Stock Market Today: Dow Futures Rise, S&P 500, Nasdaq Drops As Street Awaits Slew Of Economic Releases — AAR, Mobileye, Penguin Solutions In Focus

U.S. stock futures were mixed on Wednesday after a higher close on Tuesday. Futures of major benchmark indices were mixed.

Investors are bracing for a heavy slate of economic releases, including the ADP employment report and ISM services index, on Wednesday.

This follows the momentum that drove the Dow Jones roughly 1% higher to fresh record peaks during Tuesday’s rotation into blue-chip names.

Meanwhile, the 10-year Treasury bond yielded 4.15%, and the two-year bond was at 3.46%. The CME Group's FedWatch tool‘s projections show markets pricing an 83.9% likelihood of the Federal Reserve leaving the current interest rates unchanged in January.

| Futures | Change (+/-) |

| Dow Jones | 0.04% |

| S&P 500 | -0.10% |

| Nasdaq 100 | -0.26% |

| Russell 2000 | 0.02% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were lower in premarket on Wednesday. The SPY was down 0.11% at $691.08, while the QQQ advanced 0.29% to $621.83, according to Benzinga Pro data.

Stocks In Focus

AAR

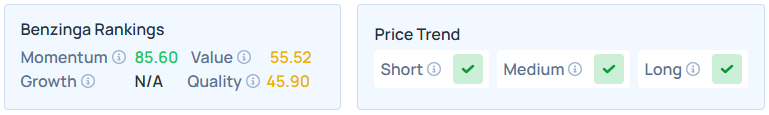

- AAR Corp. (NYSE:AIR) was 5.07% higher after posting better-than-expected results for the second quarter and issuing a strong sales forecast for the current quarter. The company said it sees third-quarter sales between $813.840 million-$827.404 million, versus market estimates of $793.438 million.

- Benzinga’s Edge Stock Rankings shows that AIR maintains a stronger price trend over the short, medium, and long term, with a moderate quality ranking. Additional information is available here.

Penguin Solutions

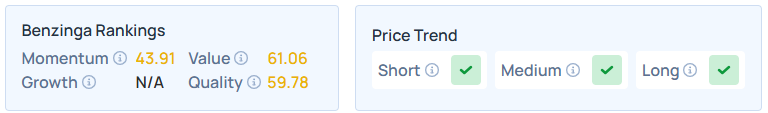

- Penguin Solutions Inc. (NASDAQ:PENG) shares rose 4.41% in premarket on Wednesday after reporting better-than-expected first-quarter financial results.

- It maintains a stronger price trend over the short, medium, and long terms with a moderate value ranking. Additional performance details, as per Benzinga's Edge Stock Rankings, are available here.

Mobileye Global

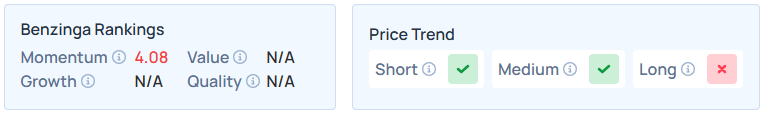

- Mobileye Global Inc. (NASDAQ:MBLY) jumped 11% after it entered a definitive agreement to acquire AI-first humanoid robotics company Mentee Robotics for approximately $900 million, aiming to combine its autonomous driving technologies with Mentee's robotic platform to lead the “Physical AI” market.

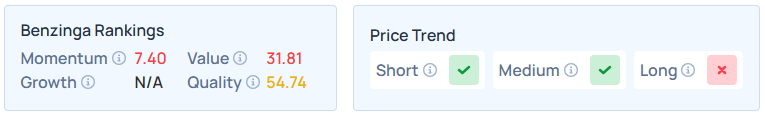

- MBLY maintains a weaker price trend over the long term but a strong trend in the short and medium terms. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Ventyx Biosciences

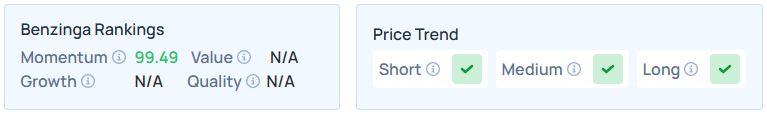

- Ventyx Biosciences Inc. (NASDAQ:VTYX) advanced 67.76% following reports that Indianapolis-based Eli Lilly & Co. (NYSE:LLY) is in advanced talks to acquire the company for more than $1 billion.

- Benzinga’s Edge Stock Rankings indicate that VTYX maintains a stronger price trend over the short, medium, and long terms. Additional performance details are available here.

Constellation Brands

- Constellation Brands Inc. (NYSE:STZ) shares were 0.50% higher as analysts expect it to post quarterly earnings at $2.64 per share on revenue of $2.16 billion after the closing bell.

- STZ maintains a stronger price trend over the short and medium terms but a weak trend in the long term, with a moderate quality ranking. Additional performance details, as per Benzinga's Edge Stock Rankings, are available here.

Cues From Last Session

Materials, health care, and industrials stocks posted the strongest gains on the S&P 500 on Tuesday, though the energy and communication services sectors bucked the trend to close lower.

| Index | Performance (+/-) | Value |

| Nasdaq Composite | 0.65% | 23,547.17 |

| S&P 500 | 0.62% | 6,944.82 |

| Dow Jones | 0.99% | 49,462.08 |

| Russell 2000 | 1.37% | 2,582.90 |

Insights From Analysts

BlackRock maintains a positive outlook for 2026, advocating a “risk-on” stance driven by structural shifts rather than traditional macroeconomic indicators.

Following a resilient 2025 where U.S. stocks gained 16.6%, the firm expects continued strength in U.S. equities, supported by “strong corporate earnings, driven in part by the AI theme” and further Federal Reserve easing.

The firm identifies three key lessons guiding their 2026 strategy. First, “immutable economic laws,” such as the difficulty of quickly rewiring supply chains, will limit policy extremes.

Second, “mega forces, especially AI, the dominant mega force, trump traditional macro,” encouraging investors to look past short-term volatility. Consequently, BlackRock remains overweight on U.S. and Japanese equities, viewing AI as a driver of structural transformation.

Economically, BlackRock anticipates the data picture to clarify, expecting a “cleaner read on the labor market and inflation” after recent noise. They warn, however, that reliable historical anchors like stable inflation have weakened, requiring a more active investment approach.

Upcoming Economic Data

Here's what investors will be keeping an eye on Wednesday.

- December’s ADP employment will be out by 8:30 a.m., December’s ISM services index data, November’s job opening data, and October’s U.S. factory orders data will be released by 10:00 a.m. Lastly, Fed Vice Chair for Supervision Michelle Bowman will speak at 4:10 p.m. ET.

Commodities, Gold, Crypto, And Global Equity Markets

Crude oil futures were trading lower in the early New York session by 1.02% to hover around $56.55 per barrel.

Gold Spot US Dollar fell 0.70% to hover around $4,463.46 per ounce. Its last record high stood at $4,550.11 per ounce. The U.S. Dollar Index spot was 0.04% higher at the 98.6200 level.

Meanwhile, Bitcoin (CRYPTO: BTC) was trading 1.74% lower at $91,732.77 per coin.

Asian markets closed mixed on Wednesday, as South Korea's KOSPI and Australia's ASX 200 indices rose. China’s CSI 300, Japan's Nikkei 225, Hong Kong's Hang Seng, and India’s Nifty 50 indices fell. European markets were mostly higher in early trade.

Photo courtesy: Shutterstock

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal