A Look At Nebius Group (NBIS) Valuation After Rubin Platform Plans And Major AI Cloud Contracts

Nebius Group (NasdaqGS:NBIS) shares are in focus after the company detailed plans to deploy NVIDIA’s Rubin platform, including Vera Rubin NVL72, across its Nebius AI Cloud and Token Factory services from the second half of 2026.

See our latest analysis for Nebius Group.

The NVIDIA Rubin news comes on top of a strong near term run, with Nebius Group’s 1 day share price return of 7.98% and 7 day share price return of 17.69% contrasting with a 90 day share price return decline of 17.84%. Its 1 year total shareholder return of 217.82% shows how powerful the recent momentum has been over a longer window.

If this kind of AI infrastructure story has your attention, it could be worth scanning other high growth tech names through high growth tech and AI stocks to see what else fits your thesis.

With Nebius trading at $100.24 and sitting around 51% below the average analyst price target of $151.50, the key question is whether the Rubin-driven AI story still offers potential upside or if future growth expectations are already reflected in the current price.

Most Popular Narrative: 37.1% Undervalued

The most followed narrative pegs Nebius Group’s fair value at about $159 per share versus the last close of $100.24, a sizable gap that hinges on aggressive growth and margin assumptions.

The analysts have a consensus price target of $74.6 for Nebius Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $90.0, and the most bearish reporting a price target of just $47.0.

Want to understand why this fair value sits well above current trading levels? The narrative leans heavily on rapid revenue expansion, rising profit margins, and a future earnings multiple that assumes Nebius can scale into a much larger AI infrastructure player. Curious which growth and margin profile is built into that outlook, and how long the market is assumed to support that kind of valuation? The full narrative lays out the numbers behind that conviction.

Result: Fair Value of $159.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this narrative could quickly be tested if competition squeezes pricing faster than expected, or if heavy GPU and data center spending reduces margins and returns.

Find out about the key risks to this Nebius Group narrative.

Another View: What Multiples Are Signalling

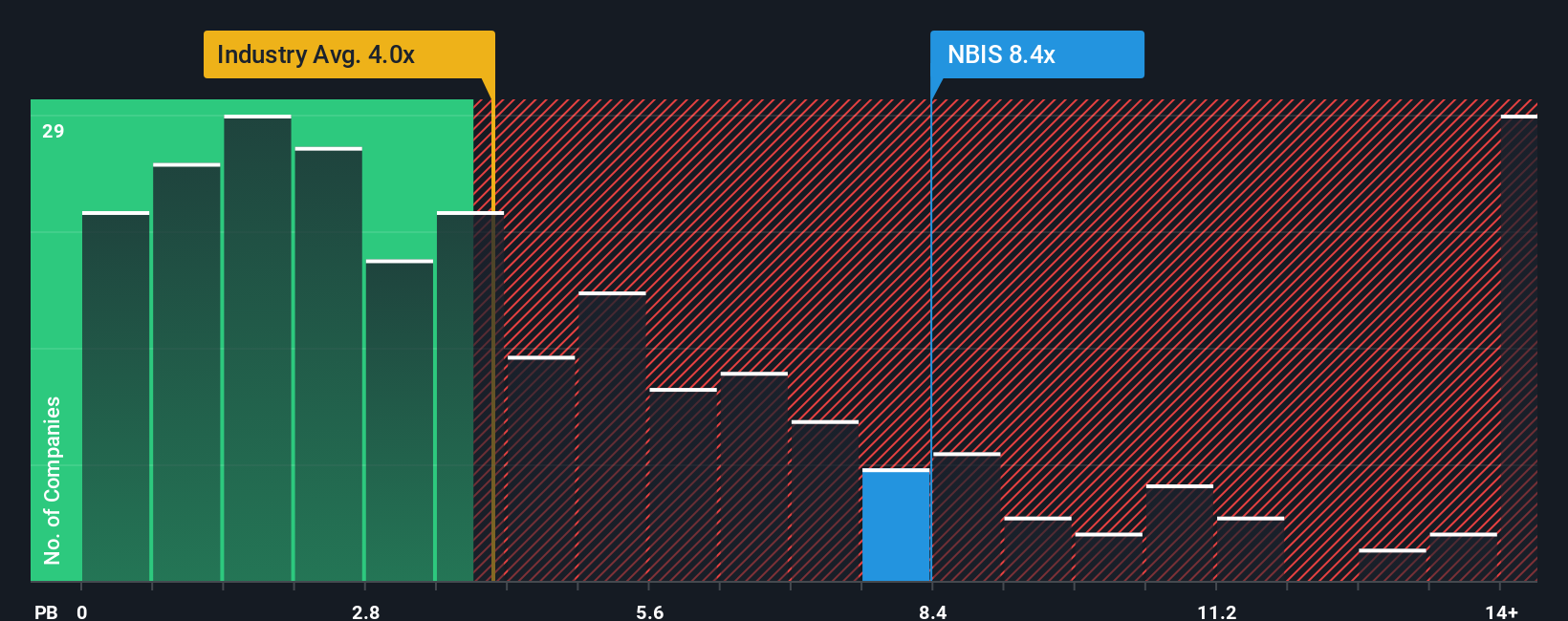

The fair value of about $159 per share paints Nebius as undervalued, but its P/B of 5.2x versus the US Software industry at 3.5x suggests the stock already carries a heavy premium to the sector, even if it screens cheaper than a peer average of 17x.

That gap can cut both ways, either as room for further rerating if the growth story holds, or a source of downside if expectations cool. How comfortable are you with paying that kind of premium for book value today?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nebius Group Narrative

If you see the story differently or prefer to weigh the numbers yourself, you can shape a personalised view in just a few minutes: Do it your way.

A great starting point for your Nebius Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready For More Investment Ideas?

If Nebius has sharpened your interest in AI and growth themes, do not stop here, broader market ideas could help you build a more resilient portfolio.

- Explore potential growth stories early by scanning these 3553 penny stocks with strong financials that pair smaller share prices with solid underlying business metrics.

- Focus on AI-related trends by checking out these 25 AI penny stocks that connect artificial intelligence themes with listed companies across different sectors.

- Look for pricing gaps by reviewing these 875 undervalued stocks based on cash flows that might offer attractive fundamentals relative to current market expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal