3 Undiscovered Gems In Asia With Promising Potential

As global markets navigate a complex landscape marked by fluctuating indices and evolving economic indicators, Asia's small-cap sector stands out with its unique potential for growth. In this dynamic environment, identifying promising stocks involves looking for companies that demonstrate resilience and adaptability amidst broader market shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Maxigen Biotech | NA | 10.31% | 23.99% | ★★★★★★ |

| New Asia Construction & Development | 42.25% | 8.68% | 50.79% | ★★★★★★ |

| Xuchang Yuandong Drive ShaftLtd | 0.06% | -13.76% | -28.84% | ★★★★★★ |

| Grade Upon Technology | NA | 21.73% | 65.67% | ★★★★★★ |

| Bonraybio | NA | 33.85% | 70.92% | ★★★★★★ |

| Wholetech System Hitech | 14.93% | 13.36% | 18.63% | ★★★★★☆ |

| Unitech Computer | 48.86% | 2.82% | -0.17% | ★★★★★☆ |

| Advancetek EnterpriseLtd | 60.69% | 28.66% | 48.38% | ★★★★★☆ |

| Lucky Cement | 49.27% | 4.40% | 18.92% | ★★★★☆☆ |

| Marusan Securities | 3.64% | 0.57% | 3.44% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

BHI (KOSDAQ:A083650)

Simply Wall St Value Rating: ★★★★★☆

Overview: BHI Co., Ltd. is involved in the development, manufacture, and supply of power plant equipment on a global scale, with a market capitalization of ₩1.80 billion.

Operations: BHI Co., Ltd. generates revenue from its Machinery & Industrial Equipment segment, amounting to ₩656.37 billion. The company's market capitalization stands at approximately ₩1.80 trillion.

BHI, a smaller player in the energy sector, has recently caught attention due to its strategic alliances and robust financial performance. Over the past year, earnings surged by 242%, far outpacing the machinery industry's growth of 31%. This uptick is reflected in their net income for Q3 2025, which jumped to KRW 11.67 billion from KRW 1.74 billion a year prior. Their recent MOU with Red Post Energy and BASIC Equipment aims to capitalize on U.S. power generation opportunities, potentially boosting BHI's market presence further amidst growing national demand for energy solutions driven by AI and industrial expansion.

- Click here to discover the nuances of BHI with our detailed analytical health report.

Evaluate BHI's historical performance by accessing our past performance report.

Whirlpool China (SHSE:600983)

Simply Wall St Value Rating: ★★★★★★

Overview: Whirlpool China Co., Ltd. focuses on the research, development, procurement, production, and sale of kitchen appliances both domestically and internationally with a market cap of CN¥8.24 billion.

Operations: Whirlpool China's primary revenue stream is the manufacture and sale of consumer electrical appliances, generating CN¥4.42 billion. The company's financial performance can be analyzed through its net profit margin, which offers insight into profitability trends over time.

Whirlpool China, an intriguing player in the consumer durables sector, has demonstrated remarkable financial health with earnings soaring 287.7% over the past year, significantly outpacing the industry average of -3.4%. The company is trading at a substantial 64.5% below its estimated fair value, suggesting potential undervaluation. With no debt on its books and high-quality earnings reported, Whirlpool China stands as a debt-free entity with robust profitability metrics. Recent results show net income climbing to CNY 316.78 million from CNY 53.07 million last year while basic earnings per share rose to CNY 0.41 from CNY 0.07, reflecting strong operational performance and growth prospects in this niche market space.

- Take a closer look at Whirlpool China's potential here in our health report.

Assess Whirlpool China's past performance with our detailed historical performance reports.

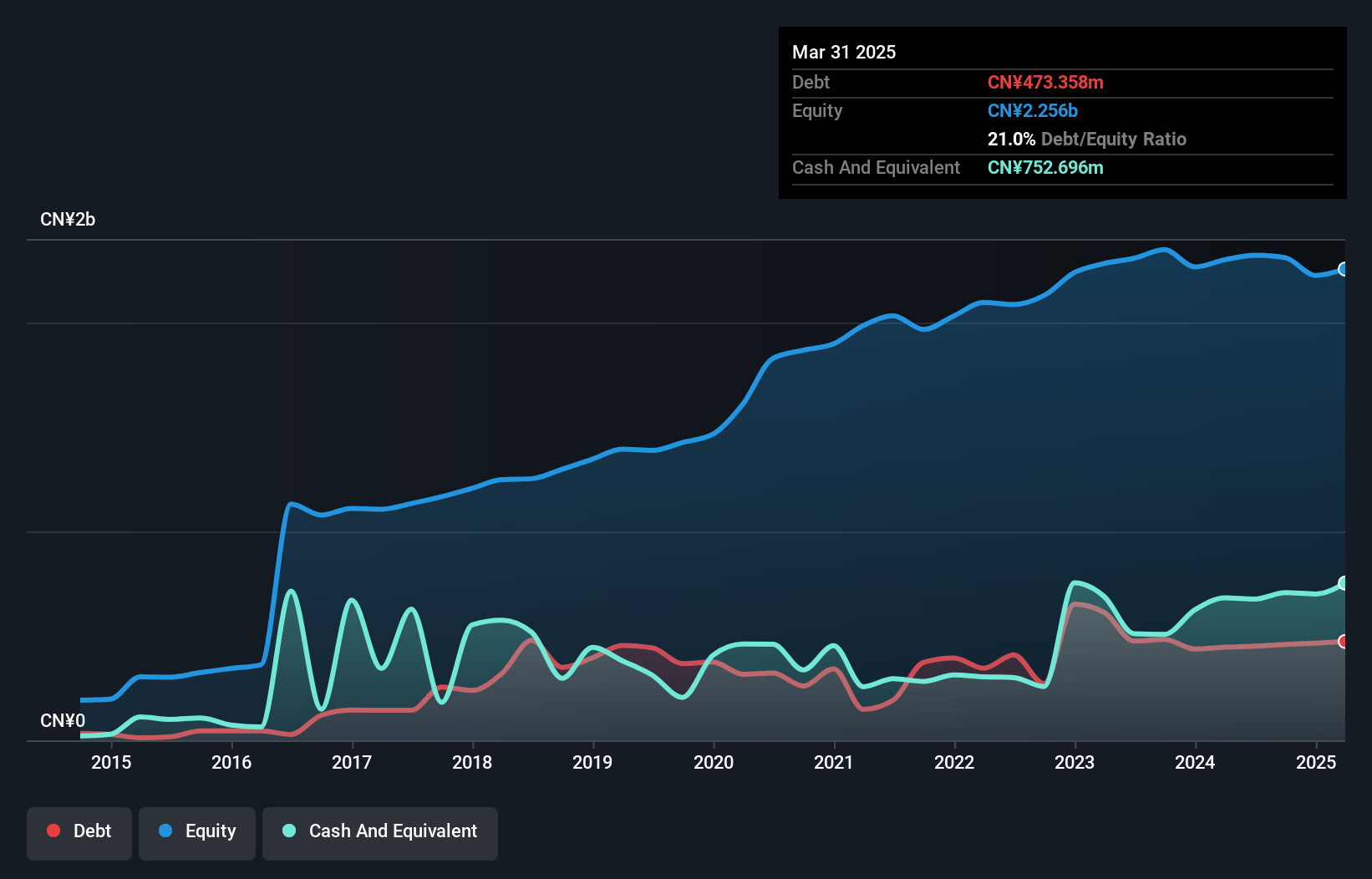

Chongqing Zaisheng Technology (SHSE:603601)

Simply Wall St Value Rating: ★★★★★☆

Overview: Chongqing Zaisheng Technology Co., Ltd. focuses on the research, manufacturing, and marketing of fiber cotton in China with a market cap of CN¥13.94 billion.

Operations: Chongqing Zaisheng Technology generates revenue primarily through its fiber cotton products. The company's net profit margin has shown notable trends, reflecting its financial efficiency in managing costs relative to its revenue streams.

Chongqing Zaisheng Technology, a dynamic player in the chemicals industry, has seen its earnings skyrocket by 591% over the past year, far outpacing the industry's average growth of 6%. Despite a highly volatile share price recently, it trades at an attractive 52% below estimated fair value. The company reported CN¥985 million in sales for the first nine months of 2025 and net income of CN¥81 million. Its debt situation appears manageable with EBIT covering interest payments by 9 times. A recent acquisition deal valued at approximately CN¥340 million indicates ongoing strategic shifts within its shareholder structure.

Next Steps

- Reveal the 2490 hidden gems among our Asian Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal