Did QBE’s $400m Catastrophe Bond Just Reframe QBE Insurance Group's (ASX:QBE) Risk Playbook?

- QBE Insurance Group recently completed a $400 million catastrophe bond through its Bridge Street Re Ltd. program, securing three years of collateralized reinsurance protection focused on earthquake risk in Australasia and the US.

- This move broadens QBE’s access to insurance-linked securities and reinforces its capital management toolkit at a time of slowing premium growth.

- We’ll now explore how QBE’s expanded catastrophe bond protection shapes its investment narrative, particularly its approach to managing large-event risk.

AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

QBE Insurance Group Investment Narrative Recap

To own QBE, you generally need to believe in a global insurer that can turn disciplined underwriting, reinsurance and investment income into steady, dividend-backed cash flows. The new US$400 million catastrophe bond looks incremental rather than transformational for the near term, but it does speak directly to the biggest short term swing factor: large-event loss volatility versus the group’s ability to protect margins and earnings.

The recent issue of US$300 million in Tier 2 subordinated notes fits alongside the catastrophe bond as part of QBE’s broader capital management toolkit. Together, these moves speak to how QBE is trying to support its balance sheet strength while it faces softer premium rate momentum, rising loss complexity and ongoing investment in technology and modernization.

However, while this extra catastrophe protection helps, investors should still be aware that underwriting results can be heavily affected by...

Read the full narrative on QBE Insurance Group (it's free!)

QBE Insurance Group’s narrative projects $20.7 billion revenue and $1.9 billion earnings by 2028. This implies a 3.7% yearly revenue decline with earnings remaining flat at around $1.9 billion.

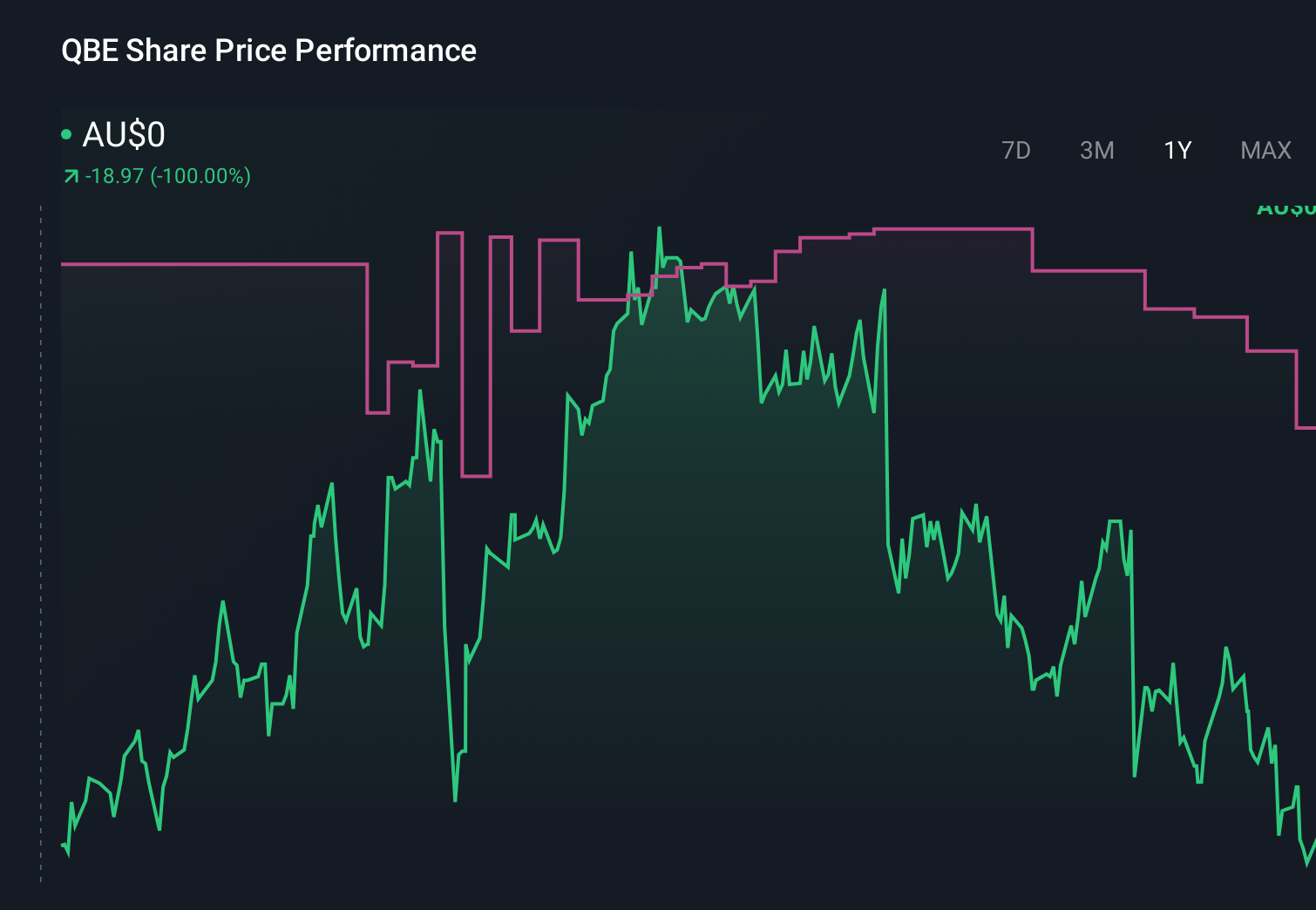

Uncover how QBE Insurance Group's forecasts yield a A$22.27 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Four Simply Wall St Community members currently see QBE’s fair value between A$19.92 and about A$48.00, underscoring how far apart individual views can be. Set against ongoing concerns about premium rate softening versus claims inflation, this spread shows why it is worth comparing several independent takes on QBE’s risk and return profile.

Explore 4 other fair value estimates on QBE Insurance Group - why the stock might be worth just A$19.92!

Build Your Own QBE Insurance Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your QBE Insurance Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free QBE Insurance Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate QBE Insurance Group's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal