Assessing Zymeworks (ZYME) Valuation After Positive Phase 3 Ziihera Trial Results

Positive Phase 3 results for Ziihera in HER2 positive first line metastatic gastroesophageal adenocarcinoma have put Zymeworks (ZYME) back in focus, as investors weigh potential milestone payments tied to future regulatory decisions.

See our latest analysis for Zymeworks.

The latest Ziihera update lands after a sharp 44.96% 90 day share price return and a 68.97% total shareholder return over the past year. However, shorter term share price returns have recently cooled, suggesting momentum has pulled back near the current US$24.18 level.

If this kind of biotech catalyst has your attention, it could be a good moment to widen your watchlist and check out healthcare stocks for other potential ideas in the sector.

With shares up 44.96% over 90 days and 68.97% over the past year, yet still trading at a reported 76% discount to one intrinsic value estimate and below the average analyst target, is this a fresh entry point, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 29.9% Undervalued

Against the last close at US$24.18, the most followed narrative anchors on a fair value of US$34.50, framing the current price as meaningfully discounted.

Analysts nudged their fair value estimate for Zymeworks slightly higher, from $34.20 to $34.50. This reflects growing confidence that the company’s shift toward a royalty aggregator model, coupled with strong HERIZON-GEA-01 data for Ziihera and encouraging early ZW191 results, can drive faster revenue growth and improved profitability.

Curious what kind of revenue trajectory, margin lift, and valuation multiple are baked into that higher fair value? The most followed narrative spells out those numbers in detail.

Result: Fair Value of $34.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still real pressure points, including heavy reliance on milestone and royalty payments, as well as the risk that early stage pipeline assets fail to progress.

Find out about the key risks to this Zymeworks narrative.

Another Angle On Valuation

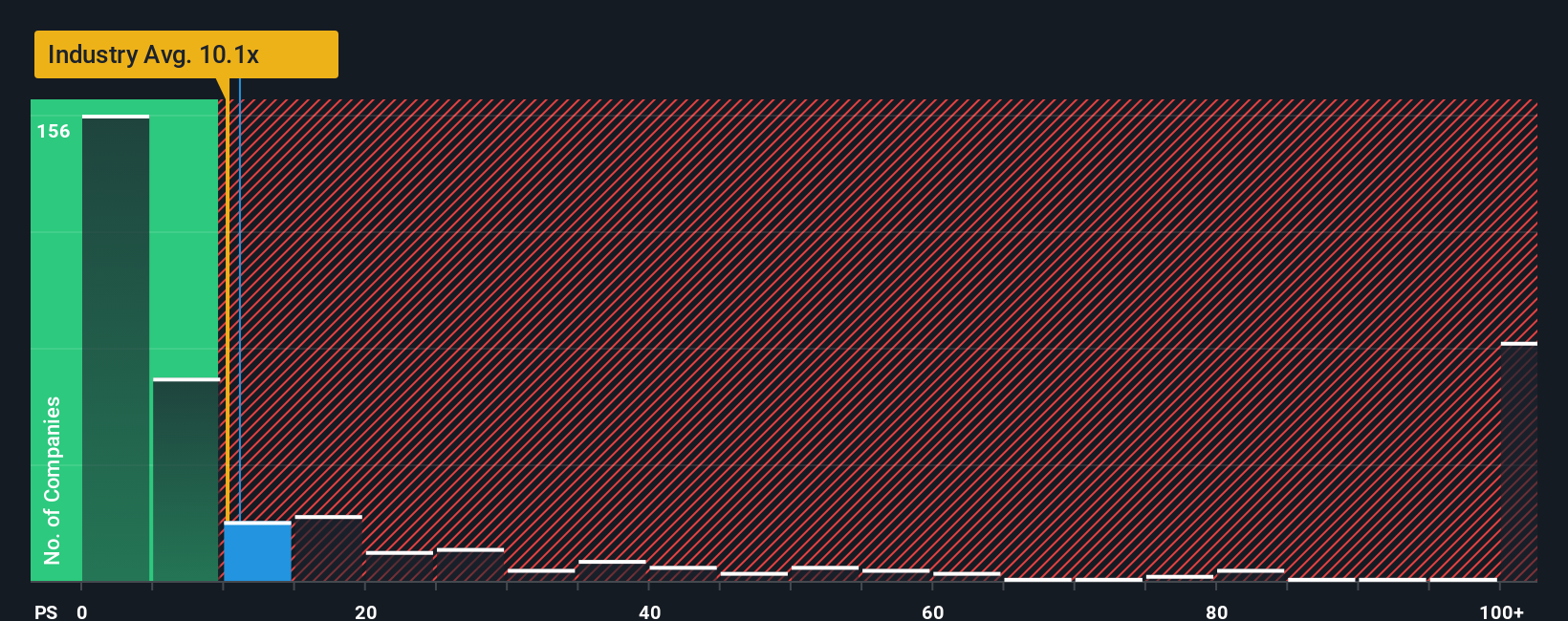

The narrative flags Zymeworks as about 29.9% undervalued versus a US$34.50 fair value, but the current P/S of 13.5x tells a different story. It is richer than the US Biotechs average at 11.5x and far above a fair ratio of 2.5x. This raises the question of whether sentiment is getting ahead of fundamentals.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Zymeworks Narrative

If you see the story differently or want to stress test the assumptions yourself, you can develop your own narrative in just a few minutes by starting with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Zymeworks.

Ready For More Investment Ideas?

If you stop with just one stock, you might miss better fits for your goals, so use targeted screeners to quickly surface ideas that match your style.

- Spot early stage opportunities by checking out these 3554 penny stocks with strong financials that pair smaller market caps with stronger underlying financials.

- Tap into potential growth by reviewing these 25 AI penny stocks that link artificial intelligence themes with higher quality business metrics.

- Zero in on value by scanning these 877 undervalued stocks based on cash flows that flag companies priced below what their cash flows might support.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal