Sonos (SONO) Valuation Revisited After CES 2026 Competitor Launches And Cautious Quarterly Outlook

Reports from CES 2026 that LG and Samsung launched audio products aimed at Sonos (SONO) helped push the stock down, as investors were already cautious about projections for the upcoming quarter.

See our latest analysis for Sonos.

Those CES headlines and cautious quarterly projections come after a strong 12 months for Sonos, with a 1 year total shareholder return of 14.44%, even as recent 30 day and 90 day share price returns of 11.02% and 5.54% declines suggest momentum has started to fade and investors are reassessing the balance between growth potential and rising competitive risks at a share price of $17.04.

If competition in home audio has your attention, it could be a good time to widen your search with high growth tech and AI stocks. You might spot ideas before they hit the headlines.

So with Sonos shares giving back some recent gains and trading at US$17.04, is the market now underestimating the home audio brand, or are investors already correctly pricing in its future growth story?

Most Popular Narrative Narrative: 4.5% Undervalued

The most followed narrative sees Sonos trading slightly below its fair value estimate of US$17.85 versus the last close at US$17.04, and attributes that gap to how future earnings, margins and cash flows could evolve from today.

Ongoing diversification into new product categories (such as headphones and enhanced home theater), coupled with growing focus on software-enabled functionality and future recurring services, is expected to reduce revenue volatility and cyclicality, supporting both topline growth and higher net margins over the medium to long term.

Curious what turns that product roadmap into a higher fair value? The narrative leans heavily on steadier revenue, stronger margins, and a richer earnings multiple. Want to see exactly how those pieces are modeled into the 2028 earnings and P/E assumptions, and how a modest discount rate ties it all together?

Result: Fair Value of $17.85 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still clear watchpoints, including tariff driven cost pressure on Vietnam and Malaysia production, as well as a lull in major new hardware until late 2026.

Find out about the key risks to this Sonos narrative.

Another View: Multiples Paint A Different Picture

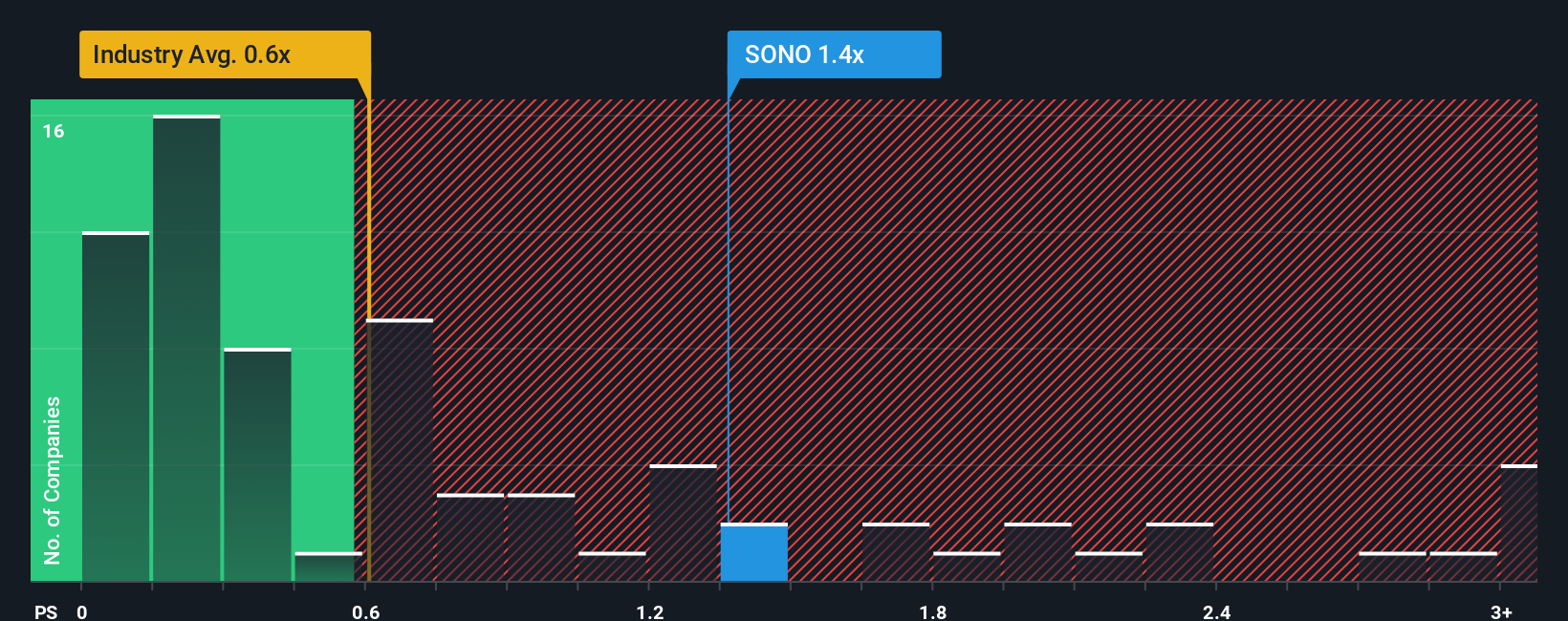

That 4.5% undervalued fair value narrative sits awkwardly beside how the market is pricing Sonos on sales today. On a P/S of 1.4x versus a fair ratio of 1x, and the US Consumer Durables average of 0.6x, the shares look expensive rather than slightly cheap.

For you as an investor, that gap means the market is already paying more per dollar of Sonos revenue than both the fair ratio and the wider industry, even while the company remains unprofitable and forecasts call for slower revenue growth than the broader US market. Is that premium really how you see the risk and reward balance?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sonos Narrative

If you see the numbers differently or want to stress test your own assumptions, you can create a personalized Sonos story in just a few minutes, starting with Do it your way.

Prefer to form your own view? Our platform makes it easy to explore a stock's fundamentals and create your own narrative in minutes.

Ready For More Investment Ideas?

If Sonos has you thinking more carefully about risk and reward, do not stop here. Broaden your watchlist and give yourself more options before the next move.

- Spot early movers by scanning these 3554 penny stocks with strong financials that pair smaller market caps with solid underlying financials.

- Target growth themes by checking out these 25 AI penny stocks tied to artificial intelligence trends that could reshape multiple sectors.

- Hunt for value by reviewing these 877 undervalued stocks based on cash flows that currently trade below what their cash flows might justify.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal