Assessing Garmin (GRMN) Valuation As Long Term Momentum Meets Mixed Recent Share Performance

Garmin (GRMN) has recently caught investor attention after a period of mixed share performance, with a small move higher over the past week but a negative return over the past 3 months.

See our latest analysis for Garmin.

At a share price of $209.35, Garmin’s recent 2.74% 1 day and 2.83% 30 day share price returns sit against a softer 90 day share price return of 19.41% and a much stronger 124.84% 3 year total shareholder return. This suggests that longer term momentum remains intact even as shorter term enthusiasm has cooled.

If Garmin has you thinking about where else growth and ownership conviction might meet, it could be worth broadening your search to fast growing stocks with high insider ownership.

With Garmin trading at $209.35 and screens suggesting around a 20% intrinsic discount, plus a 12% gap to analyst targets, you have to ask: is this a genuine entry point, or is future growth already priced in?

Most Popular Narrative: 9.4% Undervalued

With Garmin last closing at $209.35 against a narrative fair value of about $231, the narrative is framing the current price as a discount and tying that view directly to expectations for revenue, margins and the valuation multiple a few years out.

The analysts have a consensus price target of $213.833 for Garmin based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $285.0, and the most bearish reporting a price target of just $167.0.

Curious what underpins that higher fair value? The narrative leans on steady revenue gains, firm profit margins and a premium future earnings multiple. This raises the question of how those pieces fit together and what they imply for Garmin’s long term earnings power and pricing.

Result: Fair Value of $231 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are pressure points to watch, including rising operating expenses and softness in Marine and Outdoor, which could squeeze margins and challenge the potential upside.

Find out about the key risks to this Garmin narrative.

Another View: Multiples Paint A Tougher Picture

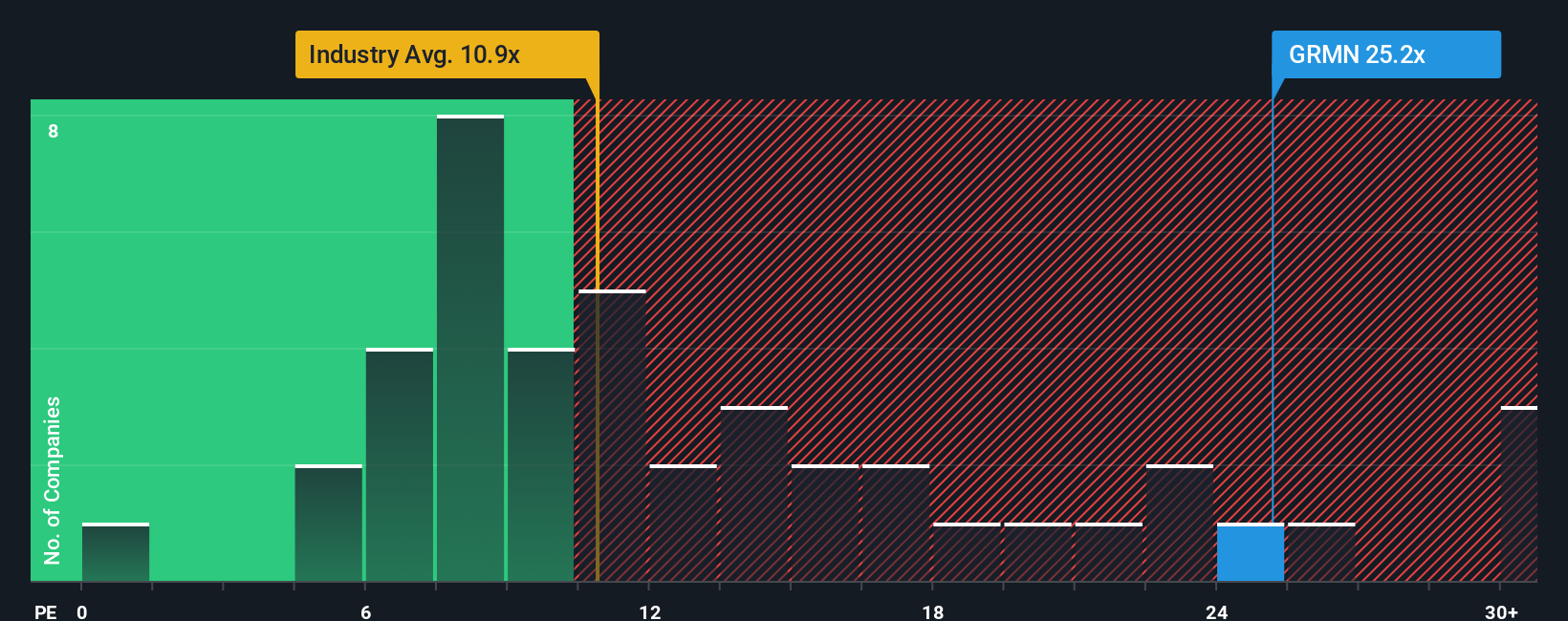

There is a twist when you look at Garmin through simple market ratios. The shares trade on a P/E of 25.6x, compared with 10.2x for the US Consumer Durables industry and 23.5x for peers, while the fair ratio is 19.9x. That premium suggests less room for error if growth or margins disappoint. So is the discount to fair value a cushion, or is the market already paying up for quality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Garmin Narrative

If this narrative does not quite match your view and you would rather put the numbers to work yourself, you can build your own in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Garmin.

Looking for more investment ideas?

If Garmin has sharpened your interest, do not stop here. Broadening your watchlist with a few focused stock ideas can help inform your next decisions.

- Spot early potential by checking out these 3555 penny stocks with strong financials that already have stronger balance sheets and fundamentals than many expect from low priced names.

- Consider structural shifts in technology by scanning these 25 AI penny stocks that shape how data, automation and intelligent tools appear in everyday products and services.

- Strengthen your income focus by reviewing these 11 dividend stocks with yields > 3% that aim to combine meaningful yields with underlying businesses backed by real cash generation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal