Mobimo’s Moody’s-Endorsed Green Bond Could Be A Game Changer For Mobimo Holding (SWX:MOBN)

- Mobimo Holding AG recently placed a CHF 155 million green bond on the Swiss capital market under its new Green Financing Framework, with listing on the Swiss Exchange planned from 28 January 2026.

- The bond, backed by a positive Second Party Opinion from Moody’s Ratings for alignment with international green finance principles, highlights Mobimo’s growing appeal to environmentally focused investors in the Swiss real estate space.

- Next, we’ll explore how this Moody’s-endorsed Green Financing Framework shapes Mobimo’s investment narrative and access to sustainability-linked capital.

AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Mobimo Holding's Investment Narrative?

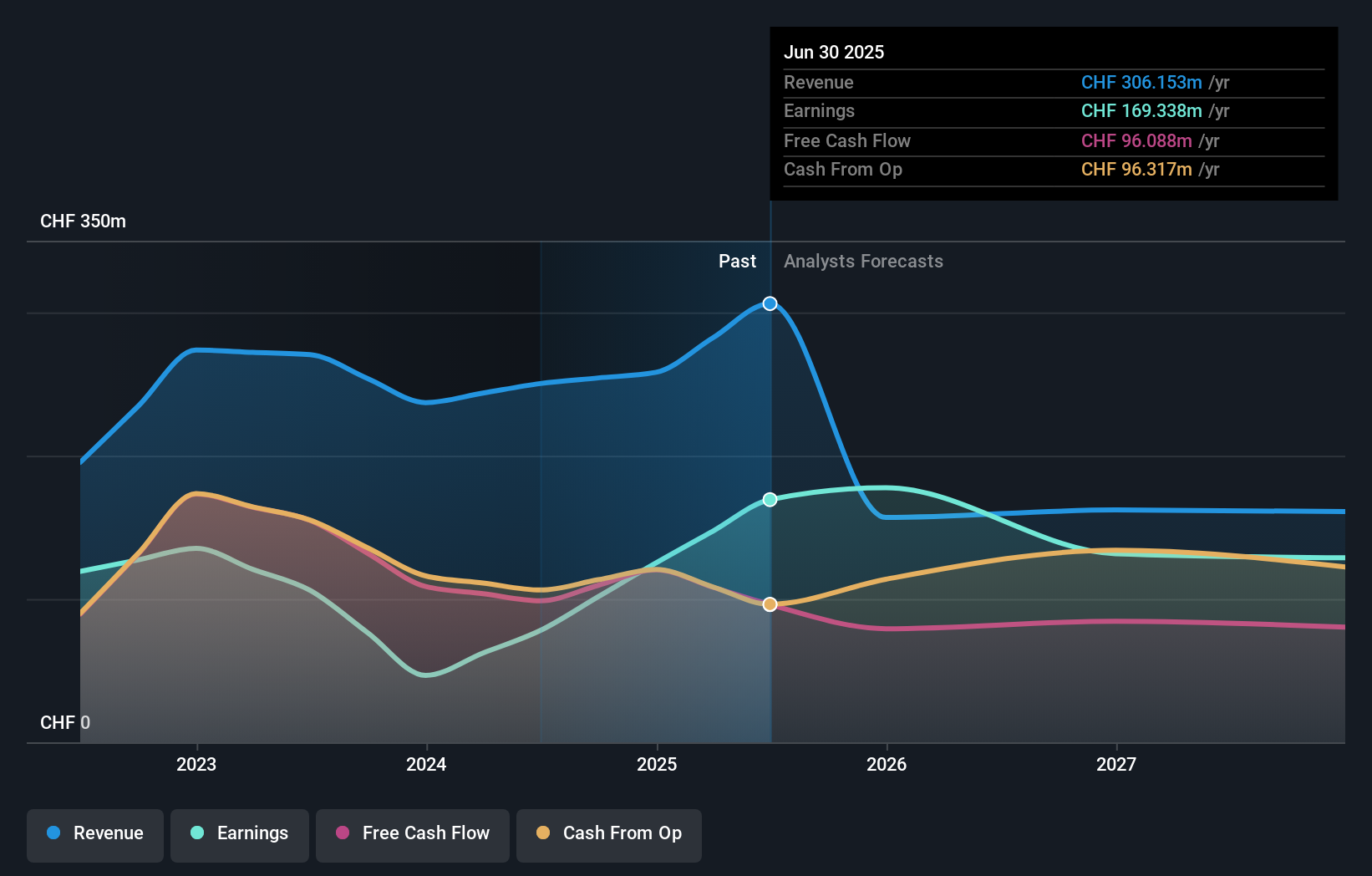

To own Mobimo, you have to believe in the long-term value of Swiss residential and mixed-use real estate, backed by a seasoned management team that is reshaping the portfolio and development pipeline while keeping the dividend attractive. Short term, investors are still watching how one-off gains, softer revenue expectations and relatively high leverage play through into cash generation. The new CHF 155 million green bond, issued under a Moody’s-endorsed Green Financing Framework, slightly tilts that balance: it reinforces Mobimo’s access to sustainability-linked capital and broadens its investor base, but it also adds to debt that is not yet well covered by operating cash flow. So while this green funding supports the development story, it does not remove the core risks around earnings quality and future revenue trends.

However, one risk around cash flow coverage and rising debt levels stands out for shareholders. Mobimo Holding's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span a wide CHF144.94 to CHF325. With the new green bond adding debt even as earnings expectations soften, these differing views underline why many market participants weigh both balance sheet resilience and access to sustainable capital before forming an opinion on Mobimo’s prospects.

Explore 2 other fair value estimates on Mobimo Holding - why the stock might be worth less than half the current price!

Build Your Own Mobimo Holding Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mobimo Holding research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Mobimo Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mobimo Holding's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 39 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal