Asian Growth Companies With High Insider Ownership January 2026

As we enter 2026, Asian markets are navigating a complex landscape, with China's manufacturing sector showing signs of recovery and Japan's stock market reflecting strong performances in technology and construction sectors. In this environment, growth companies with high insider ownership can be particularly appealing to investors seeking alignment between management interests and shareholder value.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Phison Electronics (TPEX:8299) | 10.8% | 30.2% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Modetour Network (KOSDAQ:A080160) | 12.8% | 41.8% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Fulin Precision (SZSE:300432) | 10.6% | 55.2% |

Let's review some notable picks from our screened stocks.

Meituan (SEHK:3690)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Meituan is a technology-driven retail company operating in the People's Republic of China, Hong Kong, Macao, Taiwan, and internationally with a market cap of approximately HK$648.07 billion.

Operations: The company's revenue is primarily derived from its Core Local Commerce segment, which accounts for CN¥262.69 billion, and its New Initiatives segment, contributing CN¥99.69 billion.

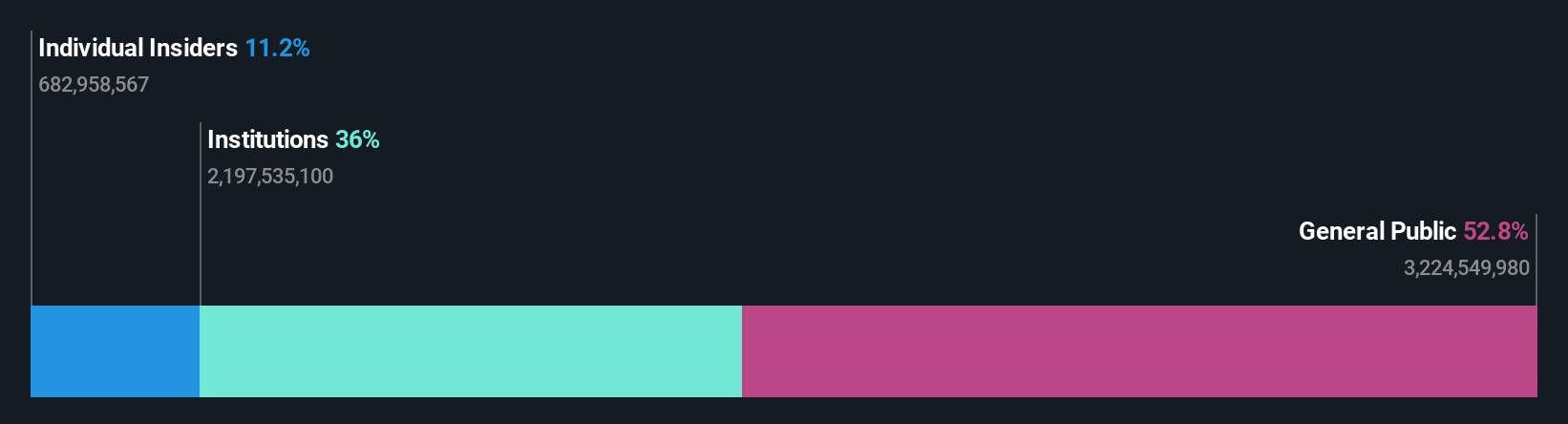

Insider Ownership: 11.2%

Revenue Growth Forecast: 10.5% p.a.

Meituan's recent earnings report showed a net loss of CNY 18.63 billion, contrasting with the previous year's net income, highlighting volatility. Despite this, revenue is expected to grow faster than the Hong Kong market at 10.5% annually. The company has issued fixed-income offerings totaling CNY 7.08 billion recently, indicating strategic capital management. Although no significant insider trading was noted in recent months, Meituan remains undervalued by some estimates and is forecasted to become profitable within three years.

- Get an in-depth perspective on Meituan's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Meituan implies its share price may be lower than expected.

Puya Semiconductor (Shanghai) (SHSE:688766)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Puya Semiconductor (Shanghai) Co., Ltd. focuses on the research, development, design, and sale of non-volatile memory chips and memory-based derivative chips both in China and internationally, with a market cap of CN¥24.21 billion.

Operations: The company generates revenue primarily from its Integrated Circuit segment, amounting to CN¥1.87 billion.

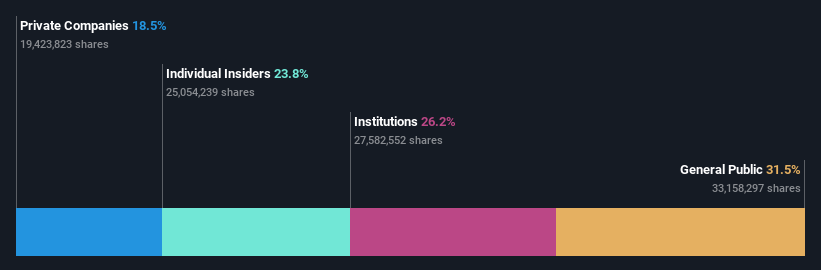

Insider Ownership: 23.7%

Revenue Growth Forecast: 24.2% p.a.

Puya Semiconductor's insider ownership is underscored by recent private placements, indicating strong internal confidence. Despite a volatile share price and a decline in net profit margins from 16.1% to 6.8%, the company's revenue is projected to grow significantly faster than the market at 24.2% annually, with earnings expected to increase by over 50%. The recent acquisition of a stake for CNY 600 million reflects external interest amidst anticipated substantial earnings growth surpassing market averages.

- Navigate through the intricacies of Puya Semiconductor (Shanghai) with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Puya Semiconductor (Shanghai)'s shares may be trading at a premium.

Ganfeng Lithium Group (SZSE:002460)

Simply Wall St Growth Rating: ★★★★★★

Overview: Ganfeng Lithium Group Co., Ltd. manufactures and sells lithium products in China with a market cap of CN¥131.67 billion.

Operations: Ganfeng Lithium Group Co., Ltd. generates its revenue primarily from the manufacturing and sale of lithium products in China.

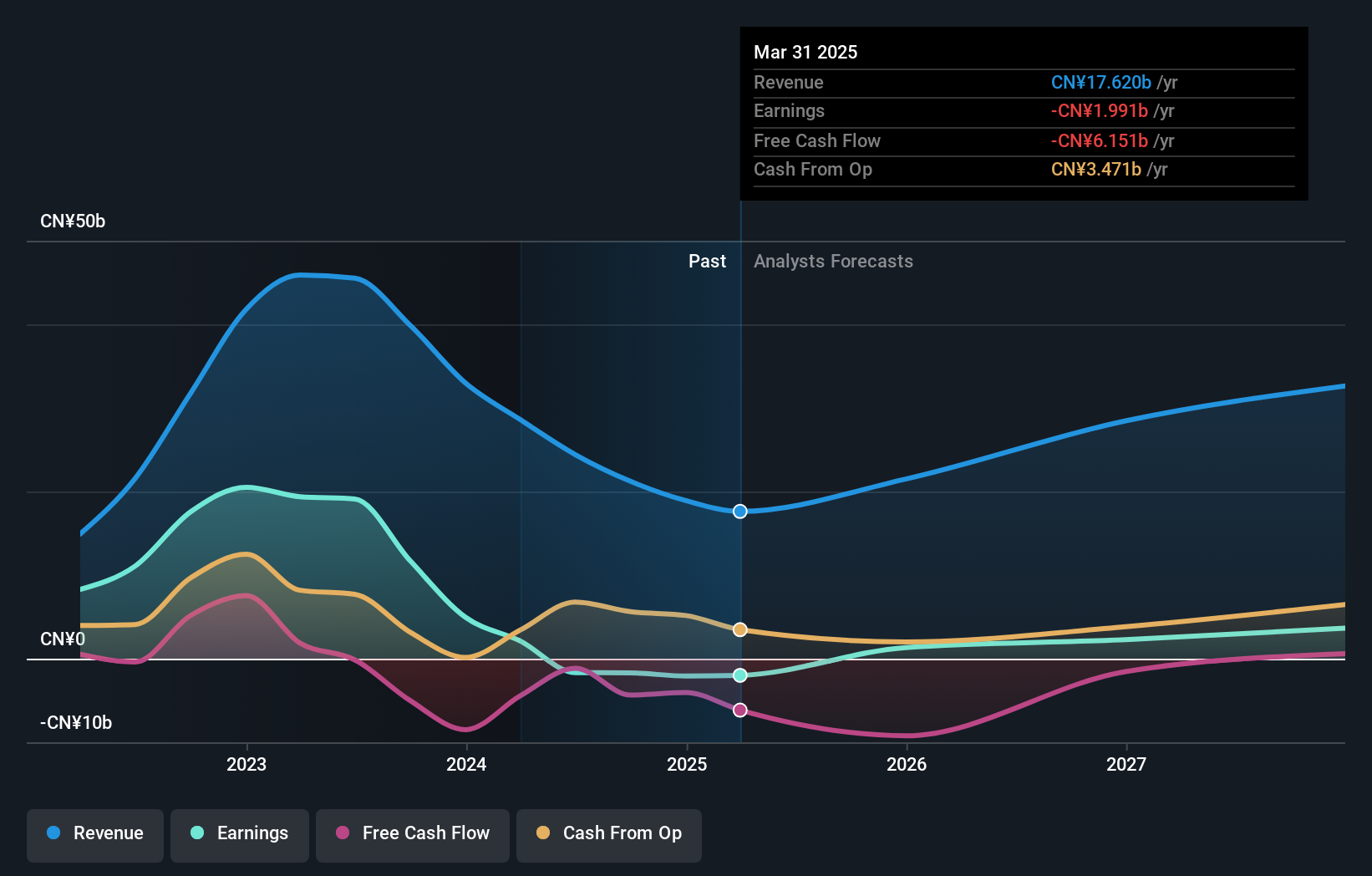

Insider Ownership: 26.7%

Revenue Growth Forecast: 23.7% p.a.

Ganfeng Lithium Group's substantial insider ownership aligns with its strategic initiatives, including the Consolidated Project, which aims to become one of the largest undeveloped lithium brine resources. Despite recent share price volatility and earnings not covering interest payments well, revenue is forecasted to grow at 23.7% annually, outpacing the market. Recent developments like board changes and environmental impact statements highlight internal confidence and a focus on sustainable growth strategies in Asia's competitive lithium sector.

- Click here to discover the nuances of Ganfeng Lithium Group with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Ganfeng Lithium Group's current price could be inflated.

Seize The Opportunity

- Navigate through the entire inventory of 628 Fast Growing Asian Companies With High Insider Ownership here.

- Ready For A Different Approach? The latest GPUs need a type of rare earth metal called Terbium and there are only 39 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal