A Look At Munters Group (OM:MTRS) Valuation After Major 2.1b SEK Data Center Cooling Order

Munters Group (OM:MTRS) has attracted fresh attention after its Data Center Technologies unit received approximately 2.1b SEK in cooling equipment orders from a US colocation data center operator, with deliveries planned from late 2026 into 2028.

See our latest analysis for Munters Group.

That sizeable DCT order lands after a strong 90 day share price return of 57.62%. However, the year to date share price return stands at a 6.88% decline and the 1 year total shareholder return at a 4.32% decline. Recent momentum therefore looks sharper than the longer term trend, which stands at a 70.87% total shareholder return over three years and 126.20% over five years.

If this kind of data center driven story has your attention, it may be a good time to scan other high growth tech and AI stocks that could benefit from similar themes.

With the shares up 57.62% over 90 days but still showing a 6.88% year-to-date decline, and trading only slightly below some value estimates, is Munters still mispriced or is the market already factoring in future growth?

Most Popular Narrative: 11.8% Undervalued

With Munters Group last closing at SEK180 against a narrative fair value of SEK204, the gap reflects a valuation built around AI related infrastructure demand and earnings assumptions.

Enhanced focus on sustainability and energy efficiency, including innovation in green manufacturing, smart facilities (Amesbury flagship), and product leadership (e.g., chillers more than 20% more efficient than competitors), is expected to drive incremental customer demand and enable premium pricing, which in turn could influence both revenue and net margin over time.

Curious what earnings profile needs to materialise to support that value gap? The narrative leans on rising margins, steady revenue growth and a future P/E reset. Want to see exactly how those moving parts are stitched together?

Result: Fair Value of $204 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could still be knocked off course if battery market softness drags on or if alternative cooling technology in data centers starts to sideline Munters' solutions.

Find out about the key risks to this Munters Group narrative.

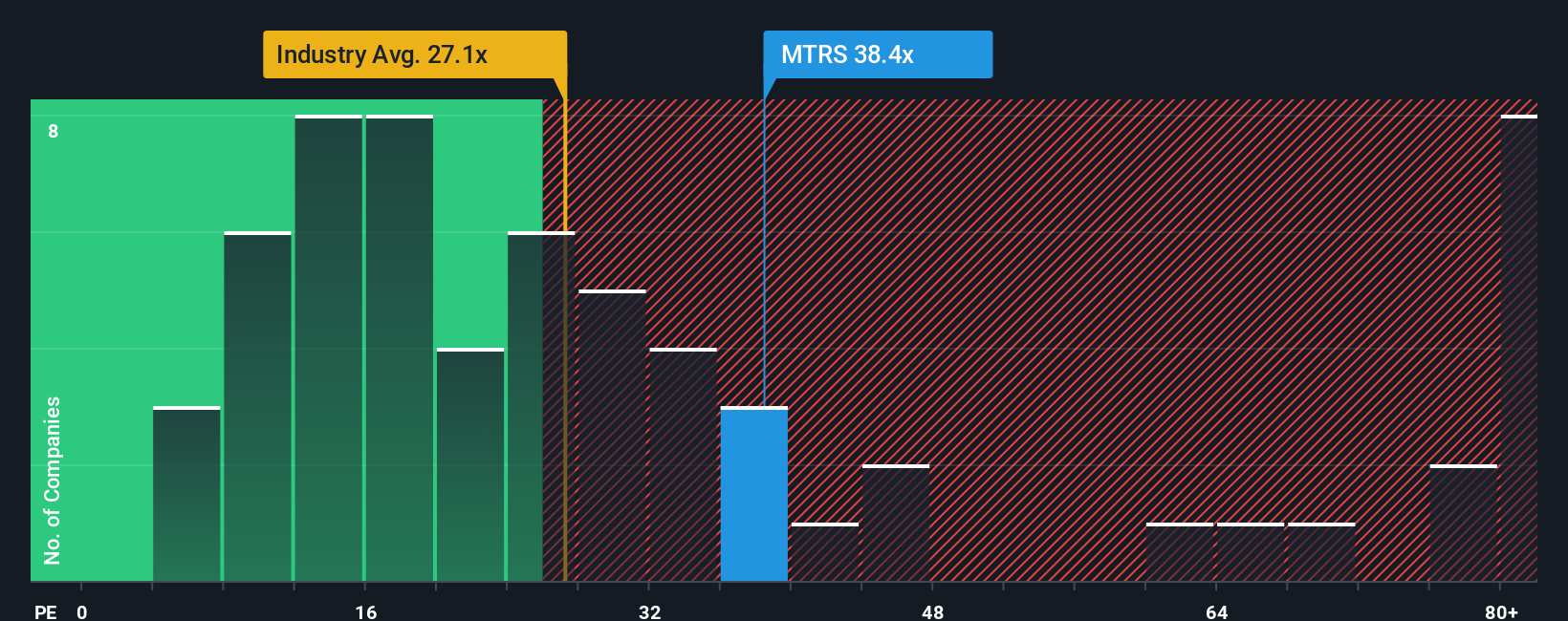

Another View: What P/E Is Telling You

The first valuation leans on a fair value of SEK204 tied to AI infrastructure demand. If you shift the lens to the current P/E of 41.9x, the picture looks different. That level is higher than both the European Building industry at 23.9x and peers at 24.4x, even though the fair ratio sits at 46.2x.

In practice, that means anyone buying today is already paying a rich price compared to similar companies, with only a modest gap to the fair ratio as potential room for error. The question is whether you are comfortable paying that kind of premium for the growth story on offer.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Munters Group Narrative

If you see the numbers differently or simply prefer to pull your own threads together, you can build a custom view in minutes with Do it your way.

A great starting point for your Munters Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready For More Investment Ideas?

If Munters has sharpened your thinking, do not stop here. Cast the net wider across other ideas before the next wave of opportunities passes you by.

- Spot potential high-growth names early by scanning these 3553 penny stocks with strong financials with solid financial underpinnings instead of relying only on well known large caps.

- Zero in on AI driven opportunities by checking these 25 AI penny stocks that sit at the intersection of machine learning and real world revenue.

- Focus your research time on pricing gaps with these 877 undervalued stocks based on cash flows, where cash flow based signals flag companies that might deserve a closer look.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal