Middle East Hidden Gems YAMAMA Cement And 2 Other Small Caps With Promising Potential

As Gulf bourses experience gains amid rising expectations of U.S. Federal Reserve rate cuts, the Middle Eastern market is capturing investor attention with its unique blend of economic resilience and growth potential. In this environment, identifying stocks with strong fundamentals and strategic positioning can offer intriguing opportunities for those looking to explore beyond the well-trodden paths, such as Yamama Cement and other promising small-cap companies in the region.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nofoth Food Products | NA | 21.36% | 25.28% | ★★★★★★ |

| Y.D. More Investments | 51.67% | 27.49% | 36.12% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| MOBI Industry | 13.81% | 5.67% | 19.69% | ★★★★★★ |

| Ajman Bank PJSC | 53.89% | 16.11% | 18.02% | ★★★★☆☆ |

| Bosch Fren Sistemleri Sanayi ve Ticaret | 36.11% | 41.59% | 7.72% | ★★★★☆☆ |

| Blume Metal Kimya Anonim Sirketi | 4.78% | 36.99% | 42.99% | ★★★★☆☆ |

We'll examine a selection from our screener results.

YAMAMA Cement (SASE:3020)

Simply Wall St Value Rating: ★★★★★☆

Overview: YAMAMA Cement Company is involved in the manufacture, production, and trading of cement in Saudi Arabia with a market capitalization of SAR4.75 billion.

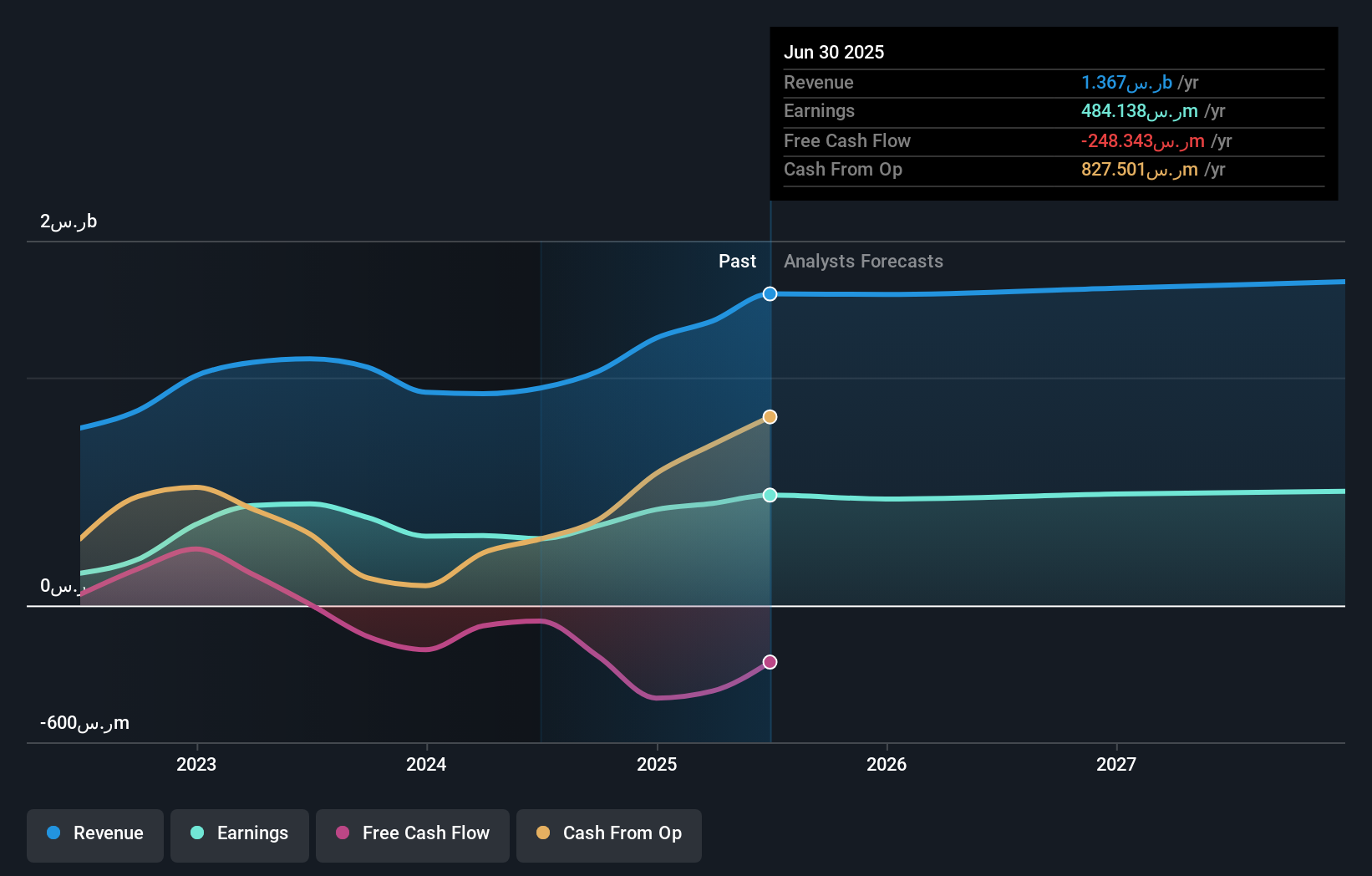

Operations: The primary revenue stream for YAMAMA Cement comes from its operations in the cement industry, generating SAR1.39 billion. The company's financial performance can be gauged by examining its net profit margin trends over recent periods.

YAMAMA Cement, a smaller player in the Middle East cement industry, has shown impressive earnings growth of 20.5% over the past year, outpacing the sector's -4.2%. Despite a dip in third-quarter net income to SAR 35.87 million from SAR 97.93 million last year, nine-month sales rose to SAR 1.02 billion from SAR 802.61 million previously, reflecting robust demand or pricing strategies. The company's debt management seems prudent with a net debt to equity ratio of 35.6%, down from 53.7% five years ago, and its interest payments are well covered by EBIT at an impressive rate of 8x coverage.

- Dive into the specifics of YAMAMA Cement here with our thorough health report.

Gain insights into YAMAMA Cement's past trends and performance with our Past report.

Edarat Communication and Information Technology (SASE:9557)

Simply Wall St Value Rating: ★★★★★☆

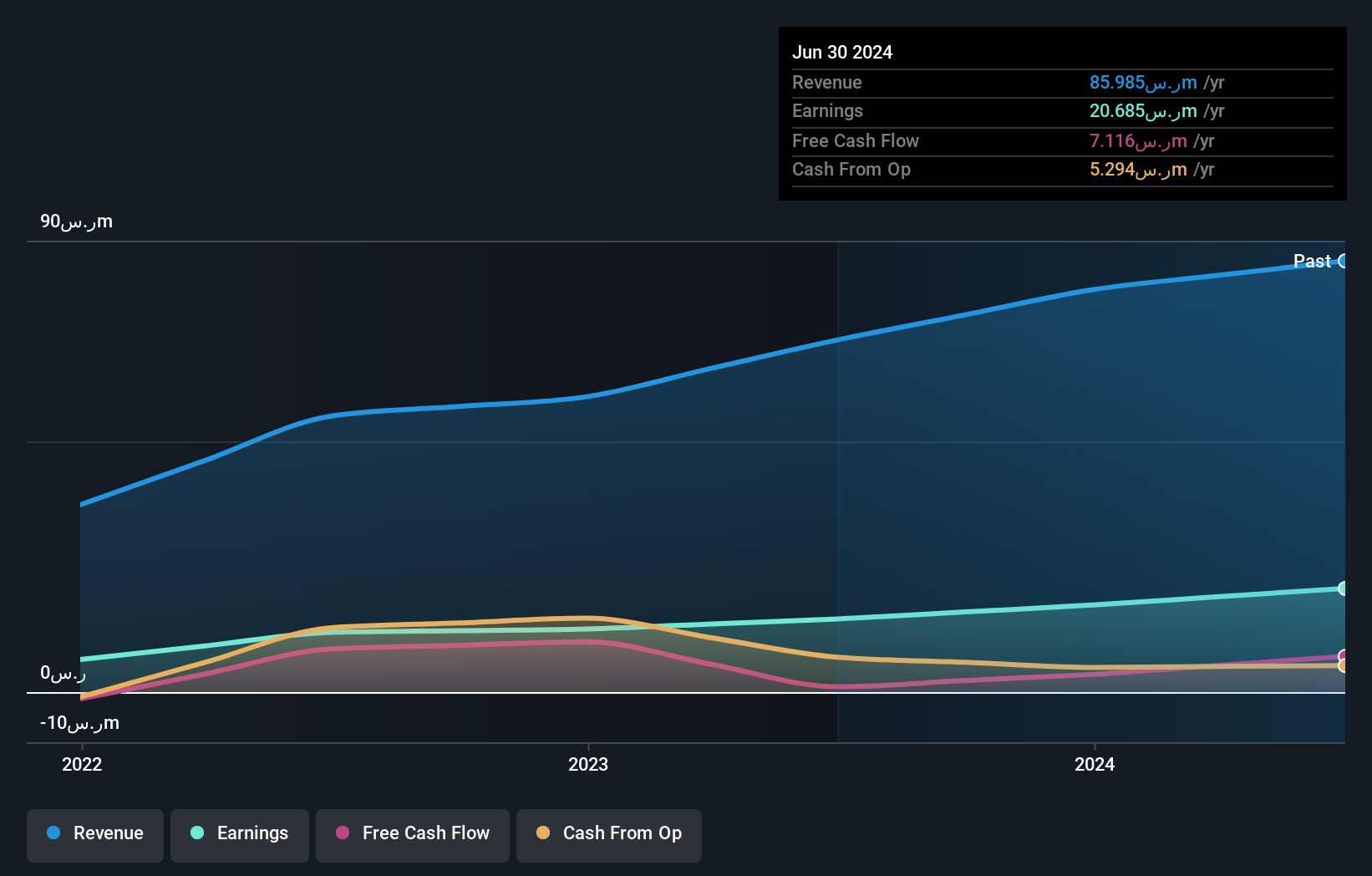

Overview: Edarat Communication and Information Technology Co. operates in the technology sector, focusing on cloud services and data center engineering, with a market capitalization of SAR1.26 billion.

Operations: Edarat generates revenue primarily from cloud services and data center engineering, with the latter contributing SAR75.32 million. The company's gross profit margin is a key financial metric to consider when evaluating its performance.

Edarat Communication and Information Technology has shown impressive growth, with earnings rising 36.9% over the past year, outpacing the IT industry's 8.3%. The company holds more cash than its total debt, indicating a strong financial position. Additionally, Edarat's interest payments are well covered by EBIT at an impressive 80.4 times coverage. Recent contracts bolster its portfolio; notable agreements include a SAR 20.7 million contract for SAHAYEB Riyadh Data Centers and a SAR 18 million deal with Mobily for colocation services, potentially enhancing future revenues and solidifying its foothold in the data center sector in Saudi Arabia.

Diplomat Holdings (TASE:DIPL)

Simply Wall St Value Rating: ★★★★★★

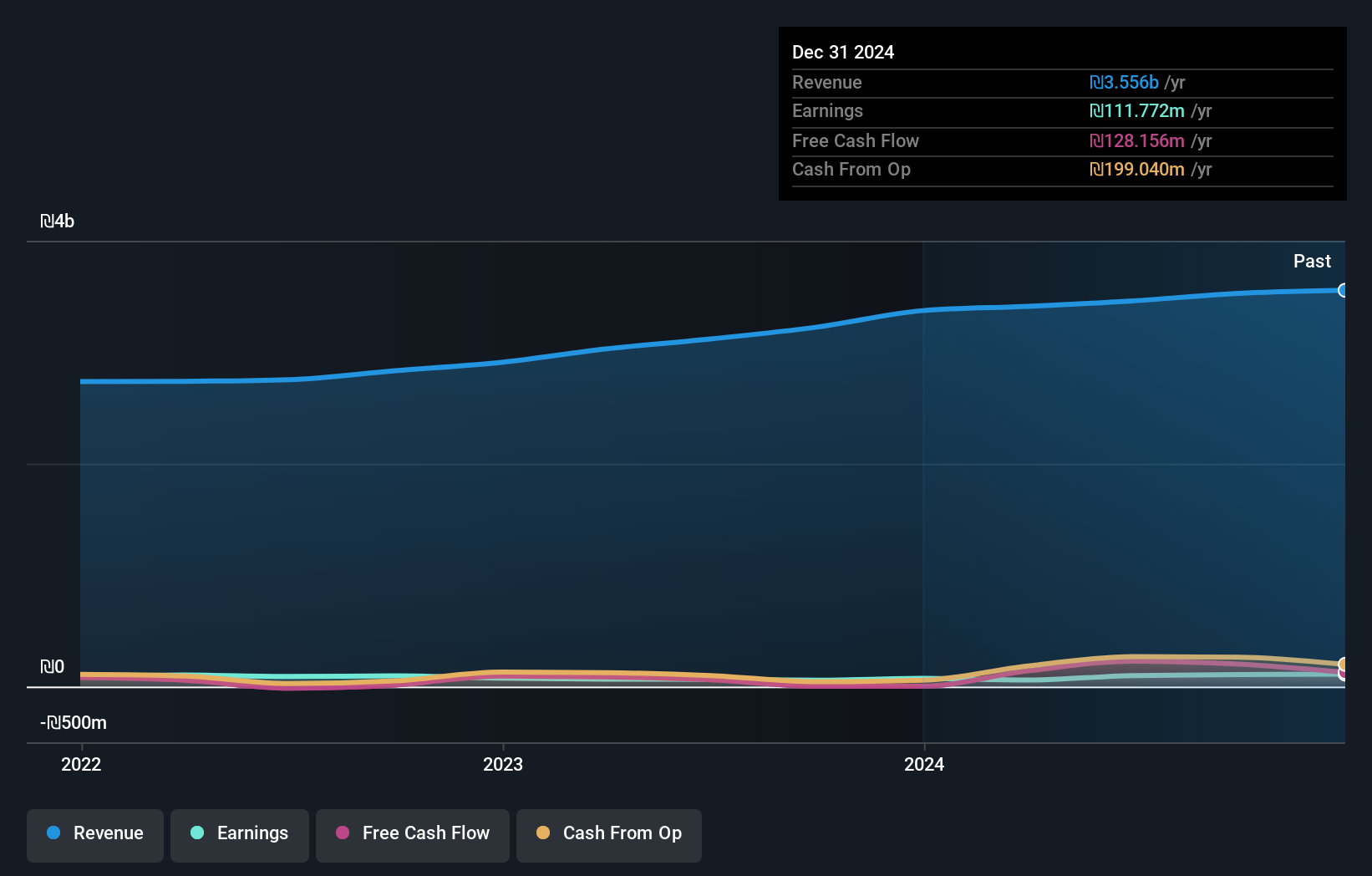

Overview: Diplomat Holdings Ltd. operates as a sales and distribution company in the fast-moving consumer goods sector, with a market cap of ₪1.42 billion.

Operations: Diplomat Holdings generates revenue primarily from the sales and distribution of fast-moving consumer goods. The company's net profit margin has shown variability, reflecting changes in cost structures and market conditions.

Diplomat Holdings, a nimble player in the Middle East market, showcases robust earnings growth of 21.2% over the past year, outpacing its industry peers at 14.2%. With a net debt to equity ratio of 30.9%, it sits comfortably within satisfactory levels, reflecting prudent financial management as this metric has improved from 79.4% five years ago to 52.4%. Despite a significant one-off gain of ₪34.9M impacting recent results, its price-to-earnings ratio stands attractively at 11.8x compared to the IL market's average of 16.7x, suggesting potential value for investors seeking opportunities in this region's retail sector.

- Click to explore a detailed breakdown of our findings in Diplomat Holdings' health report.

Evaluate Diplomat Holdings' historical performance by accessing our past performance report.

Key Takeaways

- Explore the 186 names from our Middle Eastern Undiscovered Gems With Strong Fundamentals screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal