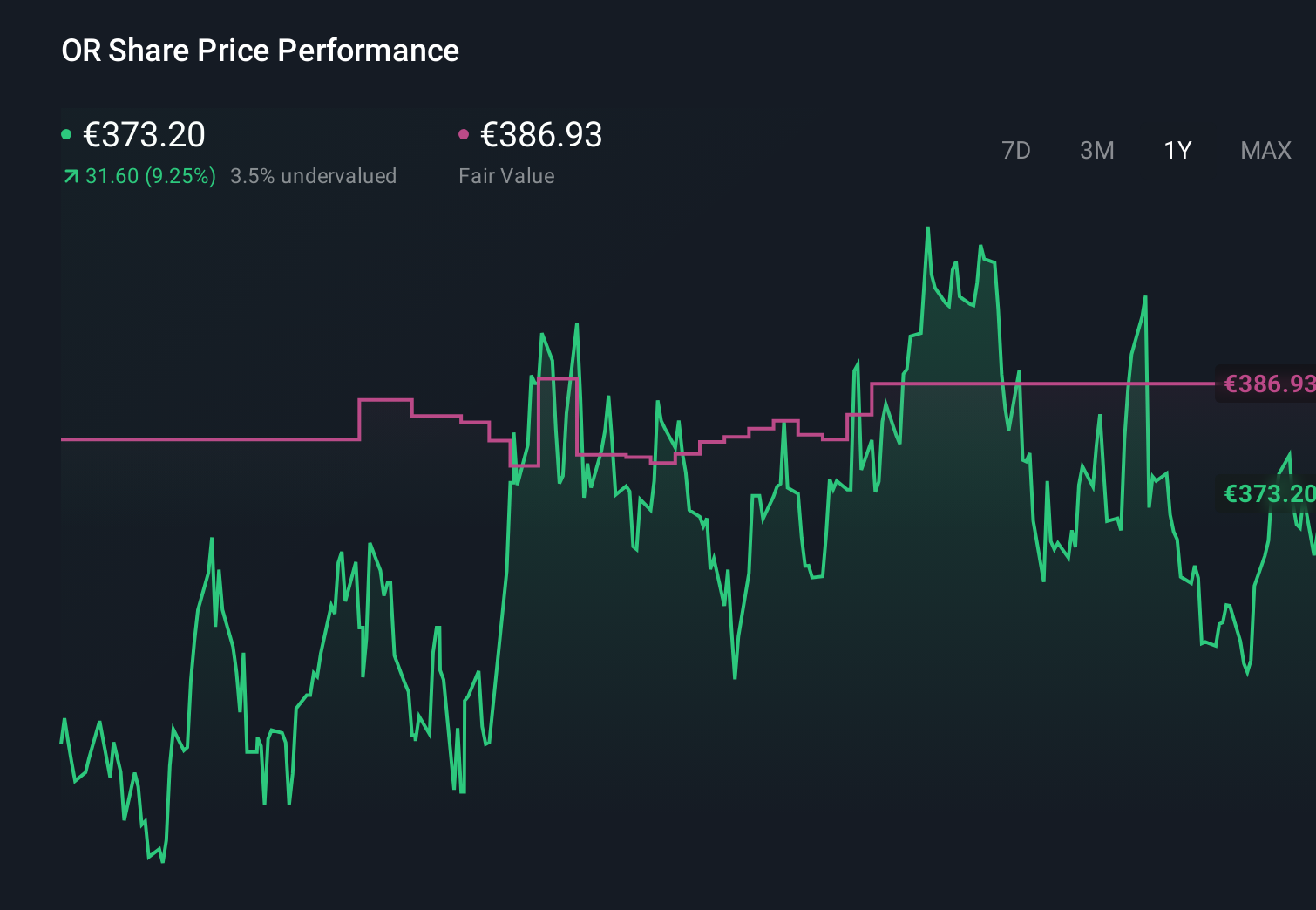

Uncover how L'Oréal's forecasts yield a €387.55 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community span roughly €285.96 to €413.80 per share, showing how far apart individual views can be. You can weigh these against the idea that premium, tech enabled beauty devices and AI investments are an important catalyst for L’Oréal’s future performance and explore several alternative viewpoints.

Explore 6 other fair value estimates on L'Oréal - why the stock might be worth 22% less than the current price!

Build Your Own L'Oréal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your L'Oréal research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free L'Oréal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate L'Oréal's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 39 companies in the world exploring or producing it. Find the list for free.

- We've found 11 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal